- India

- /

- Real Estate

- /

- NSEI:EMBDL

Do Insiders Own Lots Of Shares In Indiabulls Real Estate Limited (NSE:IBREALEST)?

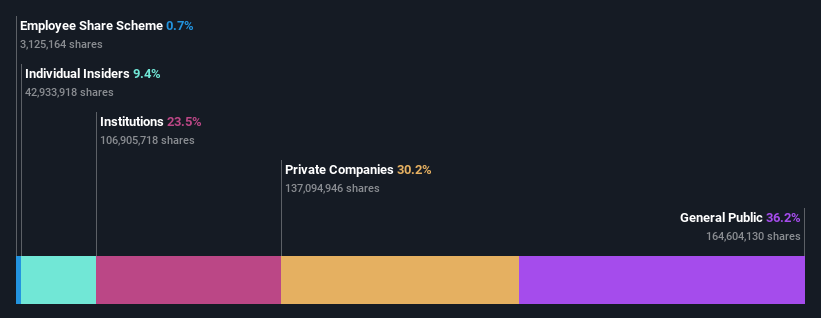

A look at the shareholders of Indiabulls Real Estate Limited (NSE:IBREALEST) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

Indiabulls Real Estate is not a large company by global standards. It has a market capitalization of ₹35b, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions own shares in the company. We can zoom in on the different ownership groups, to learn more about Indiabulls Real Estate.

See our latest analysis for Indiabulls Real Estate

What Does The Institutional Ownership Tell Us About Indiabulls Real Estate?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

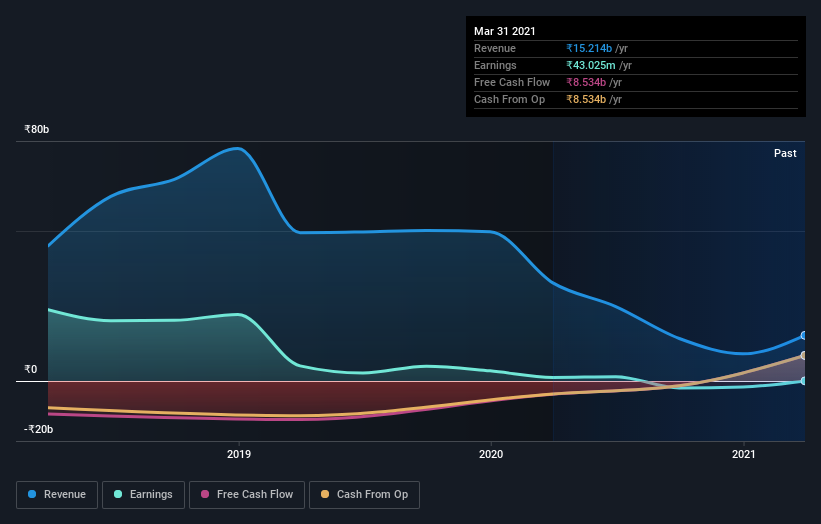

We can see that Indiabulls Real Estate does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Indiabulls Real Estate's historic earnings and revenue below, but keep in mind there's always more to the story.

Indiabulls Real Estate is not owned by hedge funds. Embassy Property Developments Private Limited is currently the company's largest shareholder with 14% of shares outstanding. With 4.4% and 3.6% of the shares outstanding respectively, Sg Infralands Private Limited and SG Devbuild Private Limited are the second and third largest shareholders.

After doing some more digging, we found that the top 17 have the combined ownership of 51% in the company, suggesting that no single shareholder has significant control over the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Indiabulls Real Estate

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Shareholders would probably be interested to learn that insiders own shares in Indiabulls Real Estate Limited. As individuals, the insiders collectively own ₹3.3b worth of the ₹35b company. Some would say this shows alignment of interests between shareholders and the board. But it might be worth checking if those insiders have been selling.

General Public Ownership

The general public, with a 36% stake in the company, will not easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

Our data indicates that Private Companies hold 30%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Be aware that Indiabulls Real Estate is showing 5 warning signs in our investment analysis , and 2 of those are concerning...

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade Indiabulls Real Estate, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Embassy Developments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:EMBDL

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives