Over the last 7 days, the Indian market has dropped by 3.6% despite a substantial rise of 40% over the past year, with earnings expected to grow by 17% per annum in the coming years. In this dynamic environment, identifying high growth tech stocks requires focusing on companies that demonstrate robust innovation and adaptability to leverage these promising growth prospects.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Sonata Software | 13.44% | 29.79% | ★★★★★☆ |

| C. E. Info Systems | 29.86% | 26.39% | ★★★★★★ |

| Syrma SGS Technology | 21.86% | 32.67% | ★★★★★☆ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Coforge (NSEI:COFORGE)

Simply Wall St Growth Rating: ★★★★★☆

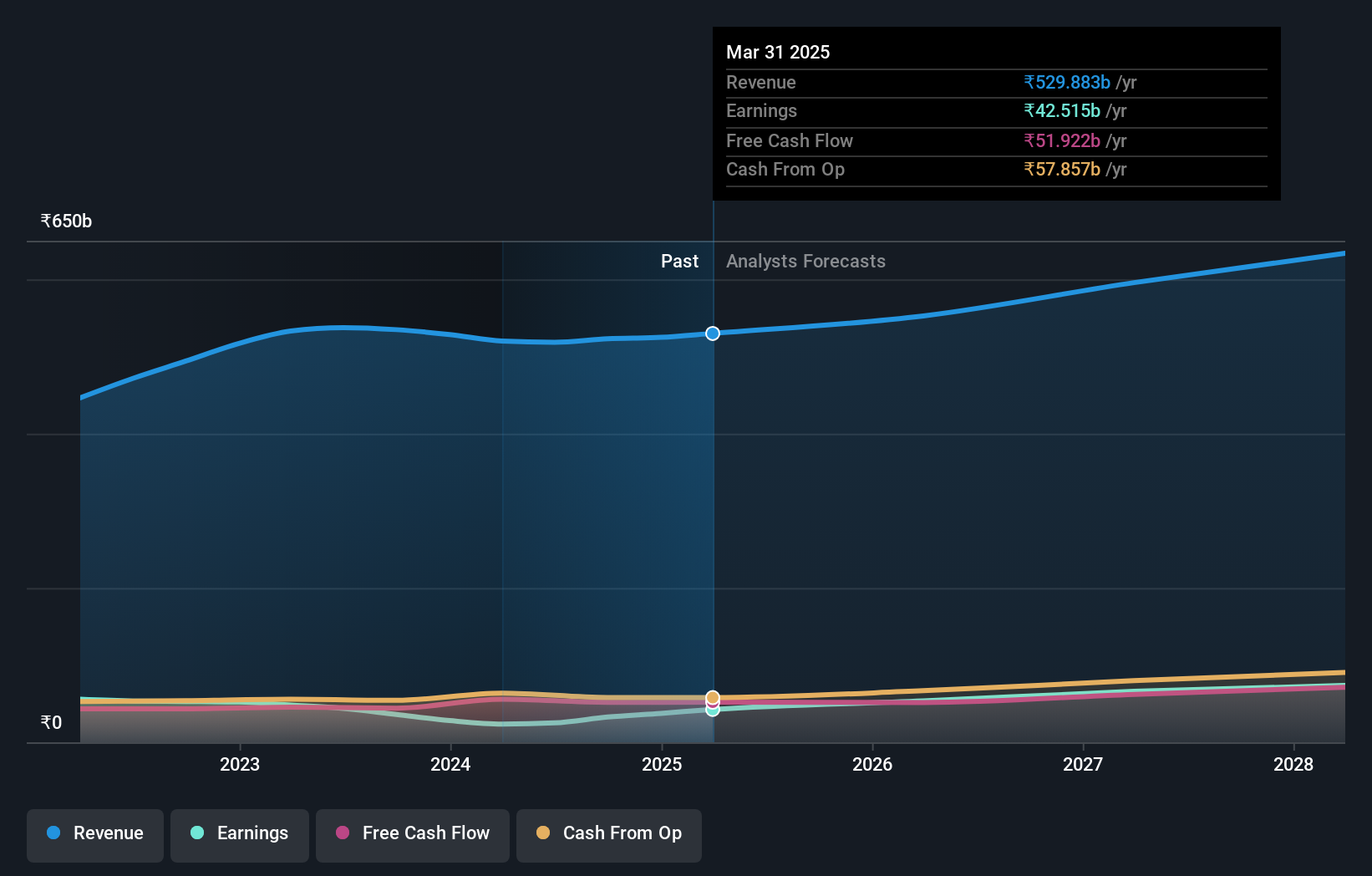

Overview: Coforge Limited offers IT and IT-enabled services across various regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific with a market cap of ₹475.23 billion.

Operations: The company generates revenue primarily from its Software Solutions segment, amounting to ₹93.59 billion.

Coforge's recent alignment with Salesforce to launch the ENZO platform underscores its innovative approach in tackling environmental challenges through technology, positioning it uniquely within India's high-growth tech sector. Despite a moderate earnings growth of 9.4% over the past year, Coforge is set to accelerate with an anticipated annual earnings increase of 23.1%. This projection outpaces the broader Indian market's forecast of 17.2%, highlighting its potential resilience and adaptability in a competitive landscape. Moreover, the firm’s commitment to R&D is evident from its increased expenditure aimed at fostering innovation and maintaining technological leadership, crucial for sustaining long-term growth in the rapidly evolving tech industry.

- Click to explore a detailed breakdown of our findings in Coforge's health report.

Examine Coforge's past performance report to understand how it has performed in the past.

KPIT Technologies (NSEI:KPITTECH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KPIT Technologies Limited specializes in offering embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector across various regions including the Americas, the United Kingdom, and Europe, with a market cap of ₹458.70 billion.

Operations: KPIT Technologies generates revenue by providing specialized software and digital solutions tailored for the automobile and mobility sectors. The company focuses on leveraging advanced technologies such as artificial intelligence to enhance its offerings across key regions like the Americas, UK, and Europe.

KPIT Technologies, a contender in India's tech arena, has recently demonstrated robust financial health with a 54.7% earnings growth over the past year, surpassing the software industry's average of 32.4%. This growth is supported by significant R&D investments aimed at innovation and market adaptation, with a notable increase in R&D expenses reflecting its commitment to maintaining technological leadership. Additionally, the company's strategic dividend payouts underscore its financial stability and shareholder value focus, as evidenced by recent AGM decisions to declare substantial dividends. With revenue projections set to outpace the Indian market at 16.3% annually and earnings expected to grow by 19.3%, KPIT Technologies is poised for continued success in an increasingly competitive sector.

- Get an in-depth perspective on KPIT Technologies' performance by reading our health report here.

Gain insights into KPIT Technologies' past trends and performance with our Past report.

Tech Mahindra (NSEI:TECHM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tech Mahindra Limited is a global provider of information technology services and solutions, operating across the Americas, Europe, India, and other international markets with a market capitalization of ₹1.43 trillion.

Operations: The company derives its revenue primarily from IT Services, accounting for ₹439.48 billion, followed by Business Process Outsourcing (BPO) at ₹78.94 billion.

Tech Mahindra's trajectory in India's tech landscape reflects a blend of challenges and growth opportunities. With an expected revenue increase of 6.9% annually, it lags behind the broader Indian market projection of 10.1%. However, its earnings outlook is more robust, forecasting a substantial 29% annual growth, outpacing the market's expectation of 17.2%. This disparity highlights its strategic focus shifting towards higher margin projects despite slower top-line growth. The company has also ramped up its R&D spending to foster innovation and maintain competitive edge in evolving technologies like ORAN and cybersecurity through key partnerships with entities like Northeastern University and Horizon3.ai. These initiatives are crucial as they navigate through regulatory challenges and executive reshuffles to potentially secure a stronger position in the high-tech industry landscape.

- Navigate through the intricacies of Tech Mahindra with our comprehensive health report here.

Understand Tech Mahindra's track record by examining our Past report.

Where To Now?

- Unlock our comprehensive list of 39 Indian High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:COFORGE

Coforge

Provides information technology (IT) and IT-enabled services in India, the Americas, Europe, the Middle East and Africa, India, and the Asia Pacific.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives