- India

- /

- Real Estate

- /

- NSEI:ARKADE

3 Undiscovered Gems In India With Promising Potential

Reviewed by Simply Wall St

The Indian market has shown impressive performance, rising 1.3% in the last 7 days and up 45% over the past year, with earnings projected to grow by 17% annually in the coming years. In this thriving environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; here are three undiscovered gems in India that fit this profile.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Suraj | 27.47% | 17.95% | 67.29% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Arkade Developers (NSEI:ARKADE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arkade Developers Limited operates as a real estate development company in India with a market cap of ₹28.16 billion.

Operations: Arkade Developers generates revenue primarily from real estate development, amounting to ₹6.35 billion. The company has a market cap of ₹28.16 billion.

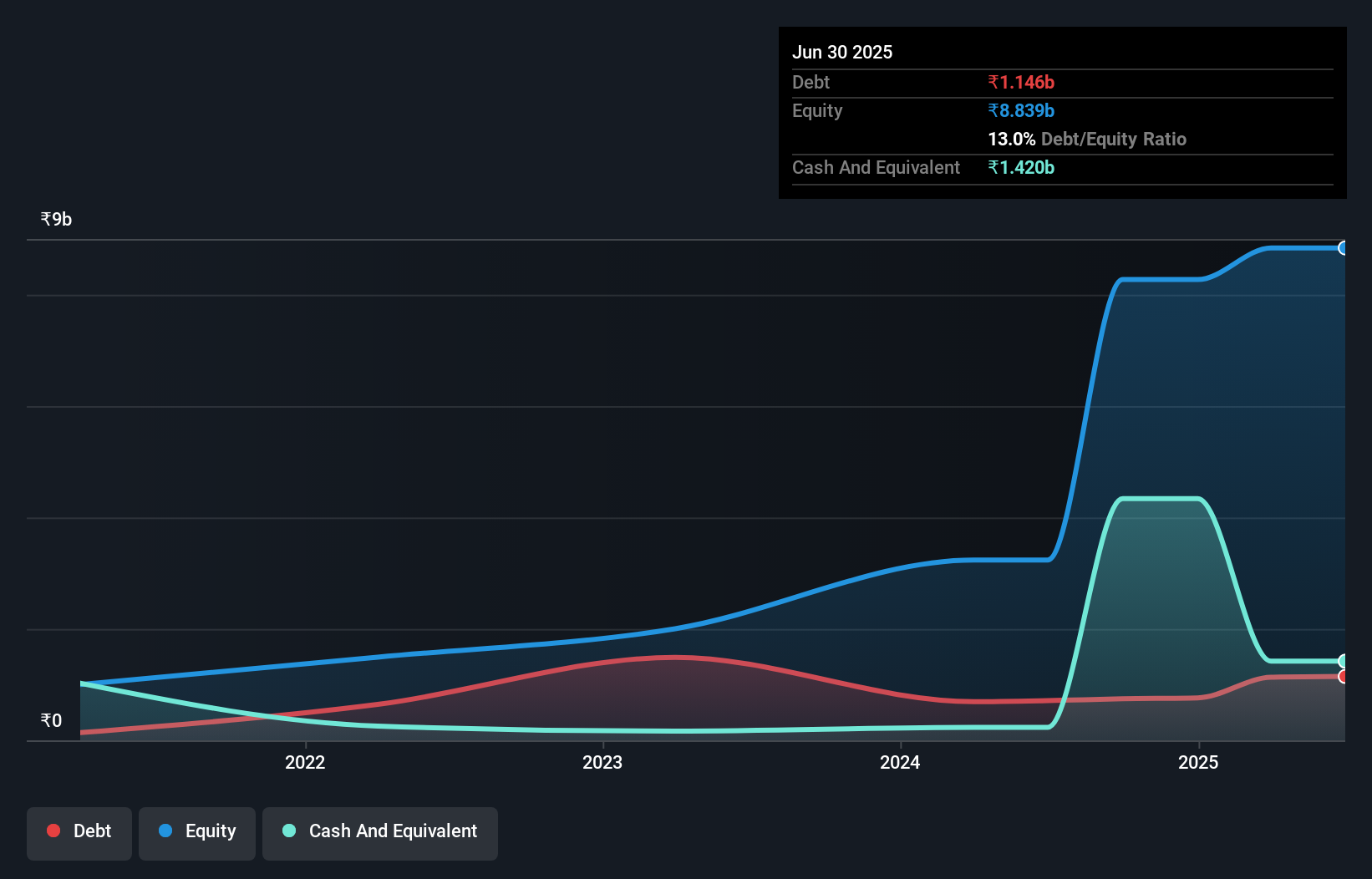

Earnings for Arkade Developers surged by 141.9% over the past year, outpacing the real estate industry's 24.1%. The company’s net debt to equity ratio stands at a satisfactory 14.2%, and its interest payments are well covered by EBIT at 12.2x coverage. Recently, Arkade completed an IPO raising INR 4.1 billion, offering shares priced between INR 123-128 each with slight discounts per security ranging from INR 4.35 to INR 4.53.

- Take a closer look at Arkade Developers' potential here in our health report.

Examine Arkade Developers' past performance report to understand how it has performed in the past.

Godawari Power & Ispat (NSEI:GPIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Godawari Power & Ispat Limited, along with its subsidiaries, operates in the mining of iron ores in India and has a market cap of ₹143.52 billion.

Operations: GPIL generates revenue primarily from the mining of iron ores. The company's net profit margin has shown variability over recent periods, reflecting fluctuations in both revenue and cost structures.

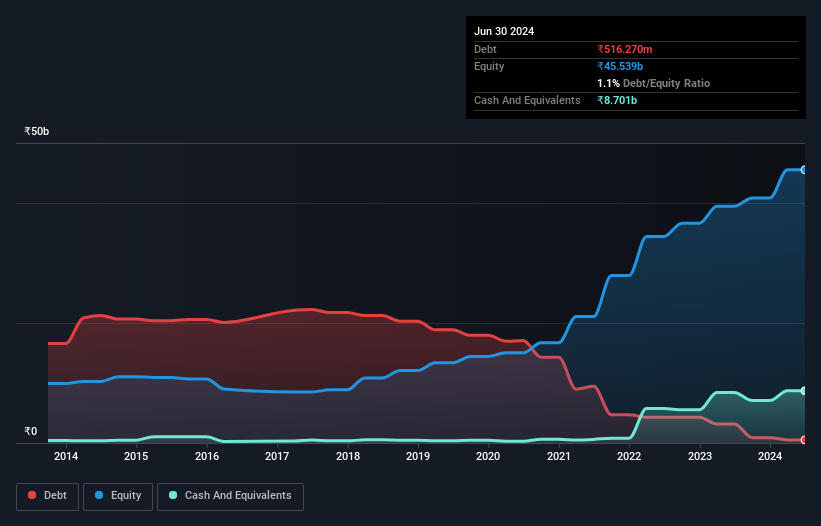

Godawari Power & Ispat (GPIL) has demonstrated robust financial health, with its debt-to-equity ratio dropping significantly from 141.1% to 1.1% over the past five years. The company’s earnings growth of 42.1% last year outpaced the industry average of 19.3%, and it trades at a favorable price-to-earnings ratio of 14.5x compared to the Indian market's 34.1x multiple. Key recent events include a special dividend payout and share repurchase totaling INR 3,010 million for approximately 2,150,000 shares or 1.72%.

- Dive into the specifics of Godawari Power & Ispat here with our thorough health report.

Learn about Godawari Power & Ispat's historical performance.

JSW Holdings (NSEI:JSWHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: JSW Holdings Limited, a non-banking financial company, primarily engages in investing and financing activities in India with a market cap of ₹101.04 billion.

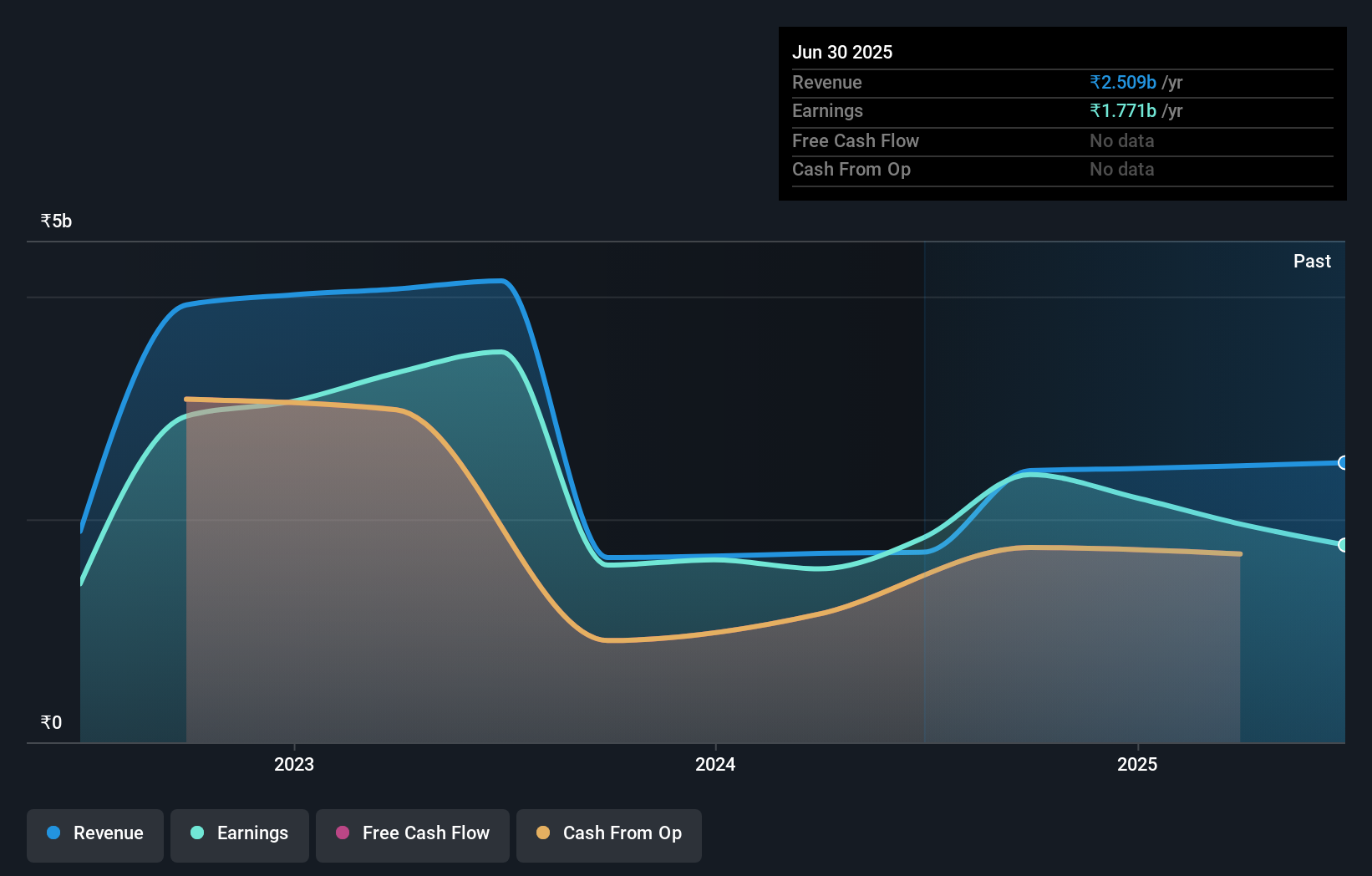

Operations: JSW Holdings generates its revenue primarily from investing and financing activities, amounting to ₹1.71 billion. The company operates within the financial sector in India with a market capitalization of ₹101.04 billion.

JSW Holdings, a notable player in India's capital markets, has shown mixed performance recently. Despite negative earnings growth of -47.5% over the past year, the company remains debt-free for five years and reported positive free cash flow at INR 912.92 million as of September 2023. Recent events include its addition to the S&P Global BMI Index and a significant increase in net income for Q1 2024 to INR 525.81 million from INR 243.57 million last year, reflecting strong operational resilience amidst industry challenges.

- Get an in-depth perspective on JSW Holdings' performance by reading our health report here.

Explore historical data to track JSW Holdings' performance over time in our Past section.

Turning Ideas Into Actions

- Unlock more gems! Our Indian Undiscovered Gems With Strong Fundamentals screener has unearthed 472 more companies for you to explore.Click here to unveil our expertly curated list of 475 Indian Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ARKADE

Arkade Developers

Operates as a real estate development company in India.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)