- India

- /

- Communications

- /

- NSEI:UMIYA-MRO

Update: MRO-TEK Realty (NSE:MRO-TEK) Stock Gained 100% In The Last Five Years

Some MRO-TEK Realty Limited (NSE:MRO-TEK) shareholders are probably rather concerned to see the share price fall 36% over the last three months. On the bright side the returns have been quite good over the last half decade. Its return of 100% has certainly bested the market return! Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 59% decline over the last three years: that's a long time to wait for profits.

View our latest analysis for MRO-TEK Realty

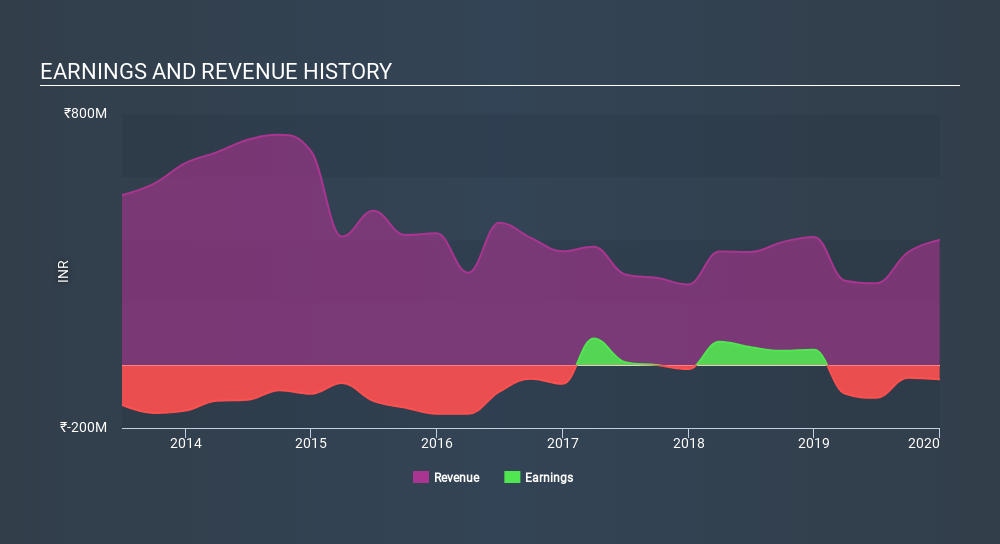

Because MRO-TEK Realty made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years MRO-TEK Realty saw its revenue shrink by 9.0% per year. Even though revenue hasn't increased, the stock actually gained 15%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on MRO-TEK Realty's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

MRO-TEK Realty shareholders are down 11% over twelve months, which isn't far from the market return of -12%. Longer term investors wouldn't be so upset, since they would have made 15%, each year, over five years. If the stock price has been impacted by changing sentiment, rather than deteriorating business conditions, it could spell opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for MRO-TEK Realty (of which 2 are a bit unpleasant!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:UMIYA-MRO

Umiya Buildcon

Engages in the manufacture, supply, and distribution of access and networking equipment and solutions in India and internationally.

Outstanding track record with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)