Spotlighting Undiscovered Gems with Potential In November 2024

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, small-cap stocks have been particularly impacted, with indices like the S&P 600 reflecting this pressure. In this environment, identifying undiscovered gems—stocks that may offer potential despite broader market volatility—requires a keen eye for companies with strong fundamentals and resilience amid economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Raymond (NSEI:RAYMOND)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Raymond Limited operates in the real estate and engineering sectors in India with a market capitalization of ₹108.87 billion.

Operations: Raymond Limited's primary revenue streams are from real estate and development of property, generating ₹18.47 billion, and its engineering businesses, including auto components and tools & hardware, contributing ₹4.42 billion and ₹4.09 billion respectively.

Raymond, a notable player in the Indian market, has seen its debt to equity ratio improve from 121.2% to 82.7% over five years, indicating better financial health. The company trades at a price-to-earnings ratio of 6.6x, significantly below the Indian market average of 32.7x, suggesting good value relative to peers. Despite earnings growing by an impressive 60.1% annually over five years, recent growth of 9.1% lagged behind the Real Estate industry's 19.2%. With its EBIT covering interest payments by 3.7 times and plans for restructuring through demergers and new listings, Raymond is positioning itself strategically for future opportunities.

- Click to explore a detailed breakdown of our findings in Raymond's health report.

Examine Raymond's past performance report to understand how it has performed in the past.

East Pipes Integrated Company for Industry (SASE:1321)

Simply Wall St Value Rating: ★★★★★★

Overview: East Pipes Integrated Company for Industry specializes in manufacturing and selling pipes, tubes, and hollow shapes made from iron and steel in Saudi Arabia, with a market capitalization of SAR5.25 billion.

