Allied Digital Services Limited's (NSE:ADSL) most bullish insider is Top Key Executive Nitin Shah, and their holdings value went up by 12% last week

If you want to know who really controls Allied Digital Services Limited (NSE:ADSL), then you'll have to look at the makeup of its share registry. With 60% stake, individual insiders possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As a result, insiders scored the highest last week as the company hit ₹8.8b market cap following a 12% gain in the stock.

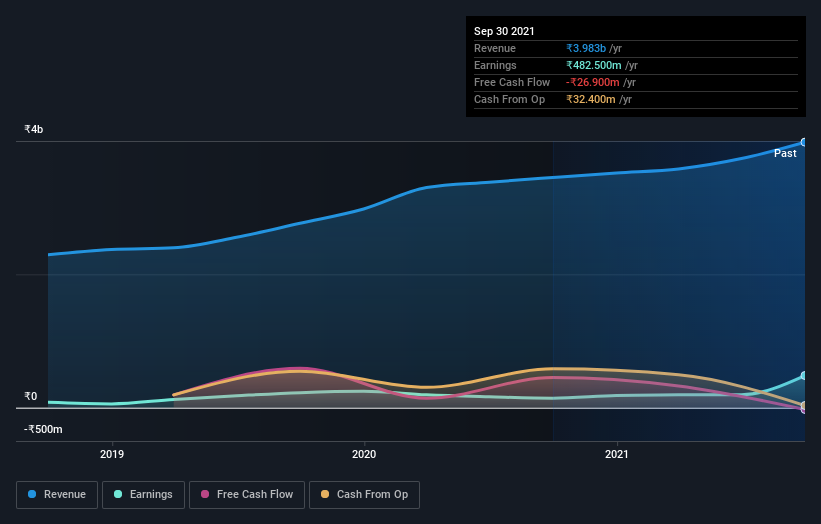

In the chart below, we zoom in on the different ownership groups of Allied Digital Services.

View our latest analysis for Allied Digital Services

What Does The Lack Of Institutional Ownership Tell Us About Allied Digital Services?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Allied Digital Services might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Hedge funds don't have many shares in Allied Digital Services. From our data, we infer that the largest shareholder is Nitin Shah (who also holds the title of Top Key Executive) with 35% of shares outstanding. Its usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder. Meanwhile, the second and third largest shareholders, hold 15% and 2.7%, of the shares outstanding, respectively. Interestingly, the second-largest shareholder, Prakash Shah is also Senior Key Executive, again, pointing towards strong insider ownership amongst the company's top shareholders.

A more detailed study of the shareholder registry showed us that 3 of the top shareholders have a considerable amount of ownership in the company, via their 52% stake.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Allied Digital Services

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems that insiders own more than half the Allied Digital Services Limited stock. This gives them a lot of power. So they have a ₹5.2b stake in this ₹8.8b business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public, who are usually individual investors, hold a 36% stake in Allied Digital Services. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

Our data indicates that Private Companies hold 3.8%, of the company's shares. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Allied Digital Services better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Allied Digital Services you should be aware of.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ADSL

Allied Digital Services

Designs, develops, deploys, and delivers end-to-end IT infrastructure services and digital solutions in India, rest of Asia, the United States, Australia, Europe, and the Middle East.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)