Over the last 7 days, the Indian market has experienced a 3.6% decline, yet it remains up by an impressive 40% over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying high growth tech stocks involves assessing their potential for innovation and scalability in alignment with these robust market trends.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Sonata Software | 13.44% | 29.79% | ★★★★★☆ |

| C. E. Info Systems | 29.86% | 26.39% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.11% | 42.50% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

KPIT Technologies (NSEI:KPITTECH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KPIT Technologies Limited specializes in offering embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector across various international markets, with a market cap of ₹462.68 billion.

Operations: The company generates revenue by providing advanced software and digital solutions tailored for the automobile and mobility industries across global markets. It focuses on leveraging embedded software and artificial intelligence to enhance automotive technology, catering primarily to clients in the Americas, the United Kingdom, and Europe.

KPIT Technologies, a contender in India's tech landscape, has shown robust growth with earnings surging by 54.7% over the past year, outpacing the software industry's growth of 32.4%. This performance is underpinned by a strategic focus on R&D, where expenses have been meticulously managed to foster innovation while maintaining efficiency. Notably, the company's revenue is projected to grow at 16.2% annually, faster than the broader Indian market's 10.1%, signaling strong market capture and potential for sustained expansion. Furthermore, KPIT’s commitment to shareholder returns is evident from its recent dividend declaration of INR 4.60 per share at its AGM, complementing an interim dividend of INR 2.10 per share—reflecting confidence in ongoing financial health and operational stability.

- Dive into the specifics of KPIT Technologies here with our thorough health report.

Understand KPIT Technologies' track record by examining our Past report.

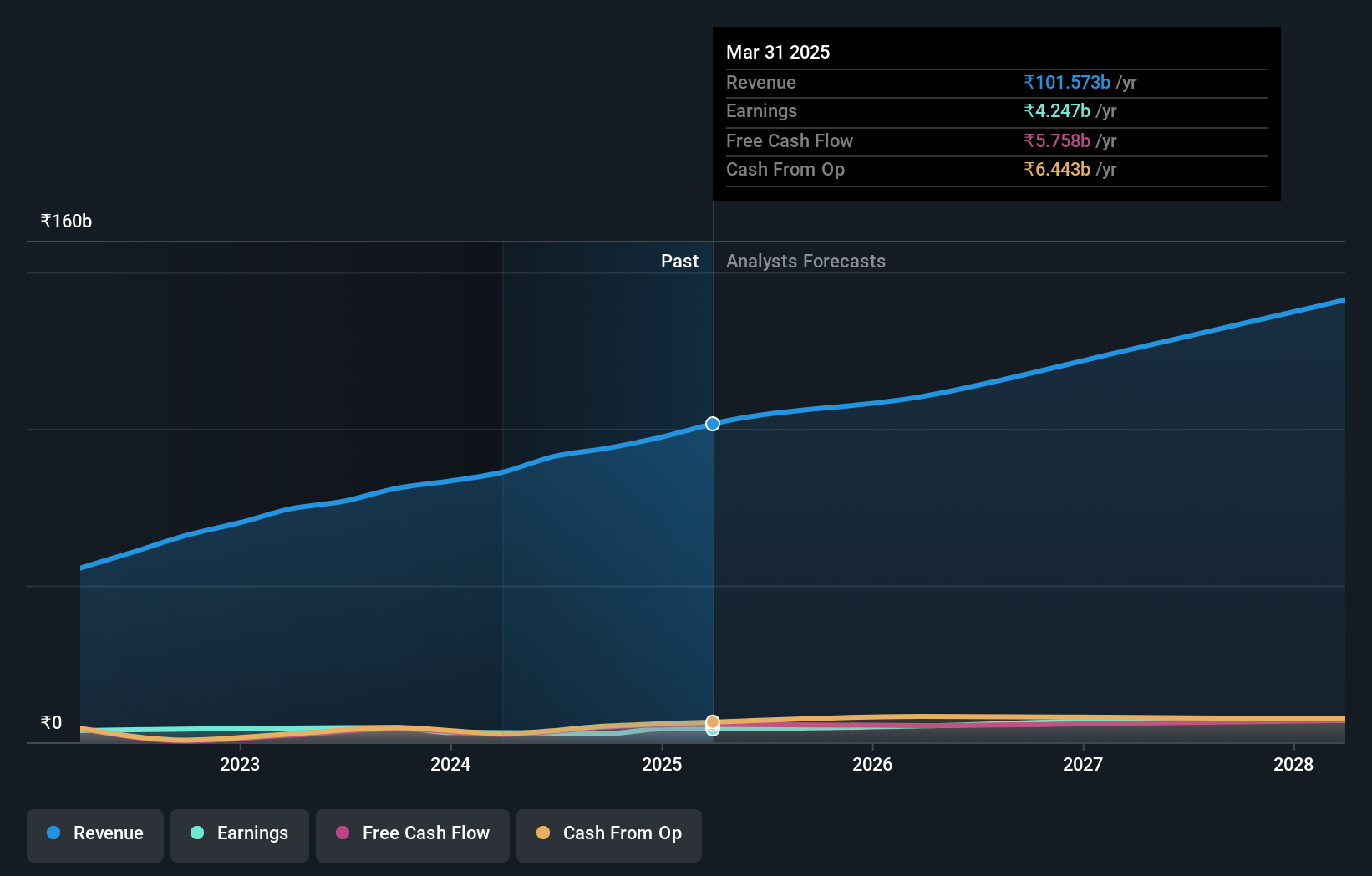

Sonata Software (NSEI:SONATSOFTW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sonata Software Limited, along with its subsidiaries, offers information technology services and solutions across various regions including the United States, Europe, the Middle East, Asia, India, and Australia with a market capitalization of ₹163.46 billion.

Operations: Sonata Software, through its subsidiaries, delivers a range of IT services and solutions globally. The company focuses on providing digital transformation services, software product engineering, and platform-based services across diverse industries. Its revenue streams are primarily derived from these service offerings in key markets such as the United States and Europe.

Sonata Software, amidst a challenging environment, has demonstrated resilience with strategic client acquisitions and robust R&D investments. Despite a revenue growth of 13.4%, which trails the industry's faster pace, the company has secured significant partnerships, like with a leading US-based Healthcare firm, enhancing its service offerings in IT outsourcing and technology modernization. This aligns with its R&D focus where expenses have been strategically channeled to foster innovation—evident from an impressive forecasted annual profit growth of 29.8%. Moreover, Sonata's commitment to shareholder value is highlighted by a substantial dividend payout totaling INR 11.40 per share this fiscal year. These moves underscore Sonata’s adaptability and forward-looking approach in harnessing technology trends to maintain competitiveness and drive future growth.

- Unlock comprehensive insights into our analysis of Sonata Software stock in this health report.

Assess Sonata Software's past performance with our detailed historical performance reports.

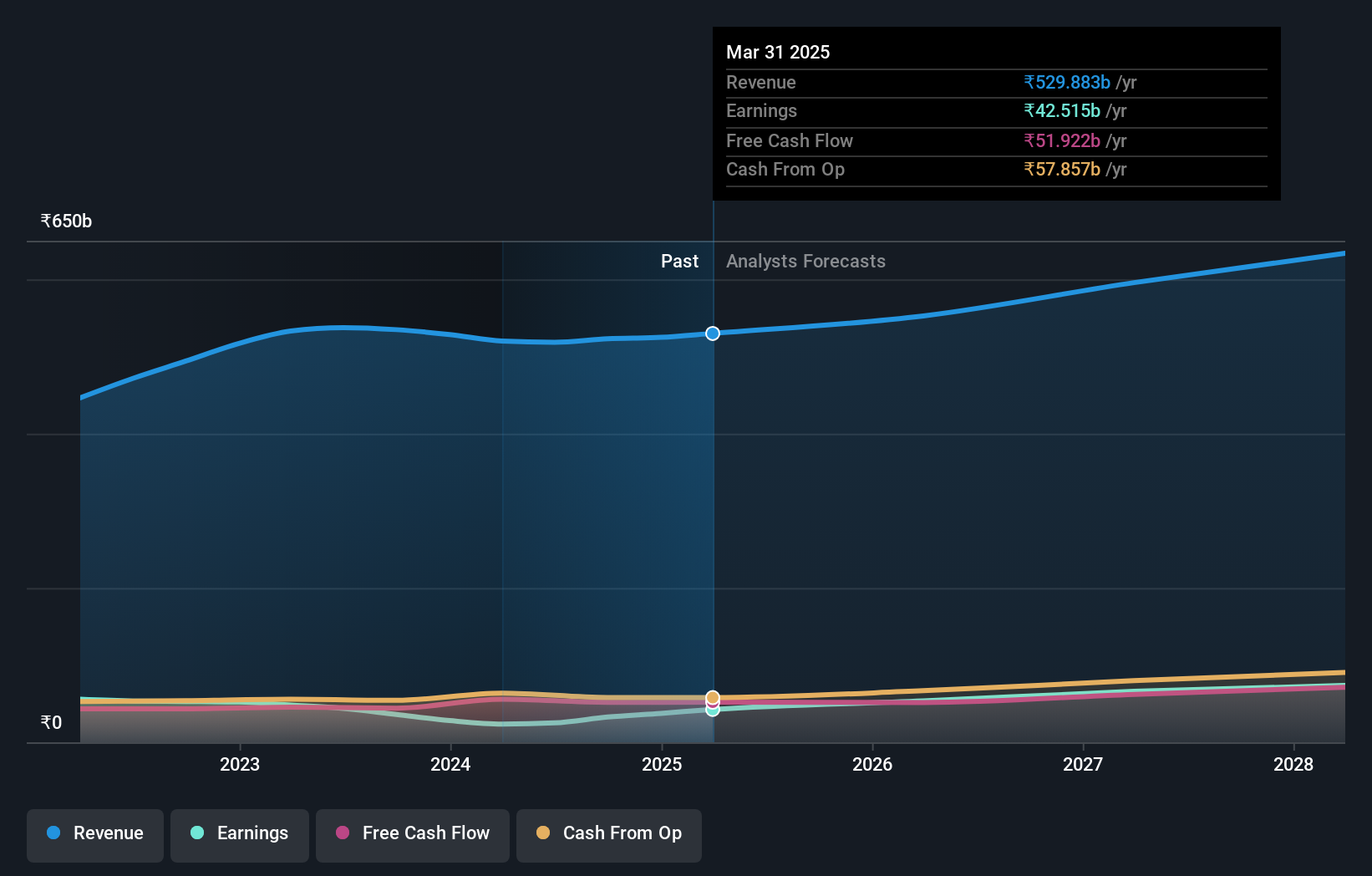

Tech Mahindra (NSEI:TECHM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tech Mahindra Limited offers information technology services and solutions across the Americas, Europe, India, and globally with a market capitalization of ₹1.43 trillion.

Operations: With a market capitalization of ₹1.43 trillion, Tech Mahindra generates revenue primarily from IT Services, contributing ₹439.48 billion, and Business Process Outsourcing (BPO), adding ₹78.94 billion to its income streams.

Tech Mahindra's strategic focus on innovation is underscored by its R&D investments, which are crucial for maintaining its competitive edge in the rapidly evolving tech landscape. With a 6.9% annual revenue growth projection, the company is slightly behind the broader market trend; however, its earnings are expected to surge by 29% annually. This robust profit forecast is supported by recent executive board enhancements and strategic alliances aimed at bolstering its technological capabilities in sectors like cybersecurity and next-gen telecom solutions such as ORAN and 6G networks. These initiatives reflect Tech Mahindra’s commitment to leveraging cutting-edge technologies to deliver superior service offerings and drive future growth despite current industry challenges.

- Click here to discover the nuances of Tech Mahindra with our detailed analytical health report.

Gain insights into Tech Mahindra's historical performance by reviewing our past performance report.

Where To Now?

- Investigate our full lineup of 39 Indian High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SONATSOFTW

Sonata Software

Provides information technology services and solutions in the United States, Europe, the Middle East, the Asia Pacific, the United Kingdom, Australia, New Zealand, and Ireland.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)