- India

- /

- Marine and Shipping

- /

- NSEI:TRANSWORLD

Here's Why We Think Shreyas Shipping and Logistics (NSE:SHREYAS) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Shreyas Shipping and Logistics (NSE:SHREYAS). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Shreyas Shipping and Logistics

How Fast Is Shreyas Shipping and Logistics Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that Shreyas Shipping and Logistics grew its EPS from ₹20.16 to ₹96.13, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, Shreyas Shipping and Logistics's revenue dropped 3.3% last year, but the silver lining is that EBIT margins improved from 9.0% to 40%. That falls short of ideal.

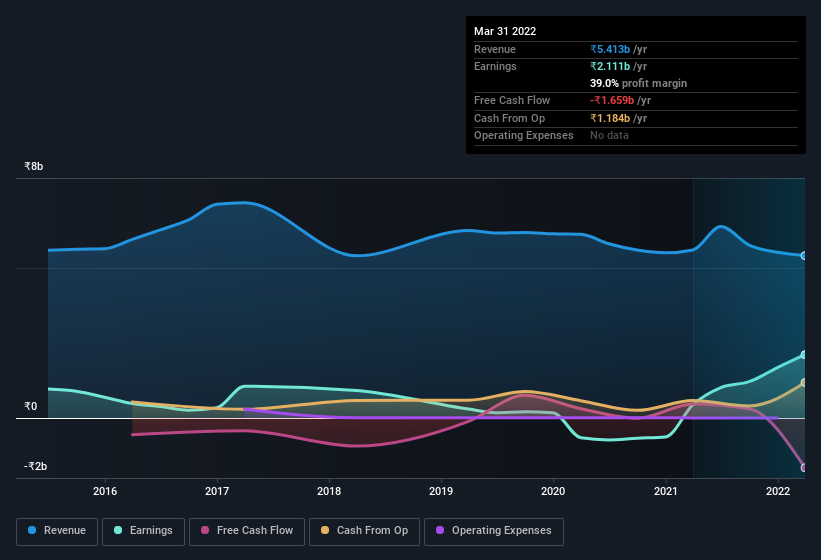

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Shreyas Shipping and Logistics is no giant, with a market capitalization of ₹7.6b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Shreyas Shipping and Logistics Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Shreyas Shipping and Logistics shares, in the last year. So it's definitely nice that Additional Non-Executive & Non-Independent Director Anisha Ramakrishnan bought ₹450k worth of shares at an average price of around ₹1.00.

On top of the insider buying, it's good to see that Shreyas Shipping and Logistics insiders have a valuable investment in the business. To be specific, they have ₹1.3b worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 17% of the company; visible skin in the game.

Should You Add Shreyas Shipping and Logistics To Your Watchlist?

Shreyas Shipping and Logistics's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Shreyas Shipping and Logistics deserves timely attention. You should always think about risks though. Case in point, we've spotted 3 warning signs for Shreyas Shipping and Logistics you should be aware of, and 1 of them is concerning.

As a growth investor I do like to see insider buying. But Shreyas Shipping and Logistics isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Transworld Shipping Lines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TRANSWORLD

Transworld Shipping Lines

Provides coastal container shipping in India and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives