- India

- /

- Specialty Stores

- /

- NSEI:ABFRL

The 8.8% return this week takes Aditya Birla Fashion and Retail's (NSE:ABFRL) shareholders three-year gains to 52%

Buying a low-cost index fund will get you the average market return. But if you invest in individual stocks, some are likely to underperform. That's what has happened with the Aditya Birla Fashion and Retail Limited (NSE:ABFRL) share price. It's up 52% over three years, but that is below the market return. On the other hand, the more recent gain of 45% over a year is certainly pleasing.

Since the stock has added ₹23b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Aditya Birla Fashion and Retail

Aditya Birla Fashion and Retail wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years Aditya Birla Fashion and Retail has grown its revenue at 33% annually. That's well above most pre-profit companies. The stock is up 15% over that time - a decent but not impressive return. We would have thought the top-line growth might have impressed buyers more. If the business can trend towards profitability and fund its growth, then the market could present an opportunity. But you might want to take a closer look at this one.

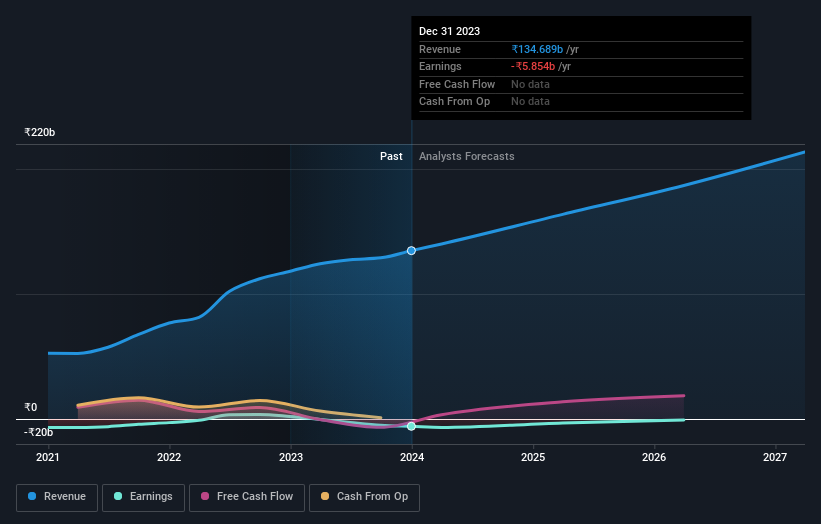

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Aditya Birla Fashion and Retail is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Aditya Birla Fashion and Retail stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Aditya Birla Fashion and Retail shareholders have received returns of 45% over twelve months, which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 6%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Aditya Birla Fashion and Retail you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ABFRL

Aditya Birla Fashion and Retail

Manufactures, distributes, and retails fashion apparel and accessories in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives