Sigachi Industries Chief Financial Officer Subbarami Oruganti Sells 100% Of Holding

We'd be surprised if Sigachi Industries Limited (NSE:SIGACHI) shareholders haven't noticed that the Chief Financial Officer, Subbarami Oruganti, recently sold ₹37m worth of stock at ₹49.77 per share. In particular, we note that the sale equated to a 100% reduction in their position size, which doesn't exactly instill confidence.

Check out our latest analysis for Sigachi Industries

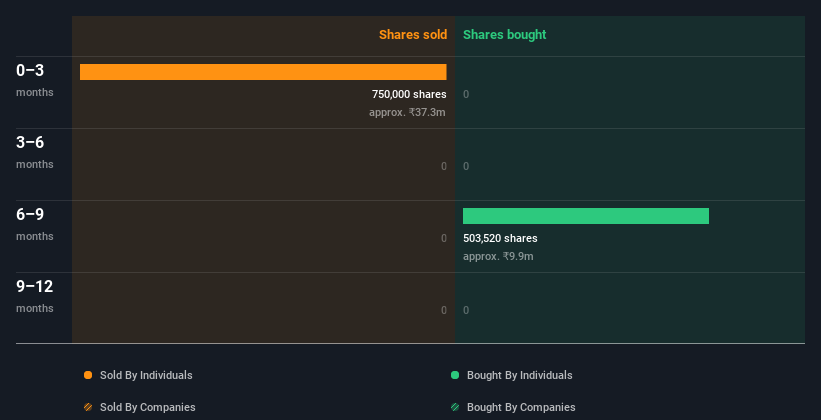

Sigachi Industries Insider Transactions Over The Last Year

In fact, the recent sale by Subbarami Oruganti was the biggest sale of Sigachi Industries shares made by an insider individual in the last twelve months, according to our records. So we know that an insider sold shares at around the present share price of ₹48.03. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. Given that the sale took place at around current prices, it makes us a little cautious but is hardly a major concern.

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Does Sigachi Industries Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Sigachi Industries insiders own about ₹6.1b worth of shares. That equates to 39% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Sigachi Industries Tell Us?

An insider sold Sigachi Industries shares recently, but they didn't buy any. And our longer term analysis of insider transactions didn't bring confidence, either. But since Sigachi Industries is profitable and growing, we're not too worried by this. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To that end, you should learn about the 2 warning signs we've spotted with Sigachi Industries (including 1 which doesn't sit too well with us).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SIGACHI

Sigachi Industries

Manufactures and sells microcrystalline cellulose and cellulose powder worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives