Will Ferrari’s (BIT:RACE) Shift From Full Electrification Redefine Its Premium Brand Strategy?

Reviewed by Sasha Jovanovic

- Ferrari announced its 2030 Strategic Plan, unveiling a revised long-term outlook with new guidance on earnings and revenue alongside a €3.50 billion share repurchase program approved by the Board of Directors in the past week.

- The company has reduced its electrification ambitions, now forecasting only 20% of its lineup to be fully electric by 2030, shifting focus toward hybrid and internal combustion models and a greater emphasis on personalization and high-margin activities.

- We'll explore how Ferrari's more conservative growth forecast and scaled-back electric vehicle plans may alter its investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ferrari Investment Narrative Recap

To be a Ferrari shareholder today, you need to have faith in the brand’s pricing power and exclusivity enduring despite evolving luxury trends and electrification challenges. The recent downward revision of long-term growth and EV targets does not materially affect the imminent launches and sustained customer demand, but the largest short-term risk remains Ferrari’s exposure to shifting economic conditions in key global markets and how these could influence order books and profitability.

Ferrari’s announcement of a €3.5 billion share repurchase program between 2026 and 2030 stands out, as it reinforces the company’s emphasis on shareholder returns amid the more cautious long-term outlook. With this buyback plan in place, capital allocation decisions and market reactions to growth expectations remain important areas for close attention.

However, investors should still be mindful of increased earnings volatility if new models or personalization fail to sustain demand among the ultra-wealthy…

Read the full narrative on Ferrari (it's free!)

Ferrari's outlook anticipates €8.8 billion in revenue and €2.1 billion in earnings by 2028. This is based on an annual revenue growth rate of 8.1% and an increase in earnings of €0.5 billion from the current €1.6 billion.

Uncover how Ferrari's forecasts yield a €447.87 fair value, a 27% upside to its current price.

Exploring Other Perspectives

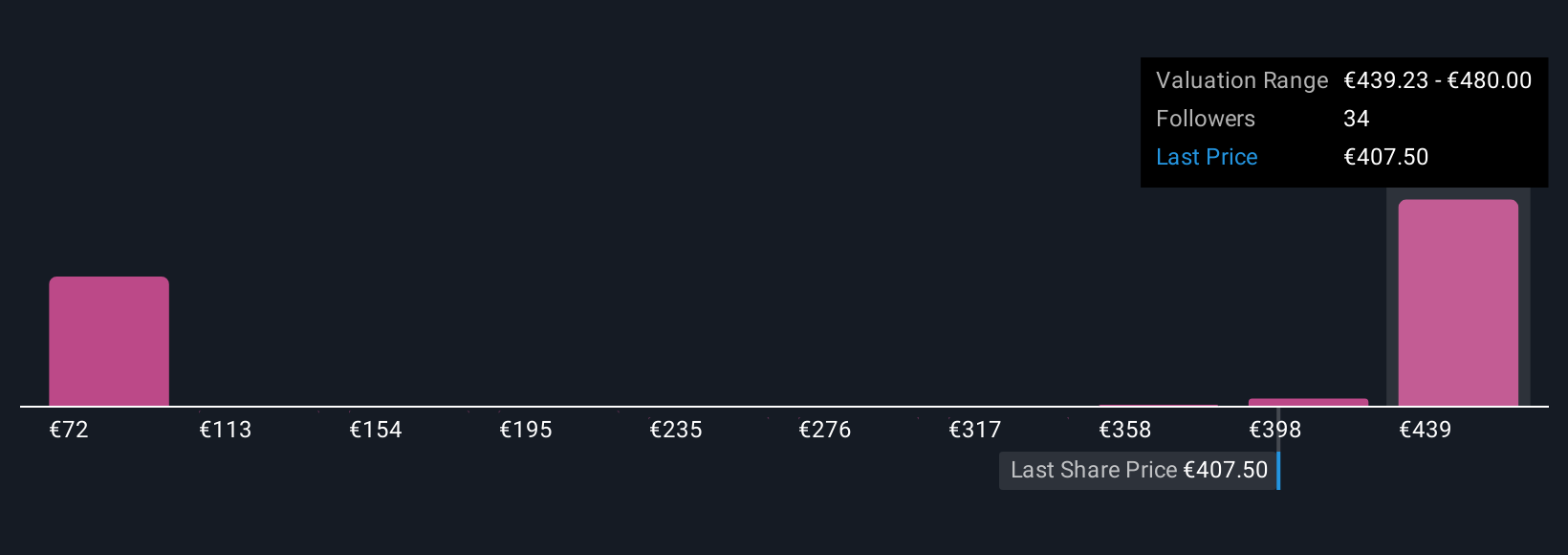

Private fair value targets from 11 Simply Wall St Community members for Ferrari range from €75.23 to €480. The variety of opinions highlights how evolving product mix risks could affect longer-term views, consider exploring different analyses to better understand what matters most for the company’s future.

Explore 11 other fair value estimates on Ferrari - why the stock might be worth as much as 36% more than the current price!

Build Your Own Ferrari Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ferrari research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ferrari research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ferrari's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives