- India

- /

- Specialty Stores

- /

- NSEI:ABFRL

Aditya Birla Fashion and Retail (NSE:ABFRL) pulls back 5.7% this week, but still delivers shareholders notable 11% CAGR over 5 years

Aditya Birla Fashion and Retail Limited (NSE:ABFRL) shareholders might be concerned after seeing the share price drop 11% in the last quarter. But at least the stock is up over the last five years. However we are not very impressed because the share price is only up 69%, less than the market return of 211%.

In light of the stock dropping 5.7% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Aditya Birla Fashion and Retail isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Aditya Birla Fashion and Retail saw its revenue grow at 19% per year. That's well above most pre-profit companies. While long-term shareholders have made money, the 11% per year gain over five years fall short of the market return. You could argue the market is still pretty skeptical, given the growing revenues. Arguably this falls in a potential sweet spot - modest share price gains but good top line growth over the long term justifies investigation, in our book.

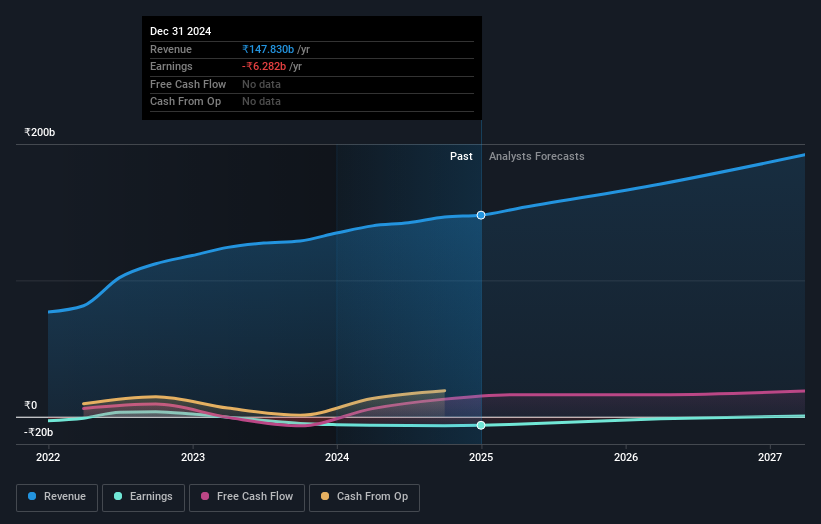

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Aditya Birla Fashion and Retail is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Aditya Birla Fashion and Retail stock, you should check out this free report showing analyst consensus estimates for future profits .

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Aditya Birla Fashion and Retail's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Aditya Birla Fashion and Retail hasn't been paying dividends, but its TSR of 72% exceeds its share price return of 69%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Aditya Birla Fashion and Retail shareholders have received a total shareholder return of 3.4% over one year. However, the TSR over five years, coming in at 11% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. You could get a better understanding of Aditya Birla Fashion and Retail's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: Aditya Birla Fashion and Retail may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

If you're looking to trade Aditya Birla Fashion and Retail, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ABFRL

Aditya Birla Fashion and Retail

Designs, manufactures, distributes, and retails fashion apparel and accessories in India and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives