This Is The Reason Why We Think Subex Limited's (NSE:SUBEXLTD) CEO Might Be Underpaid

The solid performance at Subex Limited (NSE:SUBEXLTD) has been impressive and shareholders will probably be pleased to know that CEO Vinod Padmanabhan has delivered. At the upcoming AGM on 09 July 2021, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

View our latest analysis for Subex

Comparing Subex Limited's CEO Compensation With the industry

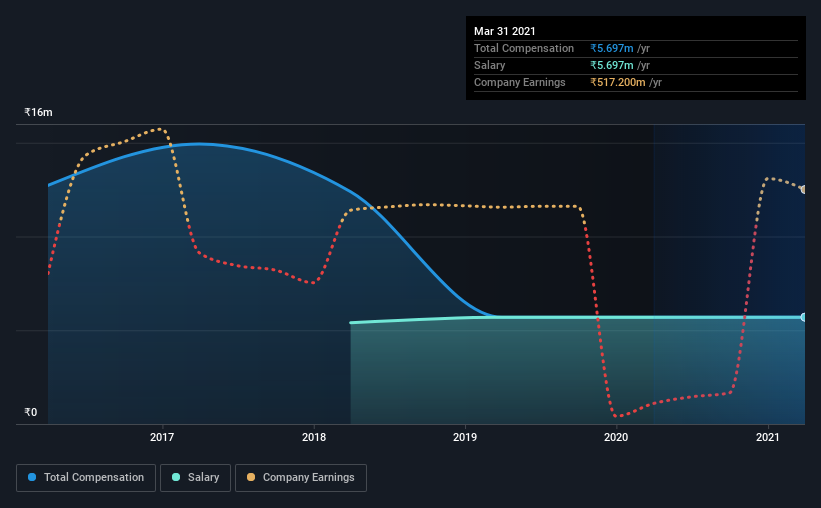

Our data indicates that Subex Limited has a market capitalization of ₹30b, and total annual CEO compensation was reported as ₹5.7m for the year to March 2021. This was the same amount the CEO received in the prior year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹5.7m.

In comparison with other companies in the industry with market capitalizations ranging from ₹15b to ₹60b, the reported median CEO total compensation was ₹15m. In other words, Subex pays its CEO lower than the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹5.7m | ₹5.7m | 100% |

| Other | - | - | - |

| Total Compensation | ₹5.7m | ₹5.7m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. Speaking on a company level, Subex prefers to tread along a traditional path, disbursing all compensation through a salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Subex Limited's Growth Numbers

Over the past three years, Subex Limited has seen its earnings per share (EPS) grow by 37% per year. Its revenue is up 1.9% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Subex Limited Been A Good Investment?

Most shareholders would probably be pleased with Subex Limited for providing a total return of 938% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Subex rewards its CEO solely through a salary, ignoring non-salary benefits completely. Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 3 warning signs for Subex that investors should be aware of in a dynamic business environment.

Important note: Subex is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Subex or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SUBEXLTD

Subex

Provides operations and business support systems to communication service providers (CSPs) worldwide.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)