- India

- /

- Renewable Energy

- /

- NSEI:GREENPOWER

Orient Green Power's (NSE:GREENPOWER) Shareholders May Want To Dig Deeper Than Statutory Profit

Following the solid earnings report from Orient Green Power Company Limited (NSE:GREENPOWER), the market responded by bidding up the stock price. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

See our latest analysis for Orient Green Power

A Closer Look At Orient Green Power's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

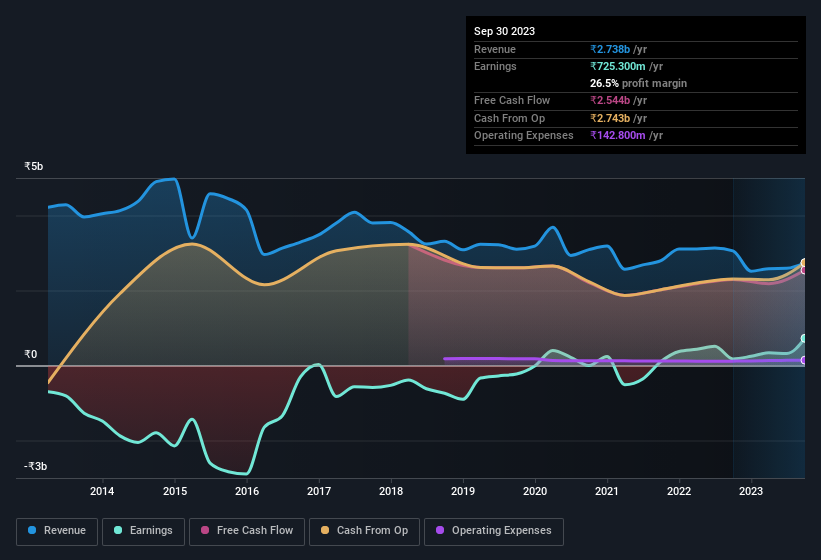

For the year to September 2023, Orient Green Power had an accrual ratio of -0.11. That indicates that its free cash flow was a fair bit more than its statutory profit. In fact, it had free cash flow of ₹2.5b in the last year, which was a lot more than its statutory profit of ₹725.3m. Orient Green Power's free cash flow improved over the last year, which is generally good to see. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Orient Green Power.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Orient Green Power issued 31% more new shares over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Orient Green Power's EPS by clicking here.

A Look At The Impact Of Orient Green Power's Dilution On Its Earnings Per Share (EPS)

As you can see above, Orient Green Power has been growing its net income over the last few years, with an annualized gain of 163,625% over three years. But EPS was only up 152,633% per year, in the exact same period. And the 311% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 292% in that time. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Orient Green Power can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

The Impact Of Unusual Items On Profit

Surprisingly, given Orient Green Power's accrual ratio implied strong cash conversion, its paper profit was actually boosted by ₹405m in unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. Orient Green Power had a rather significant contribution from unusual items relative to its profit to September 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Orient Green Power's Profit Performance

Summing up, Orient Green Power's accrual ratio suggests that its statutory earnings are well matched by cash flow while its unusual items boosted the profit in a way that might not be repeated. Further, the dilution means profits are now split more ways. Considering all this we'd argue Orient Green Power's profits probably give an overly generous impression of its sustainable level of profitability. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Every company has risks, and we've spotted 4 warning signs for Orient Green Power (of which 1 is potentially serious!) you should know about.

Our examination of Orient Green Power has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GREENPOWER

Orient Green Power

An independent power producer of renewable power, engages in the generation and sale of wind energy in India and Croatia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026