RPG Life Sciences Limited's (NSE:RPGLIFE) Shares Climb 26% But Its Business Is Yet to Catch Up

RPG Life Sciences Limited (NSE:RPGLIFE) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 96%.

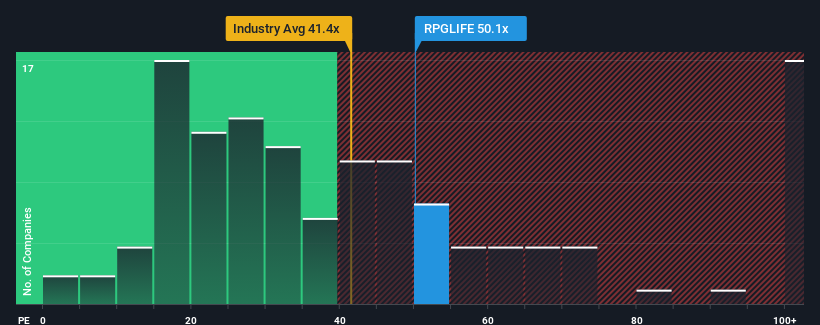

Since its price has surged higher, given around half the companies in India have price-to-earnings ratios (or "P/E's") below 34x, you may consider RPG Life Sciences as a stock to potentially avoid with its 50.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

The earnings growth achieved at RPG Life Sciences over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for RPG Life Sciences

How Is RPG Life Sciences' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like RPG Life Sciences' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 29% last year. Pleasingly, EPS has also lifted 107% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's about the same on an annualised basis.

With this information, we find it interesting that RPG Life Sciences is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

The large bounce in RPG Life Sciences' shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that RPG Life Sciences currently trades on a higher than expected P/E since its recent three-year growth is only in line with the wider market forecast. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for RPG Life Sciences that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RPGLIFE

RPG Life Sciences

An integrated pharmaceutical company, develops, manufactures, and markets branded formulations, generic, and synthetic active pharmaceutical ingredients (APIs) in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives