We Wouldn't Be Too Quick To Buy Xchanging Solutions Limited (NSE:XCHANGING) Before It Goes Ex-Dividend

Xchanging Solutions Limited (NSE:XCHANGING) stock is about to trade ex-dividend in three days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Therefore, if you purchase Xchanging Solutions' shares on or after the 11th of July, you won't be eligible to receive the dividend, when it is paid on the 1st of January.

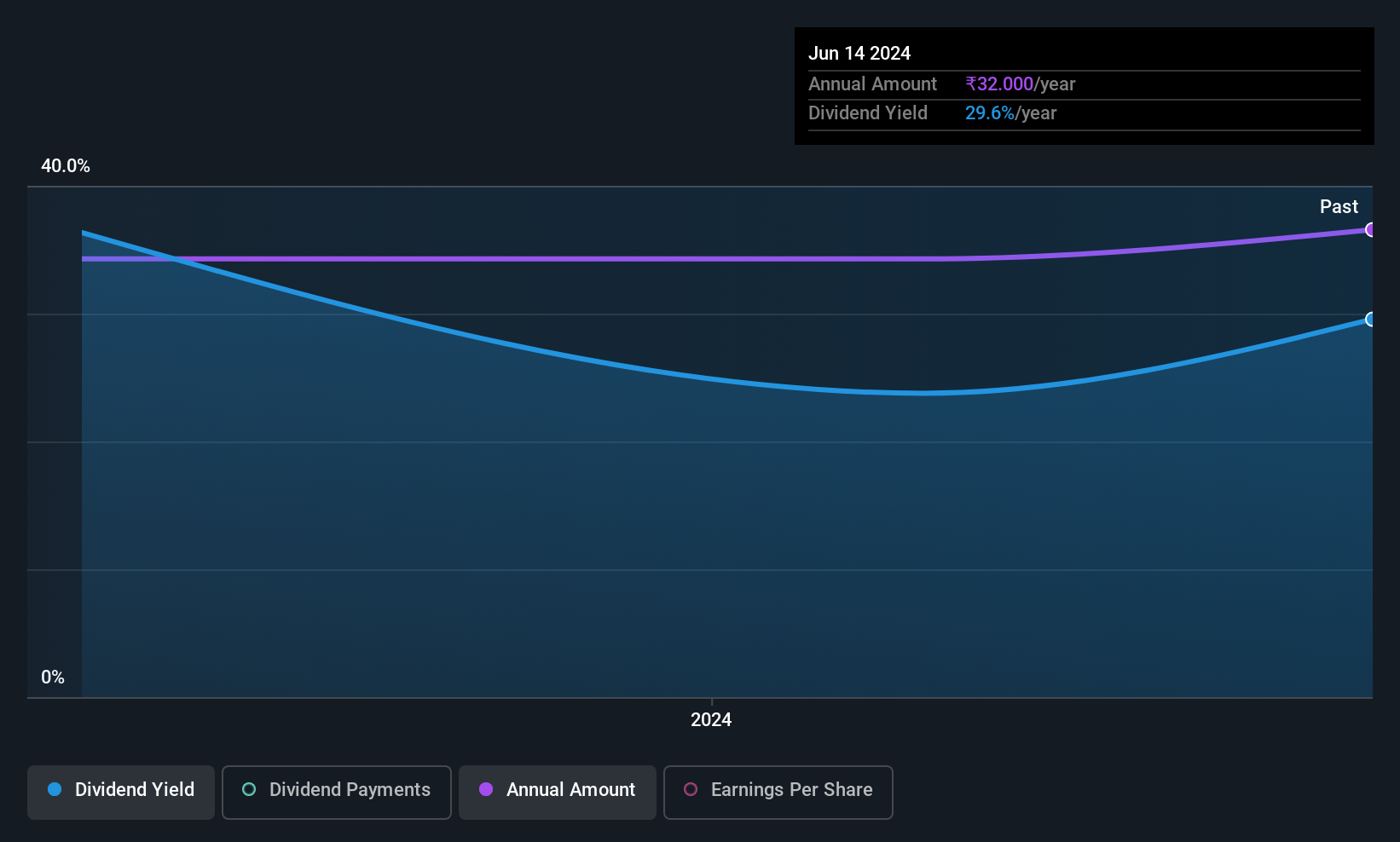

The company's next dividend payment will be ₹2.00 per share, and in the last 12 months, the company paid a total of ₹2.00 per share. Looking at the last 12 months of distributions, Xchanging Solutions has a trailing yield of approximately 2.0% on its current stock price of ₹99.75. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Xchanging Solutions can afford its dividend, and if the dividend could grow.

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. That's why it's good to see Xchanging Solutions paying out a modest 45% of its earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out 95% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Xchanging Solutions paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Were this to happen repeatedly, this would be a risk to Xchanging Solutions's ability to maintain its dividend.

Check out our latest analysis for Xchanging Solutions

Click here to see how much of its profit Xchanging Solutions paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings fall far enough, the company could be forced to cut its dividend. That explains why we're not overly excited about Xchanging Solutions's flat earnings over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Xchanging Solutions has seen its dividend decline 74% per annum on average over the past two years, which is not great to see.

Final Takeaway

Is Xchanging Solutions worth buying for its dividend? It's disappointing to see earnings per share have fallen slightly, even though Xchanging Solutions is paying out less than half its income as dividends. It's also paying out an uncomfortably high percentage of its cash flow, which makes us wonder just how sustainable the dividend really is. Bottom line: Xchanging Solutions has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

So if you're still interested in Xchanging Solutions despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. We've identified 2 warning signs with Xchanging Solutions (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:XCHANGING

Xchanging Solutions

Provides information technology services in India, Europe, the United States, Singapore, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)