Shareholders Will Probably Not Have Any Issues With Wockhardt Limited's (NSE:WOCKPHARMA) CEO Compensation

Key Insights

- Wockhardt to hold its Annual General Meeting on 28th of June

- CEO Murtaza Khorakiwala's total compensation includes salary of ₹20.2m

- The total compensation is 45% less than the average for the industry

- Over the past three years, Wockhardt's EPS fell by 38% and over the past three years, the total shareholder return was 11%

Shareholders may be wondering what CEO Murtaza Khorakiwala plans to do to improve the less than great performance at Wockhardt Limited (NSE:WOCKPHARMA) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 28th of June. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Wockhardt

Comparing Wockhardt Limited's CEO Compensation With The Industry

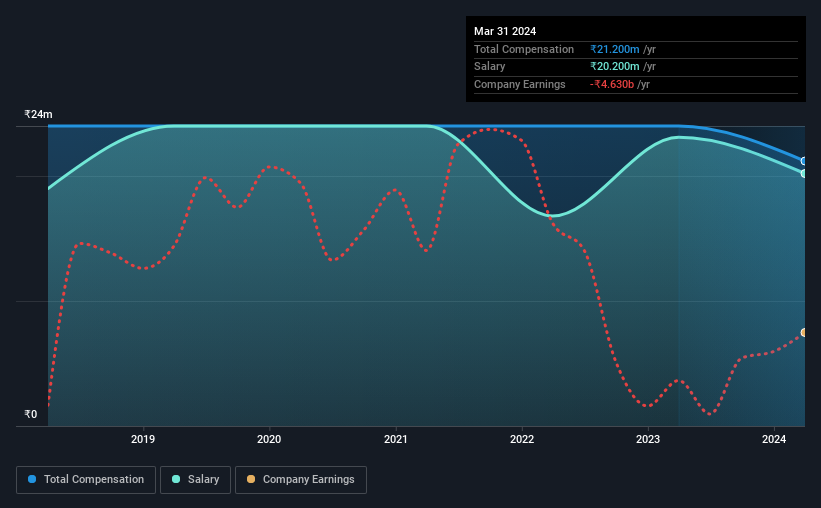

According to our data, Wockhardt Limited has a market capitalization of ₹89b, and paid its CEO total annual compensation worth ₹21m over the year to March 2024. Notably, that's a decrease of 12% over the year before. We note that the salary portion, which stands at ₹20.2m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the Indian Pharmaceuticals industry with market capitalizations ranging between ₹33b and ₹134b had a median total CEO compensation of ₹38m. Accordingly, Wockhardt pays its CEO under the industry median. Furthermore, Murtaza Khorakiwala directly owns ₹170m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹20m | ₹23m | 95% |

| Other | ₹1.0m | ₹900k | 5% |

| Total Compensation | ₹21m | ₹24m | 100% |

Talking in terms of the industry, salary represented approximately 98% of total compensation out of all the companies we analyzed, while other remuneration made up 2% of the pie. Wockhardt is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Wockhardt Limited's Growth

Over the last three years, Wockhardt Limited has shrunk its earnings per share by 38% per year. Its revenue is up 6.5% over the last year.

The decline in EPS is a bit concerning. The fairly low revenue growth fails to impress given that the EPS is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Wockhardt Limited Been A Good Investment?

Wockhardt Limited has served shareholders reasonably well, with a total return of 11% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Murtaza receives almost all of their compensation through a salary. Shareholder returns while positive, need to be looked at along with earnings, which have failed to grow and this could mean that the current momentum may not continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for Wockhardt (1 shouldn't be ignored!) that you should be aware of before investing here.

Switching gears from Wockhardt, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wockhardt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:WOCKPHARMA

Wockhardt

Operates as a pharmaceutical and biotech company, in India, the United States, the United Kingdom, Switzerland, Ireland, Russia, Europe, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)