Discover These 3 Undiscovered Gems In India With Strong Fundamentals

Reviewed by Simply Wall St

The Indian market has shown impressive momentum, rising 1.2% over the last week and up 41% over the past 12 months, with earnings expected to grow by 17% per annum over the next few years. In this thriving environment, stocks with strong fundamentals stand out as potential gems for investors seeking robust growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| Network People Services Technologies | 0.24% | 81.82% | 86.35% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.10% | -6.06% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

BF Investment (NSEI:BFINVEST)

Simply Wall St Value Rating: ★★★★★☆

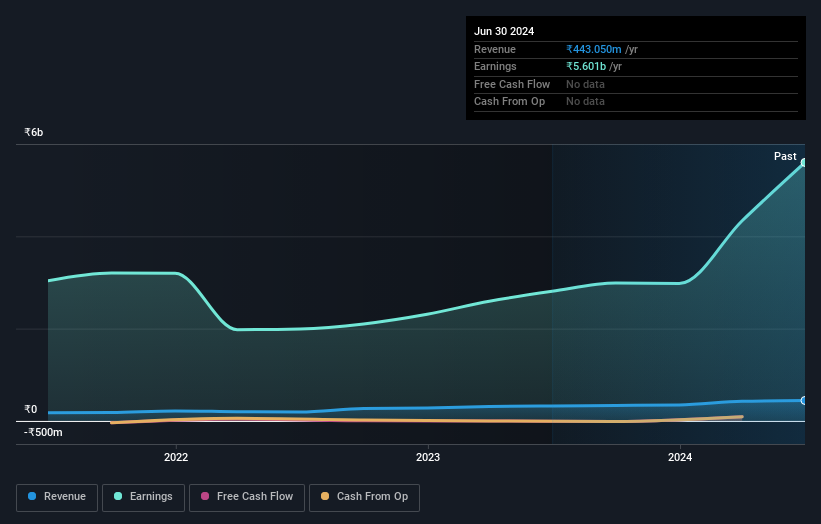

Overview: BF Investment Limited operates as a non-deposit taking investment company in India with a market cap of ₹22.59 billion.

Operations: The primary revenue stream for BF Investment Limited comes from investments in financial instruments, amounting to ₹443.05 million.

BF Investment, a small-cap entity in India, has demonstrated impressive financial health. Over the past year, earnings surged by 99.5%, outpacing the Capital Markets industry's 63.2%. The company reported Q1 2024 revenue of ₹77.23 million (up from ₹59.3 million) and net income of ₹1,826.11 million (up from ₹563.01 million). With a P/E ratio of 4x compared to the Indian market's 34x and no debt on its balance sheet, BF Investment stands out as an undervalued gem with robust growth potential.

Ecos (India) Mobility & Hospitality (NSEI:ECOSMOBLTY)

Simply Wall St Value Rating: ★★★★★☆

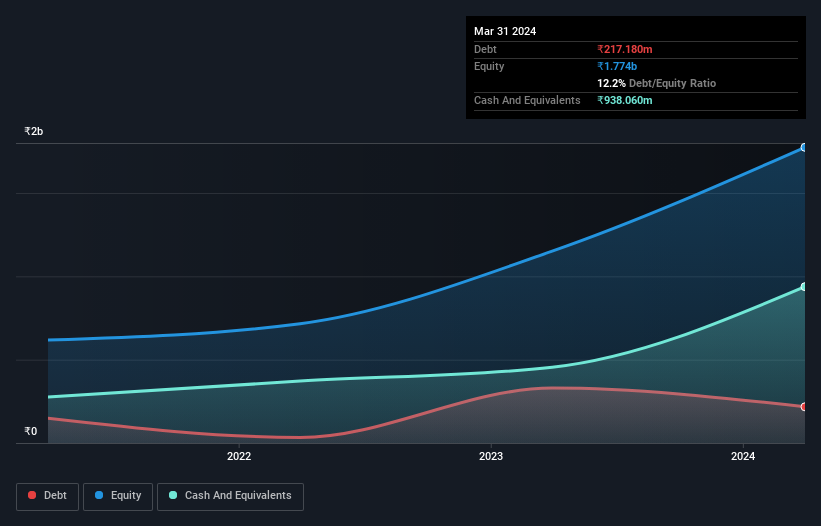

Overview: Ecos (India) Mobility & Hospitality Limited offers chauffeured car rental and employee transportation services in India and internationally, with a market cap of ₹33.53 billion.

