- Italy

- /

- Auto Components

- /

- BIT:CIR

CIR. - Compagnie Industriali Riunite (BIT:CIR) shareholders notch a 20% return over 1 year, yet earnings have been shrinking

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the CIR S.p.A. - Compagnie Industriali Riunite (BIT:CIR) share price is 20% higher than it was a year ago, much better than the market return of around 15% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! However, the stock hasn't done so well in the longer term, with the stock only up 3.9% in three years.

Since the stock has added €72m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for CIR. - Compagnie Industriali Riunite

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year CIR. - Compagnie Industriali Riunite grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 15% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

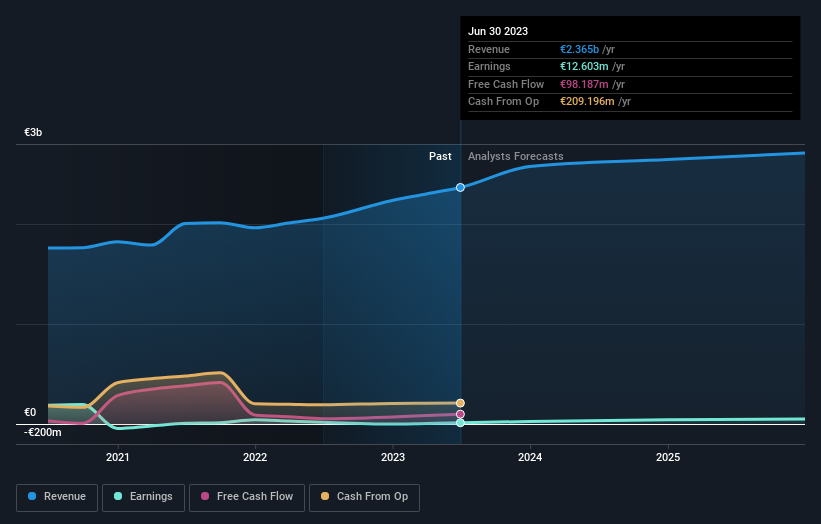

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on CIR. - Compagnie Industriali Riunite's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

CIR. - Compagnie Industriali Riunite provided a TSR of 20% over the year. That's fairly close to the broader market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 1.3% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for CIR. - Compagnie Industriali Riunite you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CIR

CIR. - Compagnie Industriali Riunite

Through its subsidiaries, primarily operates in the automotive components and healthcare sectors in Italy, rest of European countries, North America, South America, Asia, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives