- India

- /

- Metals and Mining

- /

- NSEI:VEDL

Indian Stocks That May Be Trading Below Estimated Value In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, yet it has experienced a significant increase of 45% over the past year with earnings forecasted to grow by 17% annually. In this context, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to capitalize on undervaluation in a growing market.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Apollo Pipes (BSE:531761) | ₹578.65 | ₹1136.61 | 49.1% |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1133.70 | ₹2154.28 | 47.4% |

| RITES (NSEI:RITES) | ₹320.85 | ₹517.01 | 37.9% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹459.65 | ₹762.32 | 39.7% |

| Vedanta (NSEI:VEDL) | ₹511.75 | ₹934.17 | 45.2% |

| Patel Engineering (BSE:531120) | ₹55.56 | ₹92.63 | 40% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1289.60 | ₹2142.32 | 39.8% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹272.95 | ₹445.15 | 38.7% |

| Tarsons Products (NSEI:TARSONS) | ₹441.90 | ₹708.91 | 37.7% |

| Strides Pharma Science (NSEI:STAR) | ₹1424.85 | ₹2704.30 | 47.3% |

Let's explore several standout options from the results in the screener.

Jindal Steel & Power (NSEI:JINDALSTEL)

Overview: Jindal Steel & Power Limited is engaged in the steel, mining, and infrastructure sectors both in India and internationally, with a market cap of ₹1.07 trillion.

Operations: The company generates revenue primarily from its steel products manufacturing segment, amounting to ₹510.56 billion.

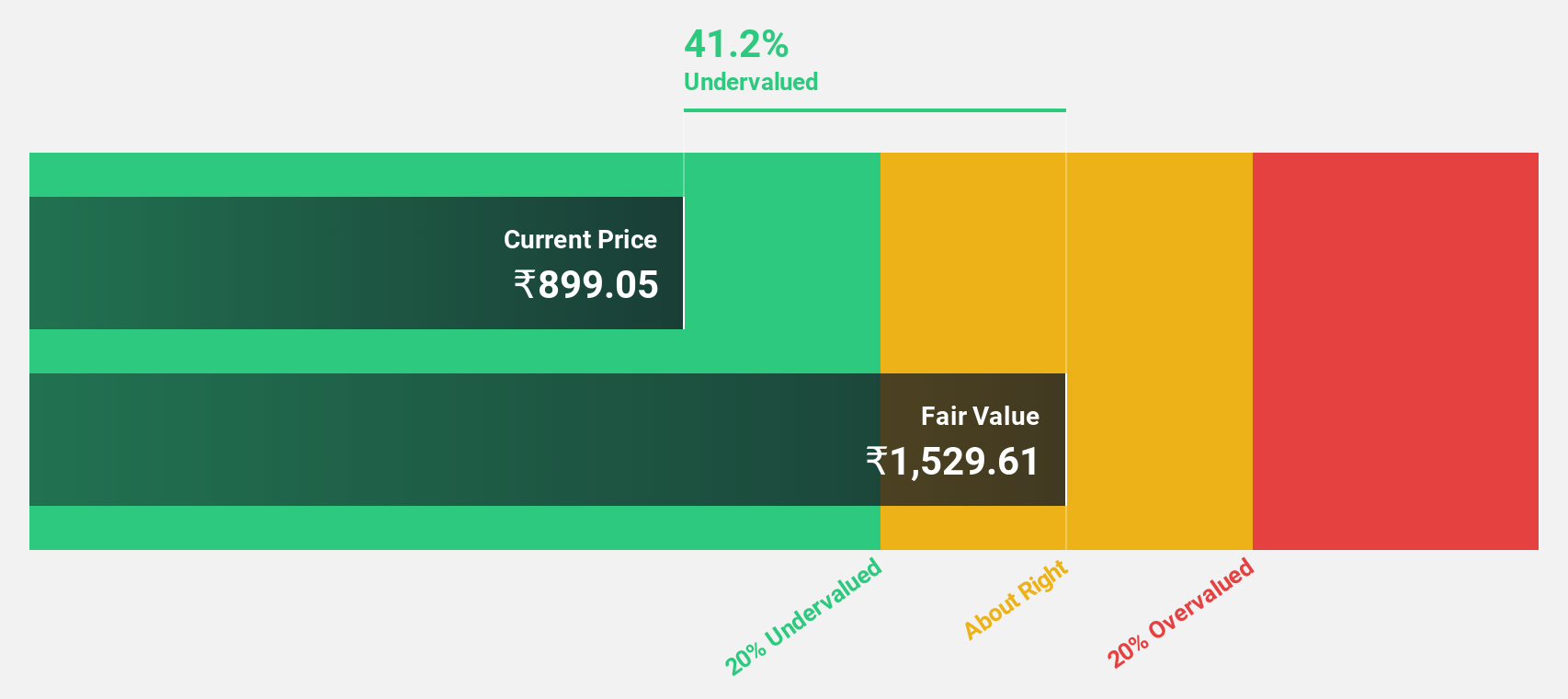

Estimated Discount To Fair Value: 12.7%

Jindal Steel & Power is trading at ₹1051.05, approximately 12.7% below its estimated fair value of ₹1204.51, suggesting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 25% annually, outpacing the Indian market's average growth rate of 17.3%. Recent strategic initiatives, including a landmark MOU with Jindal Renewables for green hydrogen integration, highlight its commitment to sustainable practices and may enhance long-term profitability and cash flow stability.

