Why Investors Shouldn't Be Surprised By Strides Pharma Science Limited's (NSE:STAR) 27% Share Price Surge

Despite an already strong run, Strides Pharma Science Limited (NSE:STAR) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 227% in the last year.

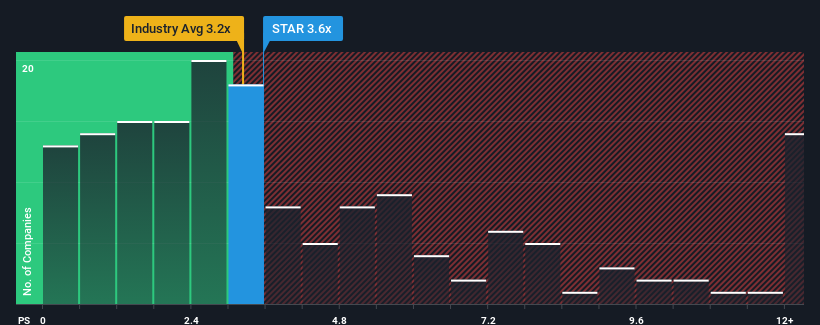

Even after such a large jump in price, it's still not a stretch to say that Strides Pharma Science's price-to-sales (or "P/S") ratio of 3.6x right now seems quite "middle-of-the-road" compared to the Pharmaceuticals industry in India, where the median P/S ratio is around 3.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Strides Pharma Science

What Does Strides Pharma Science's Recent Performance Look Like?

Strides Pharma Science certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Strides Pharma Science.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Strides Pharma Science's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 31% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 12% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 13%, which is not materially different.

In light of this, it's understandable that Strides Pharma Science's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Its shares have lifted substantially and now Strides Pharma Science's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Strides Pharma Science's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Strides Pharma Science with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:STAR

Strides Pharma Science

Develops, manufactures, and sells pharmaceutical products in Africa, Australia, North America, Europe, Asia, India, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives