- India

- /

- Specialty Stores

- /

- NSEI:TRENT

Trent Limited's (NSE:TRENT) 27% Price Boost Is Out Of Tune With Revenues

Trent Limited (NSE:TRENT) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 202% following the latest surge, making investors sit up and take notice.

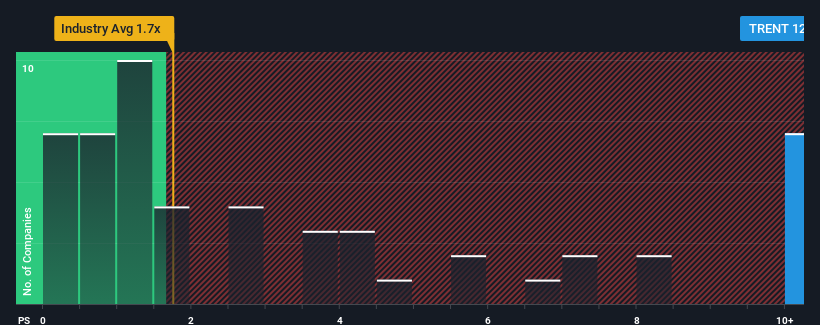

Since its price has surged higher, you could be forgiven for thinking Trent is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 12.3x, considering almost half the companies in India's Specialty Retail industry have P/S ratios below 1.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Trent

What Does Trent's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Trent has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Trent's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Trent?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Trent's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 52% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 27% each year during the coming three years according to the twelve analysts following the company. That's shaping up to be similar to the 24% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Trent's P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Shares in Trent have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Trent's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Trent (at least 1 which is significant), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Trent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TRENT

Trent

Engages in the retailing and trading of apparels, footwear, accessories, toys, games, and other products in India.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives