- Iceland

- /

- Real Estate

- /

- ICSE:REITIR

Does It Make Sense To Buy Reitir fasteignafélag hf. (ICE:REITIR) For Its Yield?

Dividend paying stocks like Reitir fasteignafélag hf. (ICE:REITIR) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

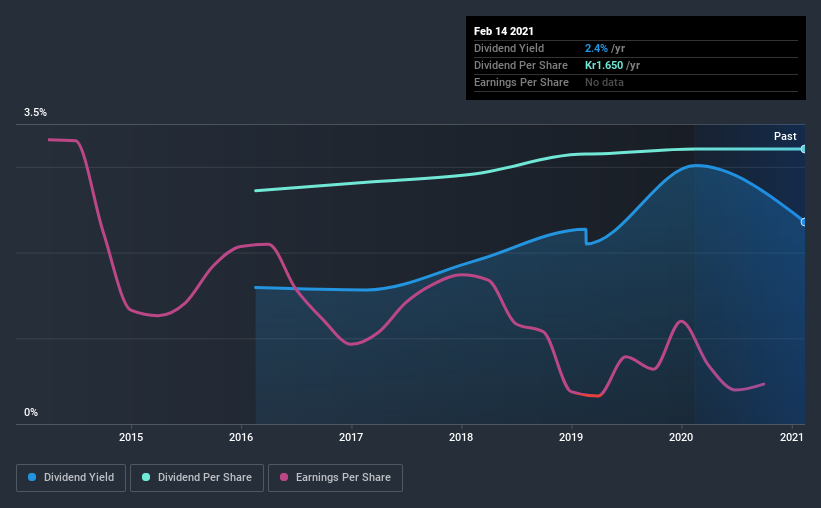

With a 2.4% yield and a five-year payment history, investors probably think Reitir fasteignafélag hf looks like a reliable dividend stock. A 2.4% yield is not inspiring, but the longer payment history has some appeal. During the year, the company also conducted a buyback equivalent to around 3.3% of its market capitalisation. There are a few simple ways to reduce the risks of buying Reitir fasteignafélag hf for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Reitir fasteignafélag hf!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 251% of Reitir fasteignafélag hf's profits were paid out as dividends in the last 12 months. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Of the free cash flow it generated last year, Reitir fasteignafélag hf paid out 29% as dividends, suggesting the dividend is affordable. It's good to see that while Reitir fasteignafélag hf's dividends were not covered by profits, at least they are affordable from a cash perspective. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

We update our data on Reitir fasteignafélag hf every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the data, we can see that Reitir fasteignafélag hf has been paying a dividend for the past five years. During the past five-year period, the first annual payment was Kr1.4 in 2016, compared to Kr1.7 last year. This works out to be a compound annual growth rate (CAGR) of approximately 3.3% a year over that time.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Reitir fasteignafélag hf's earnings per share have shrunk at 40% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're not keen on the fact that Reitir fasteignafélag hf paid out such a high percentage of its income, although its cashflow is in better shape. Earnings per share are down, and to our mind Reitir fasteignafélag hf has not been paying a dividend long enough to demonstrate its resilience across economic cycles. In summary, Reitir fasteignafélag hf has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are a number of better ideas out there.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come accross 7 warning signs for Reitir fasteignafélag hf you should be aware of, and 2 of them are a bit concerning.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade Reitir fasteignafélag hf, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ICSE:REITIR

Reitir fasteignafélag hf

Owns and leases commercial properties in Iceland.

Average dividend payer with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)