- India

- /

- Electronic Equipment and Components

- /

- NSEI:NITIRAJ

Here's What We Think About Nitiraj Engineers' (NSE:NITIRAJ) CEO Pay

Rajesh Bhatwal became the CEO of Nitiraj Engineers Limited (NSE:NITIRAJ) in 2015, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Nitiraj Engineers

Comparing Nitiraj Engineers Limited's CEO Compensation With the industry

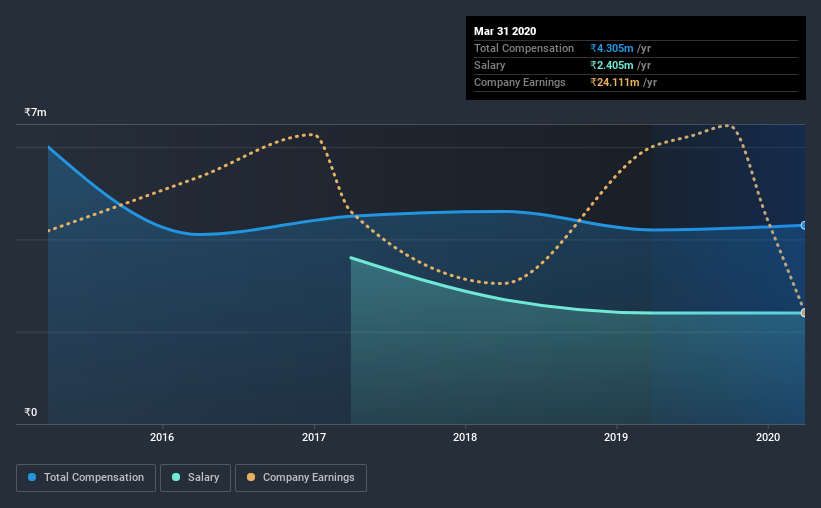

According to our data, Nitiraj Engineers Limited has a market capitalization of ₹537m, and paid its CEO total annual compensation worth ₹4.3m over the year to March 2020. This means that the compensation hasn't changed much from last year. Notably, the salary which is ₹2.40m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹3.1m. This suggests that Rajesh Bhatwal is paid more than the median for the industry. What's more, Rajesh Bhatwal holds ₹216m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹2.4m | ₹2.4m | 56% |

| Other | ₹1.9m | ₹1.8m | 44% |

| Total Compensation | ₹4.3m | ₹4.2m | 100% |

Talking in terms of the industry, salary represented approximately 99% of total compensation out of all the companies we analyzed, while other remuneration made up 0.7% of the pie. It's interesting to note that Nitiraj Engineers allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Nitiraj Engineers Limited's Growth Numbers

Nitiraj Engineers Limited has reduced its earnings per share by 19% a year over the last three years. It saw its revenue drop 11% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Nitiraj Engineers Limited Been A Good Investment?

Given the total shareholder loss of 8.0% over three years, many shareholders in Nitiraj Engineers Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we touched on above, Nitiraj Engineers Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Disappointingly, share price gains over the last three years have failed to materialize. Arguably worse, we've been waiting for positive EPS growth for the last three years. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 4 warning signs for Nitiraj Engineers (of which 2 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Nitiraj Engineers, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nitiraj Engineers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:NITIRAJ

Nitiraj Engineers

Manufactures and sells various electronic weighing scales, currency counting machines, and taxi fare meters for industrial and domestic sectors in India and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)