C. E. Info Systems Limited Just Missed Earnings - But Analysts Have Updated Their Models

Shareholders might have noticed that C. E. Info Systems Limited (NSE:MAPMYINDIA) filed its third-quarter result this time last week. The early response was not positive, with shares down 2.6% to ₹1,967 in the past week. It was not a great result overall. While revenues of ₹920m were in line with analyst predictions, earnings were less than expected, missing statutory estimates by 11% to hit ₹5.69 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for C. E. Info Systems

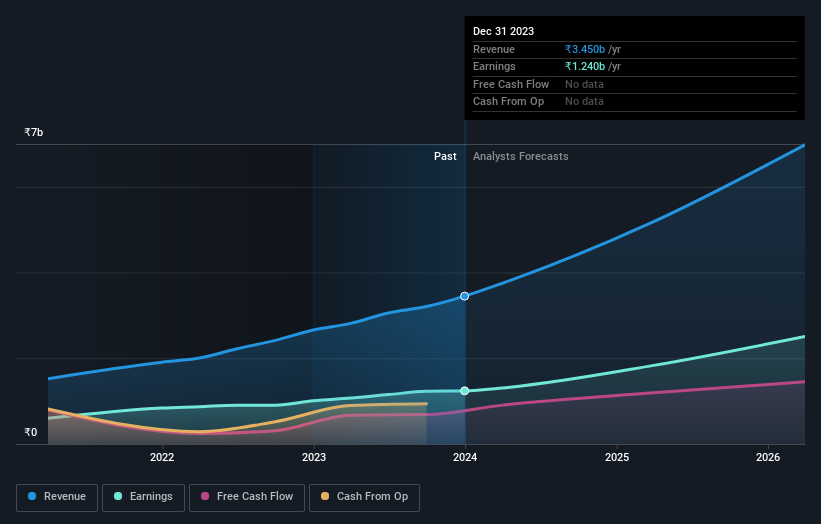

Taking into account the latest results, the consensus forecast from C. E. Info Systems' four analysts is for revenues of ₹5.19b in 2025. This reflects a major 50% improvement in revenue compared to the last 12 months. Per-share earnings are expected to soar 49% to ₹34.15. In the lead-up to this report, the analysts had been modelling revenues of ₹5.82b and earnings per share (EPS) of ₹34.25 in 2025. So there's been a clear change in sentiment after these results, with the analysts making a substantial drop in revenues and reconfirming their earnings per share estimates.

The analysts have also increased their price target 12% to ₹2,051, clearly signalling that lower revenue forecasts next year are not expected to have a material impact on C. E. Info Systems' valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values C. E. Info Systems at ₹2,450 per share, while the most bearish prices it at ₹1,703. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await C. E. Info Systems shareholders.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that C. E. Info Systems' rate of growth is expected to accelerate meaningfully, with the forecast 39% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 20% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 15% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect C. E. Info Systems to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. They also downgraded C. E. Info Systems' revenue estimates, but industry data suggests that it is expected to grow faster than the wider industry. Even so, earnings are more important to the intrinsic value of the business. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on C. E. Info Systems. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple C. E. Info Systems analysts - going out to 2026, and you can see them free on our platform here.

You can also see our analysis of C. E. Info Systems' Board and CEO remuneration and experience, and whether company insiders have been buying stock.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAPMYINDIA

C. E. Info Systems

Provides digital mapping, geospatial, and Internet of Things (IoT) platform solutions in India and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026