Operations: Ecos (India) Mobility & Hospitality Limited generates revenue primarily from providing transport and car hire services, amounting to ₹5.54 billion. The company's financial performance includes key metrics such as net profit margin, which is critical for assessing profitability.

Ecos (India) Mobility & Hospitality has been making waves with its recent IPO, raising INR 6.01 billion. The company’s earnings grew by 43.4% over the past year, significantly outpacing the transportation industry’s growth of 13.4%. With net income rising to INR 625.31 million from INR 435.91 million a year ago and basic earnings per share at INR 10.42 compared to last year's INR 7.27, Ecos shows strong financial health and promising prospects for future growth in the small-cap space.

- Dive into the specifics of Ecos (India) Mobility & Hospitality here with our thorough health report.

Unicommerce eSolutions (NSEI:UNIECOM)

Simply Wall St Value Rating: ★★★★★☆

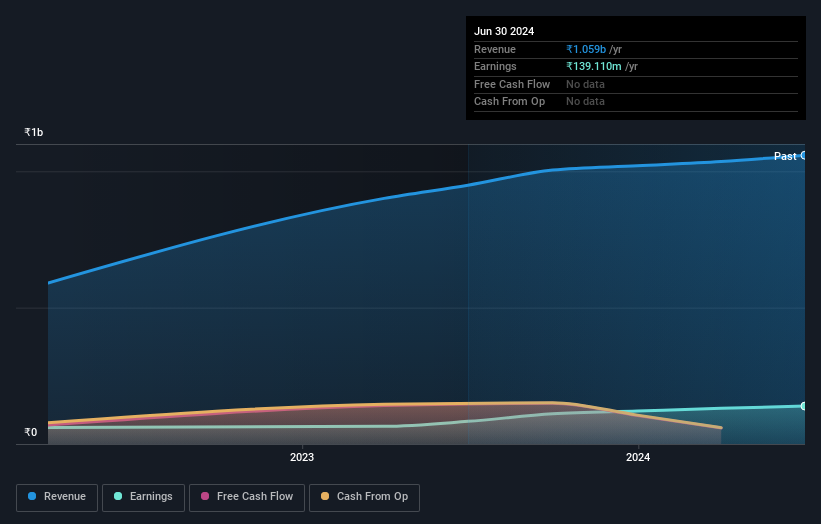

Overview: Unicommerce eSolutions Limited offers a suite of software-as-a-service products in India and internationally, with a market cap of ₹22.78 billion.

Operations: Unicommerce eSolutions Limited generates revenue primarily from its software services, amounting to ₹1.06 billion. The company's market cap is ₹22.78 billion.

Unicommerce eSolutions has shown impressive earnings growth of 67.6% over the past year, outpacing the software industry's 32.4%. Recent partnerships, such as with Healthkart to enhance its e-commerce supply chain, highlight its innovative tech solutions. The company reported revenue of INR 290.2 million for Q1 2025 compared to INR 262.67 million a year ago and net income increased to INR 35.12 million from INR 26.79 million last year, indicating robust financial health and operational efficiency.

- Navigate through the intricacies of Unicommerce eSolutions with our comprehensive health report here.

Assess Unicommerce eSolutions' past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 473 companies within our Indian Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UNIECOM

Unicommerce eSolutions

Provides a suite of software-as-a-service products in India and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives