- India

- /

- Communications

- /

- NSEI:NELCO

Nelco's (NSE:NELCO) Shareholders Will Receive A Bigger Dividend Than Last Year

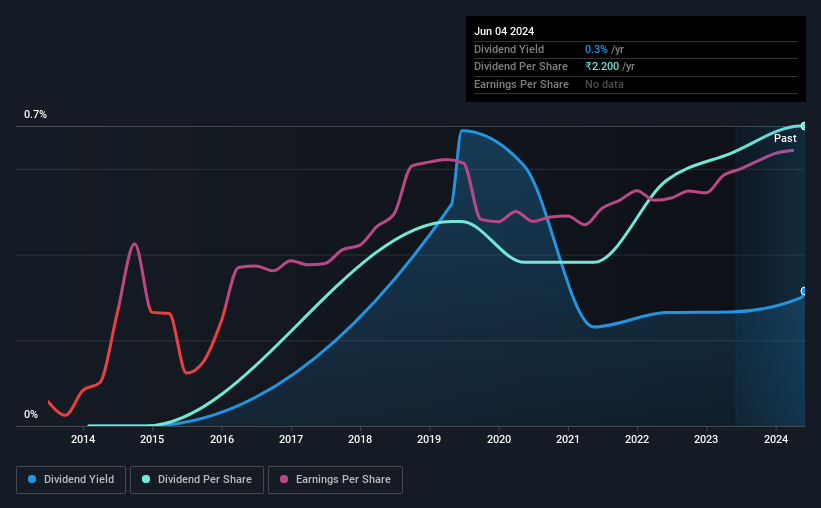

The board of Nelco Limited (NSE:NELCO) has announced that it will be paying its dividend of ₹2.20 on the 17th of July, an increased payment from last year's comparable dividend. Although the dividend is now higher, the yield is only 0.3%, which is below the industry average.

View our latest analysis for Nelco

Nelco's Dividend Is Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Before making this announcement, Nelco was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Over the next year, EPS could expand by 1.2% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 23% by next year, which is in a pretty sustainable range.

Nelco's Dividend Has Lacked Consistency

Looking back, Nelco's dividend hasn't been particularly consistent. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2019, the dividend has gone from ₹1.50 total annually to ₹2.20. This works out to be a compound annual growth rate (CAGR) of approximately 8.0% a year over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Nelco might have put its house in order since then, but we remain cautious.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Unfortunately, Nelco's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

Our Thoughts On Nelco's Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Nelco that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nelco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NELCO

Nelco

Provides solutions in the areas of very small aperture terminals (VSAT) connectivity, satellite communication (Satcom) projects, and integrated security and surveillance solutions in India.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)