- India

- /

- Infrastructure

- /

- NSEI:DREDGECORP

A Piece Of The Puzzle Missing From Dredging Corporation of India Limited's (NSE:DREDGECORP) Share Price

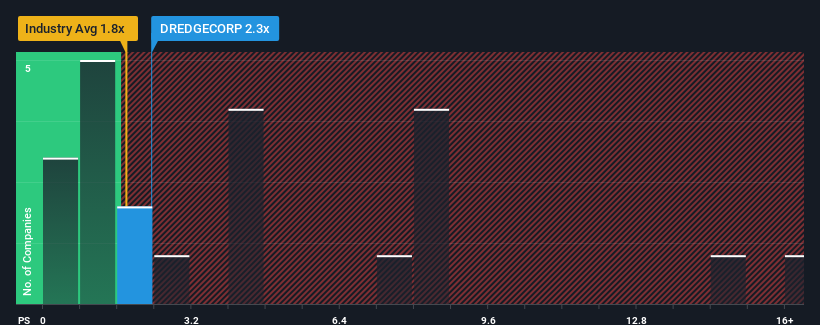

You may think that with a price-to-sales (or "P/S") ratio of 2.3x Dredging Corporation of India Limited (NSE:DREDGECORP) is a stock worth checking out, seeing as almost half of all the Infrastructure companies in India have P/S ratios greater than 4.4x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Dredging Corporation of India

How Dredging Corporation of India Has Been Performing

For example, consider that Dredging Corporation of India's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Dredging Corporation of India's earnings, revenue and cash flow.How Is Dredging Corporation of India's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Dredging Corporation of India's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 21% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

It's interesting to note that the rest of the industry is similarly expected to grow by 8.1% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Dredging Corporation of India is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Dredging Corporation of India's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Dredging Corporation of India currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Having said that, be aware Dredging Corporation of India is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DREDGECORP

Dredging Corporation of India

Provides dredging services to various ports, the Indian navy, fishing harbors, and other maritime organizations primarily in India.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives