Ramco Systems Limited (NSE:RAMCOSYS) Surges 27% Yet Its Low P/S Is No Reason For Excitement

Ramco Systems Limited (NSE:RAMCOSYS) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 79%.

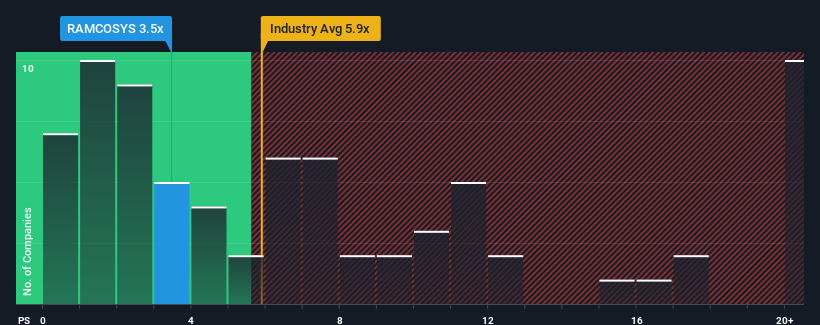

In spite of the firm bounce in price, Ramco Systems may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.5x, since almost half of all companies in the Software industry in India have P/S ratios greater than 5.9x and even P/S higher than 11x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Ramco Systems

How Ramco Systems Has Been Performing

With revenue growth that's inferior to most other companies of late, Ramco Systems has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Ramco Systems' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Ramco Systems would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.6% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 11% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the one analyst following the company. That's shaping up to be materially lower than the 15% growth forecast for the broader industry.

With this in consideration, its clear as to why Ramco Systems' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Ramco Systems' P/S

Despite Ramco Systems' share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Ramco Systems' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Ramco Systems that you should be aware of.

If you're unsure about the strength of Ramco Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RAMCOSYS

Ramco Systems

Operates as an enterprise software company in the United States, Europe, the Asia-Pacific, India, and the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion