Sláturfélags Suðurlands svf (ICE:SFS B) Seems To Use Debt Quite Sensibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Sláturfélags Suðurlands svf. (ICE:SFS B) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Sláturfélags Suðurlands svf

What Is Sláturfélags Suðurlands svf's Debt?

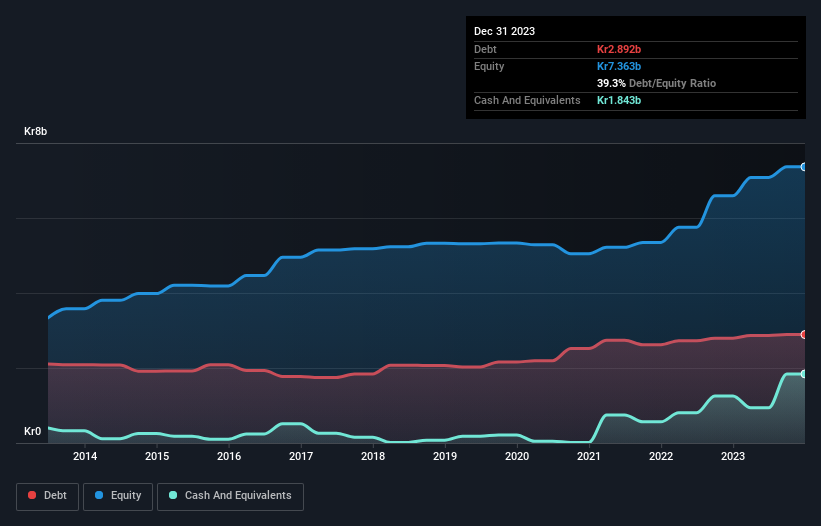

As you can see below, Sláturfélags Suðurlands svf had Kr2.89b of debt, at December 2023, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has Kr1.84b in cash leading to net debt of about Kr1.05b.

A Look At Sláturfélags Suðurlands svf's Liabilities

According to the last reported balance sheet, Sláturfélags Suðurlands svf had liabilities of Kr2.24b due within 12 months, and liabilities of Kr4.16b due beyond 12 months. On the other hand, it had cash of Kr1.84b and Kr1.93b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by Kr2.63b.

The deficiency here weighs heavily on the Kr1.44b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Sláturfélags Suðurlands svf would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Sláturfélags Suðurlands svf's low debt to EBITDA ratio of 0.60 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.2 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Also relevant is that Sláturfélags Suðurlands svf has grown its EBIT by a very respectable 24% in the last year, thus enhancing its ability to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Sláturfélags Suðurlands svf will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Sláturfélags Suðurlands svf produced sturdy free cash flow equating to 78% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Based on what we've seen Sláturfélags Suðurlands svf is not finding it easy, given its level of total liabilities, but the other factors we considered give us cause to be optimistic. There's no doubt that its ability to to convert EBIT to free cash flow is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Sláturfélags Suðurlands svf's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Sláturfélags Suðurlands svf (1 is potentially serious) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ICSE:SFS B

Sláturfélags Suðurlands svf

Engages in the abattoir, meat processing, and import and export businesses in Iceland.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)