Uncovering Hidden Gems Aarti Pharmalabs And 2 Other Small Caps with Strong Potential

Reviewed by Simply Wall St

The Indian market has shown impressive performance, rising 1.0% in the last 7 days and up 45% over the past year, with earnings expected to grow by 17% annually in the coming years. In this robust environment, identifying small-cap stocks with strong potential can offer significant opportunities for investors seeking to capitalize on emerging growth stories.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | -0.26% | -1.39% | ★★★★★★ |

| Indo Amines | 82.32% | 17.15% | 20.00% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.64% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Master Trust | 37.05% | 27.57% | 41.99% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.68% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.07% | -10.66% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Aarti Pharmalabs (NSEI:AARTIPHARM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aarti Pharmalabs Limited, along with its subsidiaries, manufactures and sells active pharmaceutical ingredients, pharmaceutical intermediates, and xanthine derivatives in India and internationally, with a market cap of ₹62.40 billion.

Operations: Aarti Pharmalabs generates revenue primarily from its pharmaceuticals segment, amounting to ₹19.50 billion.

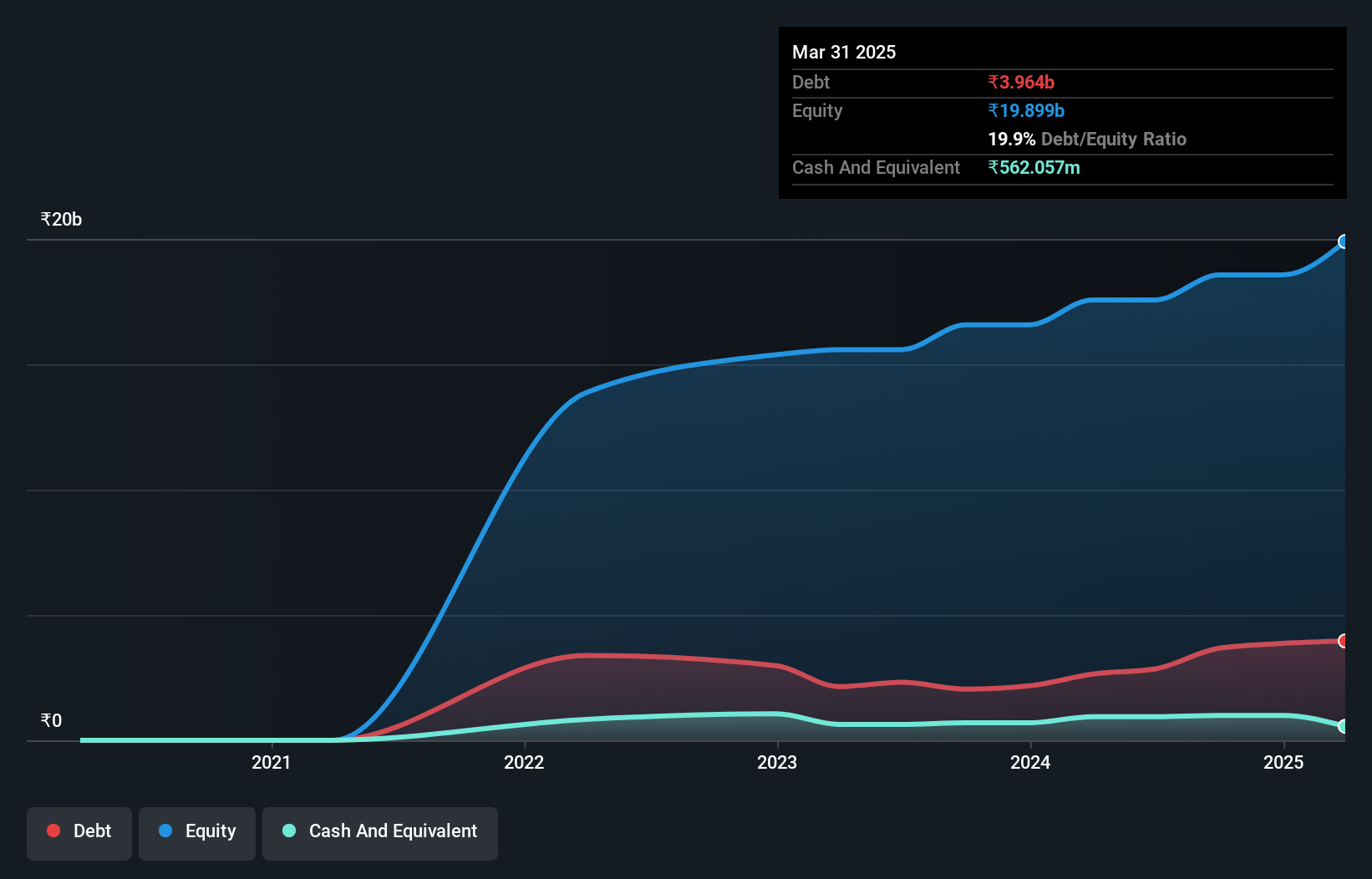

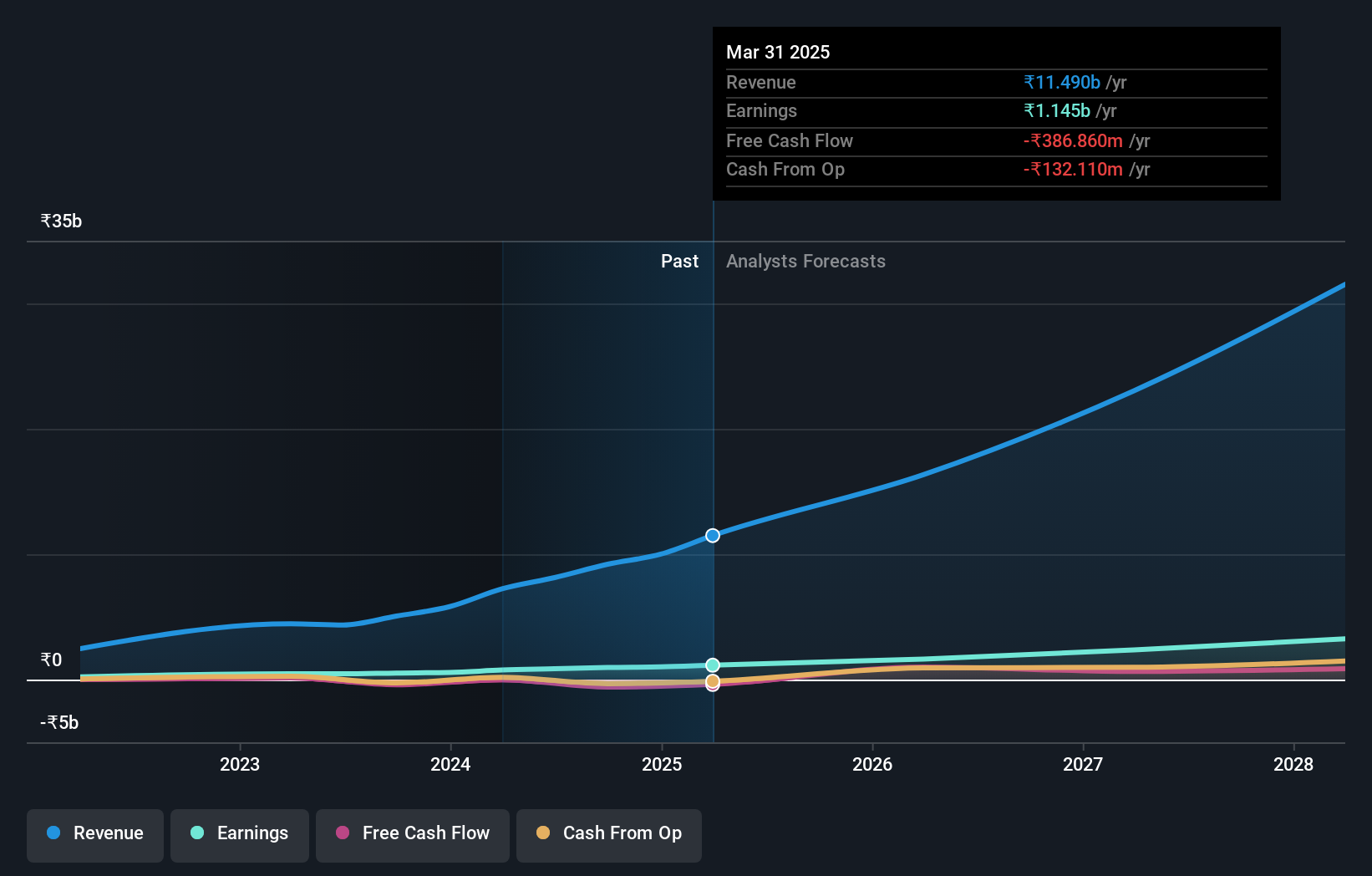

Aarti Pharmalabs, a noteworthy player in the Indian pharmaceuticals sector, has shown impressive financial performance with earnings growth of 19.4% over the past year, surpassing industry growth. The company’s net debt to equity ratio stands at a satisfactory 10.9%, and its interest payments are well covered by EBIT at 21.7x coverage. Recent board appointments bring extensive industry experience, and Q1 2025 results reported revenue of ₹5.58 billion (up from ₹4.59 billion).

- Click to explore a detailed breakdown of our findings in Aarti Pharmalabs' health report.

Gain insights into Aarti Pharmalabs' past trends and performance with our Past report.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of approximately ₹153.40 billion.

Operations: Netweb Technologies India Limited generates revenue primarily through the manufacturing and sale of computer servers, amounting to ₹8.14 billion. The company's market cap is approximately ₹153.40 billion.

Netweb Technologies India has shown impressive performance, with earnings growing by 85.8% over the past year, outpacing the tech industry's 10.8%. The company recently reported Q1 2024 sales of INR 1.49 billion compared to INR 598 million a year ago and net income of INR 154 million up from INR 51 million last year. Their debt-to-equity ratio improved significantly from 108% to just 2.3% over five years, showcasing robust financial health and strategic management.

Sundaram Finance Holdings (NSEI:SUNDARMHLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sundaram Finance Holdings Limited operates in investments, business processing, and support services across India, Australia, and the United Kingdom with a market cap of ₹89.89 billion.

Operations: The company generates revenue primarily from investments (₹2.51 billion), domestic shared services (₹105.51 million), and overseas shared services (₹489.78 million).

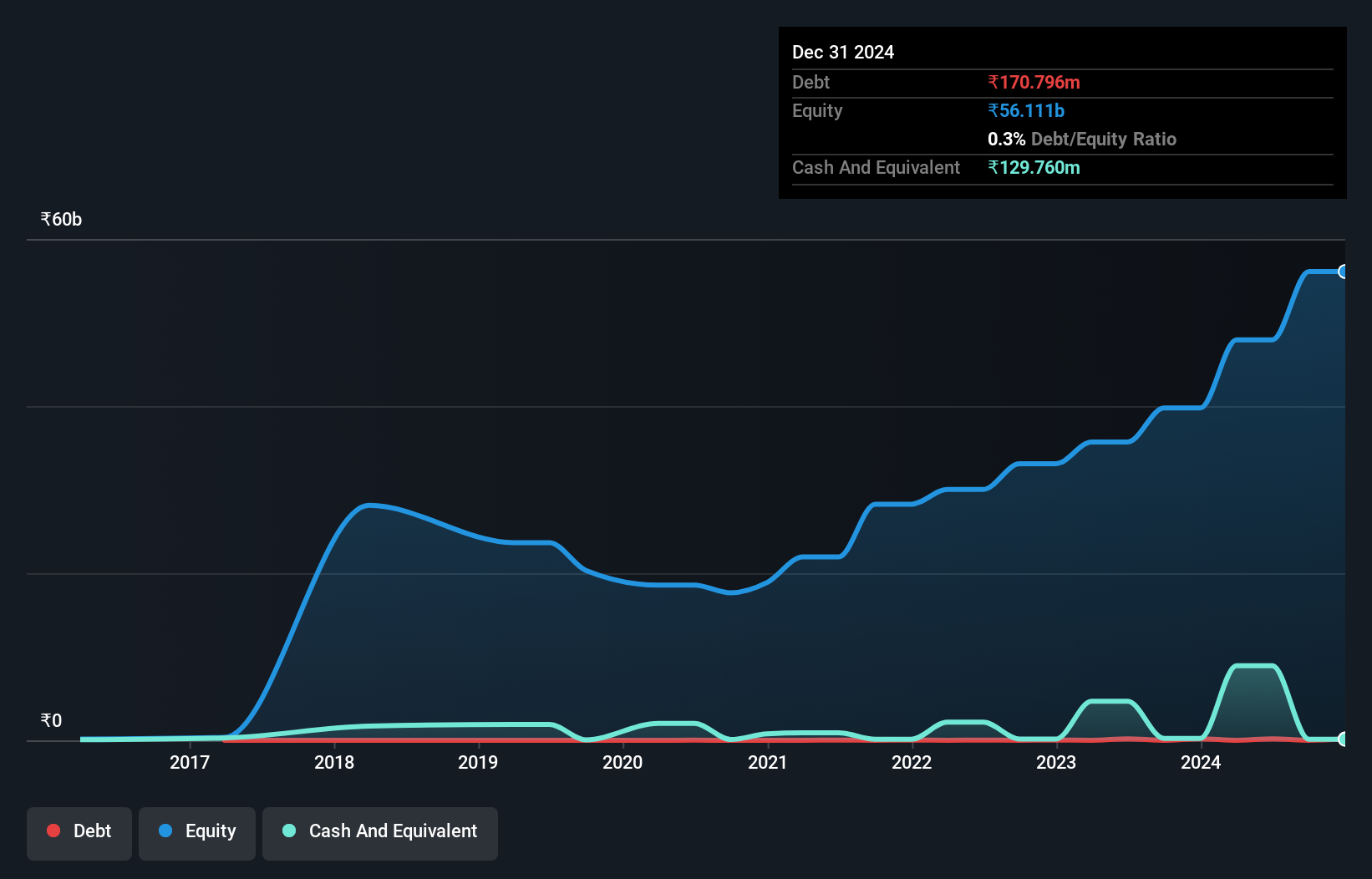

Sundaram Finance Holdings has shown strong financial performance with earnings growing by 114.5% in the past year, outpacing the Auto Components industry’s 20.1%. The company boasts a price-to-earnings ratio of 15.7x, significantly below the Indian market average of 34.3x, indicating potential undervaluation. Despite a volatile share price over the last three months, its debt to equity ratio has only increased modestly from 0% to 0.4% over five years, while EBIT covers interest payments by an impressive 265 times.

- Take a closer look at Sundaram Finance Holdings' potential here in our health report.

Learn about Sundaram Finance Holdings' historical performance.

Where To Now?

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 467 more companies for you to explore.Click here to unveil our expertly curated list of 470 Indian Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AARTIPHARM

Aarti Pharmalabs

Manufactures and sells active pharmaceutical ingredients, pharmaceutical intermediates, and xanthine derivatives in India and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)