- India

- /

- Renewable Energy

- /

- NSEI:JPPOWER

Should You Be Adding Jaiprakash Power Ventures (NSE:JPPOWER) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Jaiprakash Power Ventures (NSE:JPPOWER), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Jaiprakash Power Ventures with the means to add long-term value to shareholders.

Check out our latest analysis for Jaiprakash Power Ventures

How Fast Is Jaiprakash Power Ventures Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Jaiprakash Power Ventures grew its EPS from ₹0.43 to ₹1.72, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

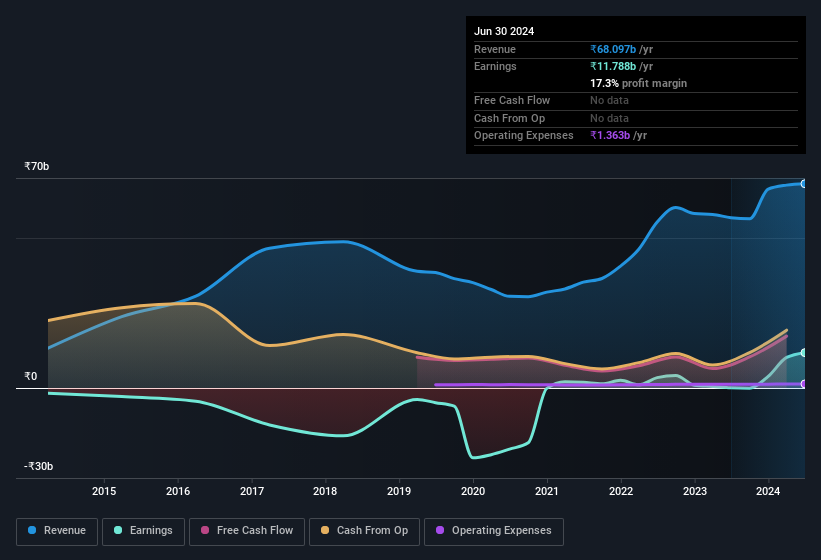

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Jaiprakash Power Ventures shareholders can take confidence from the fact that EBIT margins are up from 11% to 33%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Jaiprakash Power Ventures Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Jaiprakash Power Ventures shares worth a considerable sum. Given insiders own a significant chunk of shares, currently valued at ₹6.6b, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Jaiprakash Power Ventures with market caps between ₹84b and ₹268b is about ₹41m.

Jaiprakash Power Ventures' CEO took home a total compensation package worth ₹24m in the year leading up to March 2024. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Jaiprakash Power Ventures To Your Watchlist?

Jaiprakash Power Ventures' earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that Jaiprakash Power Ventures is worth considering carefully. What about risks? Every company has them, and we've spotted 1 warning sign for Jaiprakash Power Ventures you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JPPOWER

Jaiprakash Power Ventures

Engages in the power generation and cement grinding businesses in India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)