- Our comprehensive growth report raises the possibility that Jindal Steel & Power is poised for substantial financial growth.

- Take a closer look at Jindal Steel & Power's balance sheet health here in our report.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across Africa, Australia, North America, Europe, Asia, India, and internationally with a market cap of ₹131.03 billion.

Operations: The company's revenue primarily comes from its Pharmaceutical Business, excluding Bio-Pharmaceuticals, amounting to ₹42.09 billion.

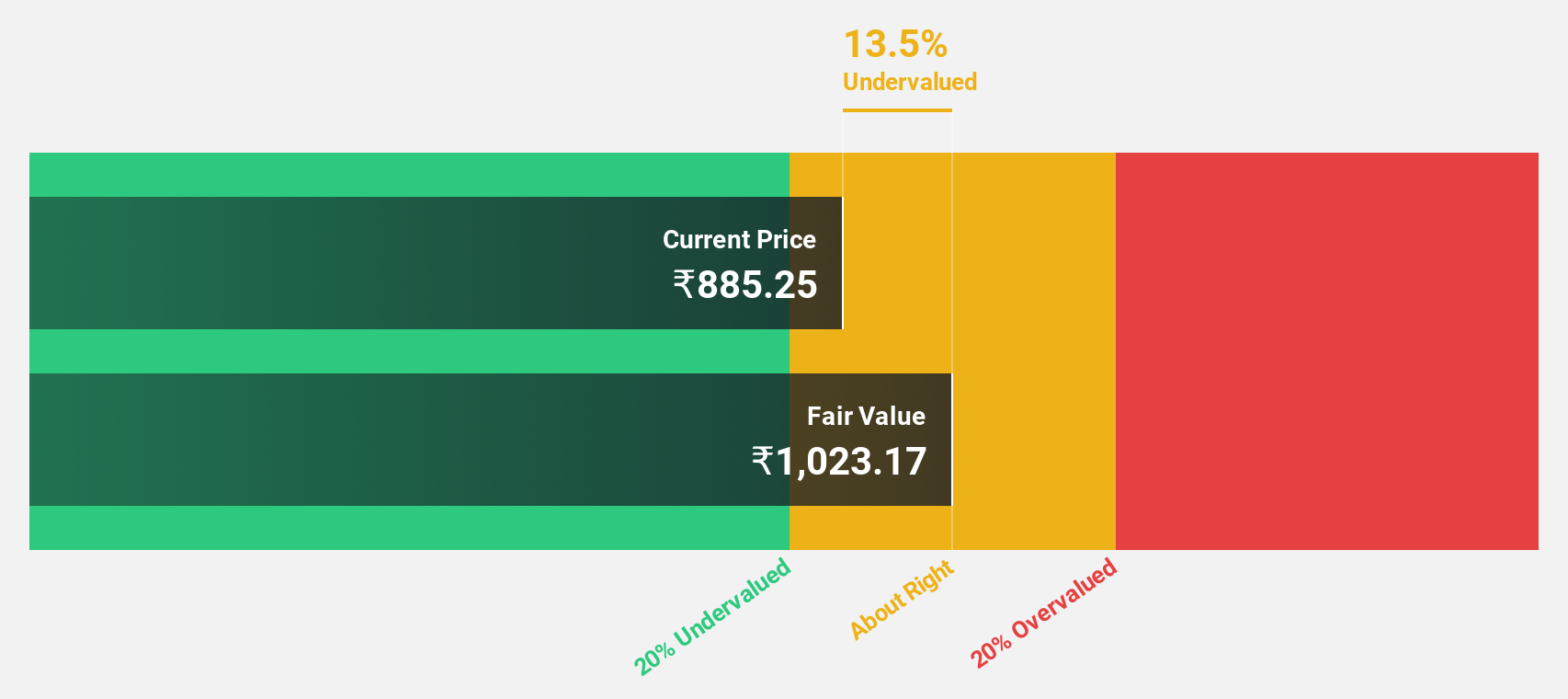

Estimated Discount To Fair Value: 47.3%

Strides Pharma Science, trading at ₹1424.85, is significantly undervalued with a fair value estimate of ₹2704.3. The company is projected to achieve profitability within three years and has an expected annual earnings growth rate of 65.18%, surpassing the Indian market average. Recent financial results show improved performance with a net income of ₹702.02 million for Q1 2024, reversing a previous loss, enhancing its attractiveness based on cash flows despite recent management changes and partial NCD redemption.

- In light of our recent growth report, it seems possible that Strides Pharma Science's financial performance will exceed current levels.

- Navigate through the intricacies of Strides Pharma Science with our comprehensive financial health report here.

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited is a diversified natural resources company engaged in the exploration, extraction, and processing of minerals and oil and gas across India, Europe, China, the United States, Mexico, and internationally with a market cap of ₹1.99 trillion.

Operations: Vedanta Limited's revenue segments include Aluminium at ₹499.81 billion, Copper at ₹197.31 billion, Oil and Gas at ₹179.05 billion, Iron Ore at ₹83.51 billion, Power at ₹62.54 billion, and Zinc - International at ₹32.06 billion.

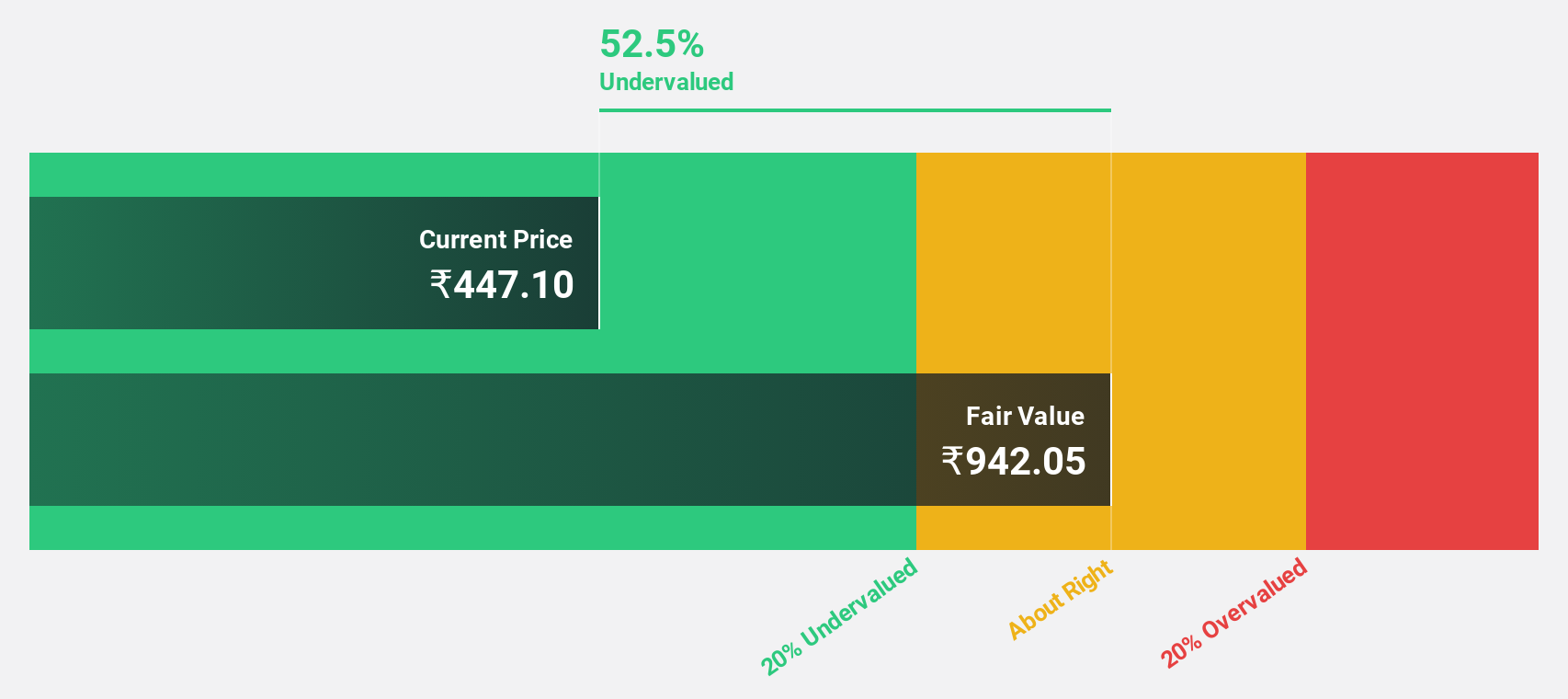

Estimated Discount To Fair Value: 45.2%

Vedanta, priced at ₹511.75, is trading significantly below its estimated fair value of ₹934.17, indicating potential undervaluation based on cash flows. Despite a decline in profit margins from 6.2% to 3.6%, the company's earnings are forecasted to grow at an impressive rate of over 41% annually, outpacing the broader Indian market's growth expectations. However, Vedanta faces challenges with debt levels and recent shareholder dilution amid ongoing corporate restructuring efforts like the planned demerger of key business units.

- Our expertly prepared growth report on Vedanta implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Vedanta.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued Indian Stocks Based On Cash Flows screener has unearthed 23 more companies for you to explore.Click here to unveil our expertly curated list of 26 Undervalued Indian Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VEDL

Vedanta

A diversified natural resources company, explores, extracts, and processes minerals, and oil and gas in India, Europe, China, the United States, Mexico, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives