What Is CyberTech Systems and Software's (NSE:CYBERTECH) P/E Ratio After Its Share Price Rocketed?

It's really great to see that even after a strong run, CyberTech Systems and Software (NSE:CYBERTECH) shares have been powering on, with a gain of 30% in the last thirty days. The full year gain of 10% is pretty reasonable, too.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

View our latest analysis for CyberTech Systems and Software

Does CyberTech Systems and Software Have A Relatively High Or Low P/E For Its Industry?

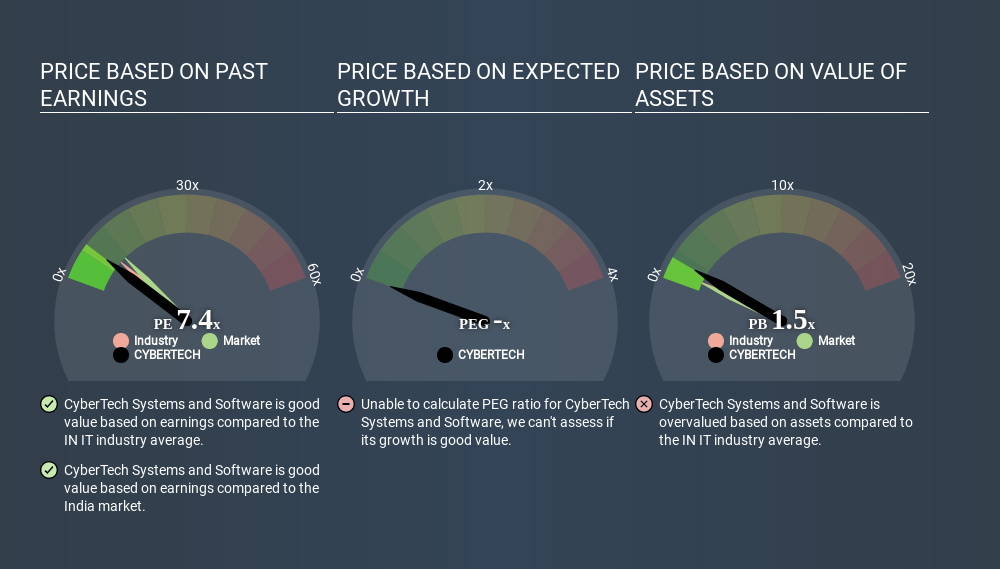

CyberTech Systems and Software's P/E of 9.09 indicates relatively low sentiment towards the stock. The image below shows that CyberTech Systems and Software has a lower P/E than the average (10.2) P/E for companies in the it industry.

This suggests that market participants think CyberTech Systems and Software will underperform other companies in its industry. Since the market seems unimpressed with CyberTech Systems and Software, it's quite possible it could surprise on the upside. You should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. When earnings grow, the 'E' increases, over time. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Notably, CyberTech Systems and Software grew EPS by a whopping 29% in the last year. And its annual EPS growth rate over 5 years is 20%. So we'd generally expect it to have a relatively high P/E ratio.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Is Debt Impacting CyberTech Systems and Software's P/E?

With net cash of ₹376m, CyberTech Systems and Software has a very strong balance sheet, which may be important for its business. Having said that, at 31% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On CyberTech Systems and Software's P/E Ratio

CyberTech Systems and Software's P/E is 9.1 which is below average (11.2) in the IN market. Not only should the net cash position reduce risk, but the recent growth has been impressive. The below average P/E ratio suggests that market participants don't believe the strong growth will continue. What is very clear is that the market has become less pessimistic about CyberTech Systems and Software over the last month, with the P/E ratio rising from 7.0 back then to 9.1 today. If you like to buy stocks that could be turnaround opportunities, then this one might be a candidate; but if you're more sensitive to price, then you may feel the opportunity has passed.

Investors have an opportunity when market expectations about a stock are wrong. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

You might be able to find a better buy than CyberTech Systems and Software. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:CYBERTECH

CyberTech Systems and Software

Provides geospatial, networking, and enterprise information technology solutions in India and the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion