When Indowind Energy Limited (NSE:INDOWIND) reported its results to June 2022 its auditors, Sanjiv Shah & Associates could not be sure that it would be able to continue as a going concern in the next year. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay. Even more worrying, the auditor has noted that their opinion of the accounts is qualified, which means that the company will probably have trouble with its lenders, as well as potential investors.

Given its situation, it may not be in a good position to raise capital on favorable terms. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

View our latest analysis for Indowind Energy

How Much Debt Does Indowind Energy Carry?

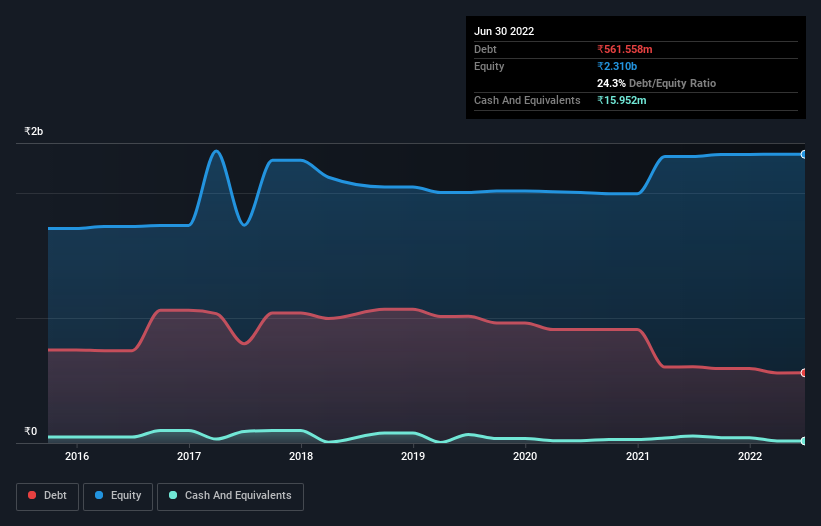

The image below, which you can click on for greater detail, shows that Indowind Energy had debt of ₹561.6m at the end of March 2022, a reduction from ₹609.5m over a year. However, because it has a cash reserve of ₹16.0m, its net debt is less, at about ₹545.6m.

How Strong Is Indowind Energy's Balance Sheet?

The latest balance sheet data shows that Indowind Energy had liabilities of ₹450.0m due within a year, and liabilities of ₹118.0m falling due after that. Offsetting these obligations, it had cash of ₹16.0m as well as receivables valued at ₹80.6m due within 12 months. So it has liabilities totalling ₹471.4m more than its cash and near-term receivables, combined.

This deficit isn't so bad because Indowind Energy is worth ₹1.32b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.081 times and a disturbingly high net debt to EBITDA ratio of 8.4 hit our confidence in Indowind Energy like a one-two punch to the gut. The debt burden here is substantial. However, the silver lining was that Indowind Energy achieved a positive EBIT of ₹1.5m in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Indowind Energy will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for any shareholders, Indowind Energy actually produced more free cash flow than EBIT over the last year. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Indowind Energy's interest cover and net debt to EBITDA definitely weigh on it, in our esteem. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. We think that Indowind Energy's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. We prefer to invest in companies that ensure the balance sheet remains healthier than that. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Indowind Energy you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDOWIND

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.