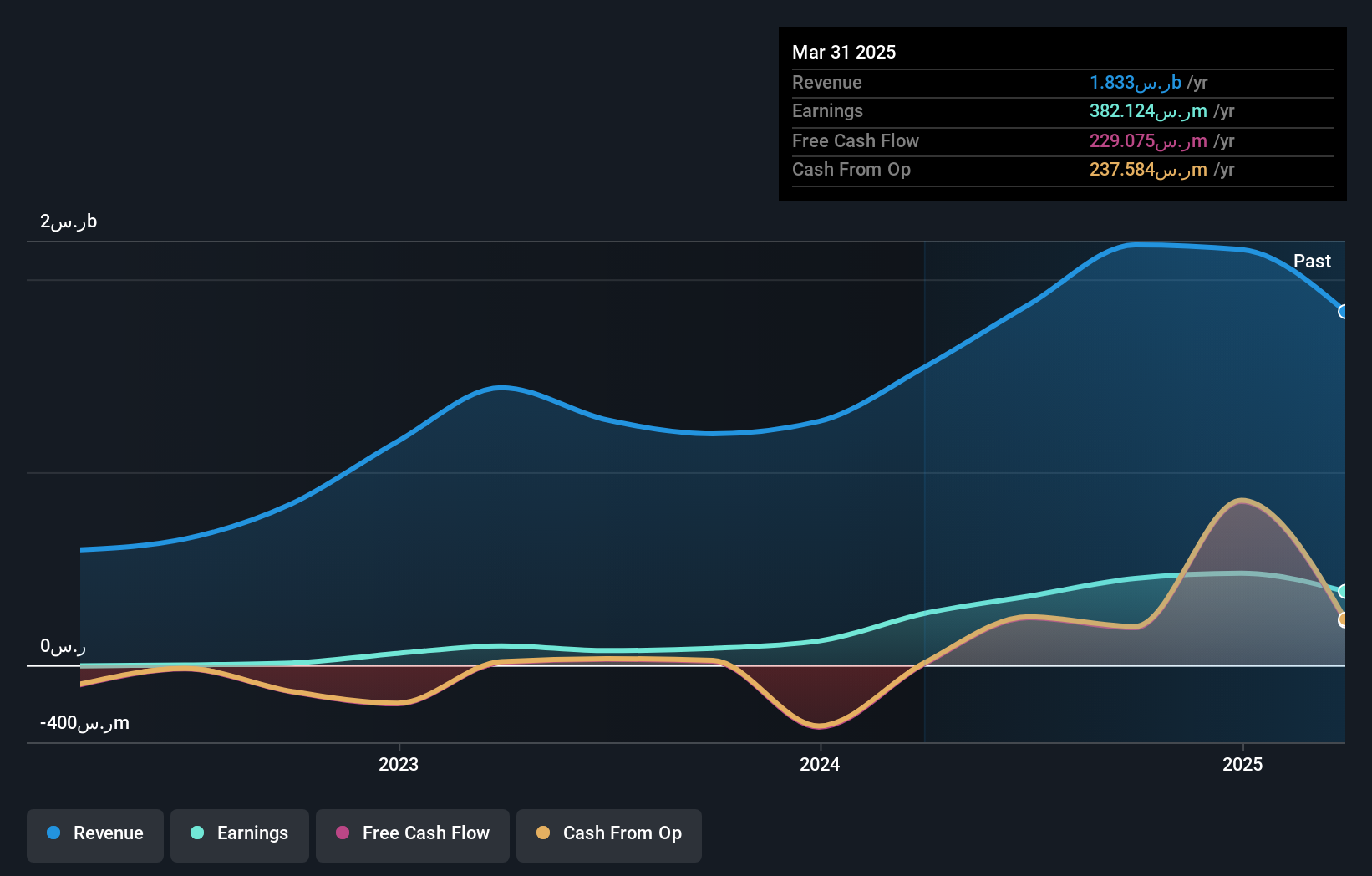

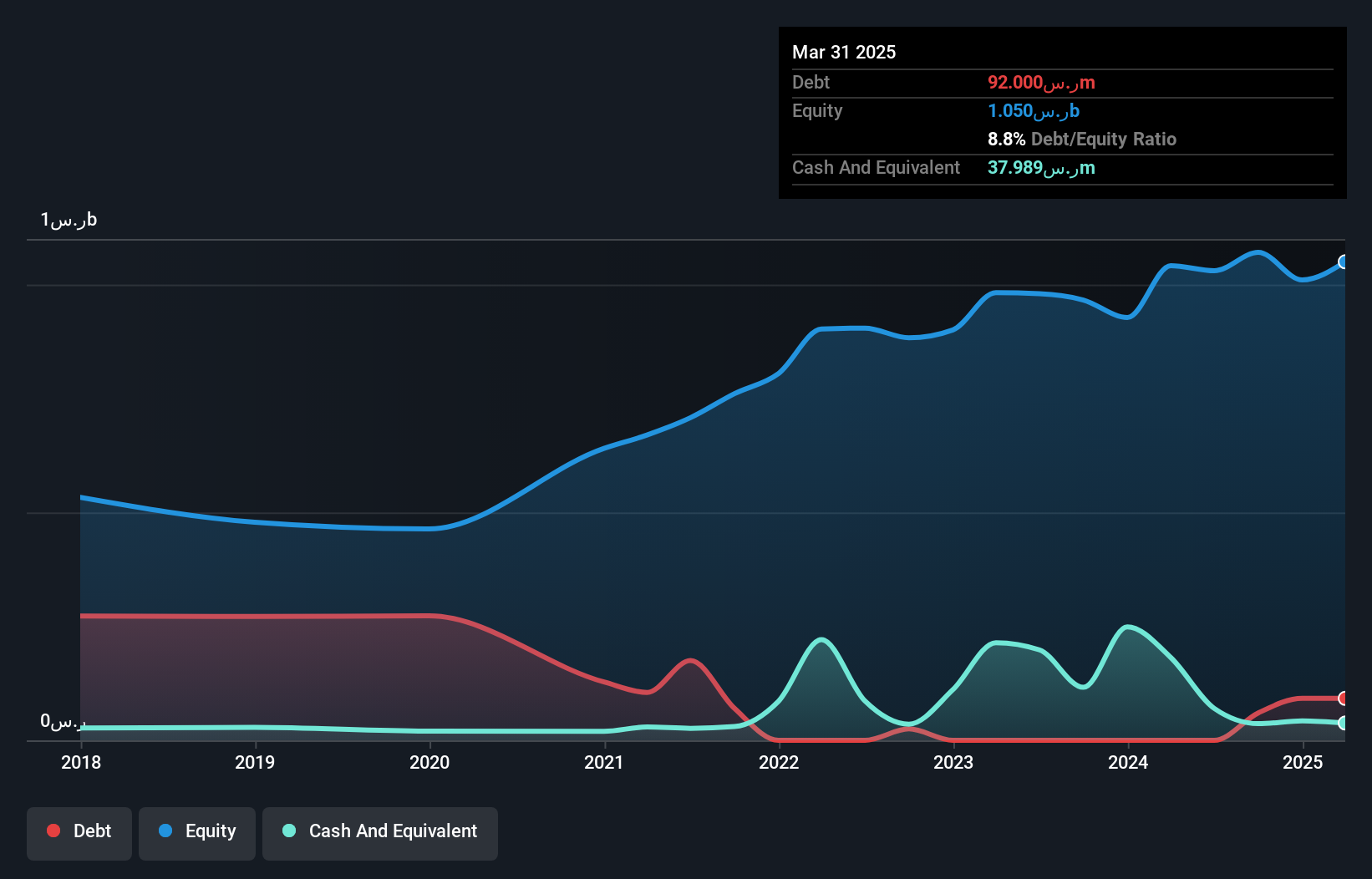

Operations: The company's revenue primarily comes from its Machinery - Pumps segment, generating SAR1.87 billion.

East Pipes Integrated Company for Industry has shown remarkable progress, with earnings surging by 375.6% over the past year, outpacing the Metals and Mining industry growth of 59.5%. The company's debt-to-equity ratio impressively decreased from 464.8% to just 14.3% over five years, indicating solid financial management. Recent developments include its addition to the S&P Global BMI Index and securing contracts worth SAR 235 million (Approx. INR 5,250 million), which will impact future earnings positively. With sales jumping to SAR 364 million in Q1 from SAR 39 million a year ago, EPIC's strategic positioning aligns well with Saudi Arabia's Vision 2030 goals.

Almunajem Foods (SASE:4162)

Simply Wall St Value Rating: ★★★★★★

Overview: Almunajem Foods Company specializes in the import, marketing, and distribution of frozen, chilled, and dry foodstuffs in Saudi Arabia with a market cap of SAR7.01 billion.

Operations: Almunajem Foods generates revenue primarily from three regional segments: Central Region (SAR1.42 billion), Eastern & Northern Regions (SAR683.50 million), and Western & Southern Regions (SAR1.27 billion).

Almunajem Foods, a nimble player in the food industry, has shown solid financial health with no debt compared to five years ago when its debt-to-equity ratio was 62.7%. The company reported earnings growth of 52.7% over the past year, outpacing the Consumer Retailing industry's -3%. Recent earnings announcements revealed second-quarter sales of SAR 826.29 million and net income of SAR 63.82 million, both up from last year’s figures. Trading at a value estimated to be 15.2% below fair value suggests potential upside for investors seeking opportunities in this market segment.

- Click here and access our complete health analysis report to understand the dynamics of Almunajem Foods.

Gain insights into Almunajem Foods' past trends and performance with our Past report.

Taking Advantage

- Navigate through the entire inventory of 4738 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RAYMOND

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives