3 Stocks Estimated To Be Trading Below Intrinsic Value In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration and its potential impact on policy, investors are witnessing a mixed performance across various sectors. With financials and energy shares gaining from deregulation hopes while healthcare and EV stocks face setbacks, identifying undervalued stocks becomes crucial for those looking to capitalize on market inefficiencies. In such an environment, a good stock is one that is trading below its intrinsic value, offering potential for growth as market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.71 | CN¥33.16 | 49.6% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.49 | CN¥76.93 | 50% |

| Taiwan Union Technology (TPEX:6274) | NT$156.50 | NT$311.70 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.57 | CN¥29.09 | 49.9% |

| ConvaTec Group (LSE:CTEC) | £2.43 | £4.85 | 49.9% |

| TF Bank (OM:TFBANK) | SEK312.00 | SEK621.04 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.23 | CA$8.40 | 49.6% |

| Saipem (BIT:SPM) | €2.342 | €4.65 | 49.6% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44450.00 | ₩88893.31 | 50% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €7.408 | €14.72 | 49.7% |

Let's explore several standout options from the results in the screener.

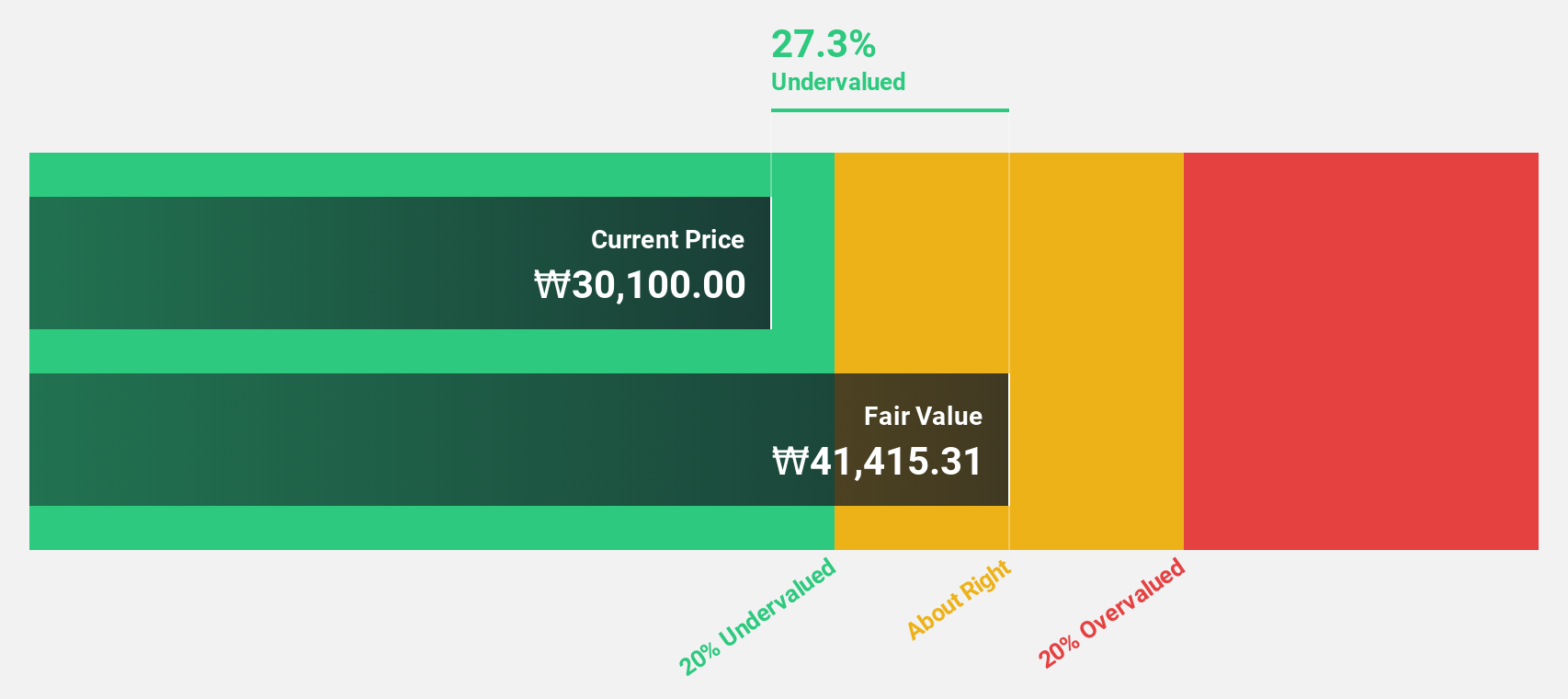

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Overview: JUSUNG ENGINEERING Co., Ltd. manufactures and sells semiconductor, display, solar, and lighting equipment both in South Korea and internationally, with a market cap of approximately ₩1.31 trillion.

Operations: The company's revenue is primarily derived from its semiconductor equipment and services segment, which generated approximately ₩338.28 billion.

Estimated Discount To Fair Value: 30.3%

JUSUNG ENGINEERING Ltd. appears undervalued, trading at ₩27,650, which is 30.3% below its estimated fair value of ₩39,661.13. Despite slower earnings growth than the market at 20.5%, it benefits from a robust revenue forecast of 22% annually and recent profit growth of 43.5%. Analysts expect a price rise by 64.8%. The company announced a KRW 50 billion share buyback to enhance shareholder value and stabilize stock prices by April 2025.

- According our earnings growth report, there's an indication that JUSUNG ENGINEERINGLtd might be ready to expand.

- Click here to discover the nuances of JUSUNG ENGINEERINGLtd with our detailed financial health report.

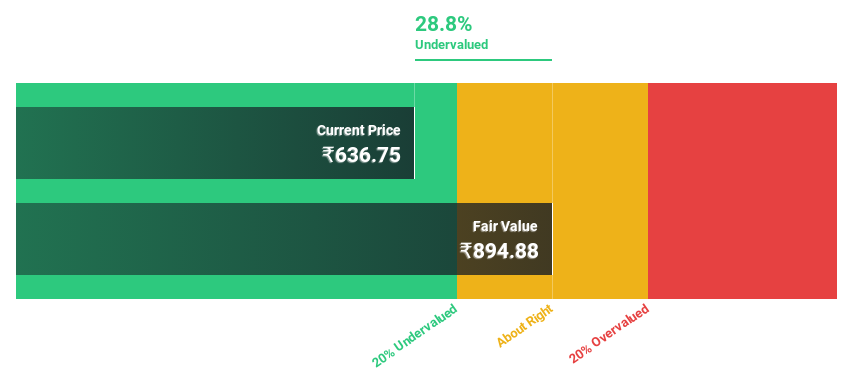

Cyient DLM (NSEI:CYIENTDLM)

Overview: Cyient DLM Limited offers electronic manufacturing solutions both in India and internationally, with a market cap of ₹50.50 billion.

Operations: The company generates revenue of ₹13.30 billion from its electronic manufacturing solutions segment.

Estimated Discount To Fair Value: 28.8%

Cyient DLM is trading at ₹636.75, significantly below its estimated fair value of ₹894.88, indicating potential undervaluation based on cash flows. The company has shown strong revenue growth, with recent earnings rising by 75.5% year-over-year and forecasted to grow at 47.1% annually, outpacing the Indian market's average. Its strategic partnership with Honeywell Aerospace Technologies highlights its commitment to innovation and positions it well for future growth in aerospace engineering.

- The analysis detailed in our Cyient DLM growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Cyient DLM stock in this financial health report.

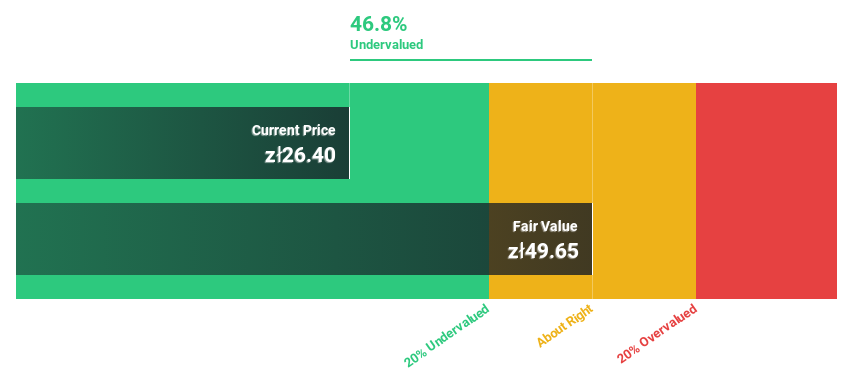

Celon Pharma (WSE:CLN)

Overview: Celon Pharma S.A. is an integrated pharmaceutical company involved in the research, manufacture, and marketing of pharmaceutical products, with a market cap of PLN1.42 billion.

Operations: The company's revenue is derived from two main segments: Innovative products, contributing PLN35.27 million, and Generic Drugs, accounting for PLN171.54 million.

Estimated Discount To Fair Value: 46.8%

Celon Pharma is trading at PLN26.4, substantially below the estimated fair value of PLN49.65, suggesting it may be undervalued based on cash flows. Despite recent losses and shareholder dilution, its revenue is forecast to grow faster than the Polish market at 7.8% annually, with profitability expected in three years. However, recent earnings showed a net loss of PLN 23.7 million for the first half of 2024 compared to last year's profit, highlighting financial challenges amidst potential growth prospects.

- Our expertly prepared growth report on Celon Pharma implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Celon Pharma.

Summing It All Up

- Explore the 935 names from our Undervalued Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CLN

Celon Pharma

An integrated pharmaceutical company, engages in the research, manufacture, and marketing of pharmaceutical products and preparations.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives