Jai Balaji Industries And Two More Undiscovered Gems In India

Reviewed by Simply Wall St

India's stock market has experienced a slight decline of 1.0% over the past week, yet it boasts an impressive annual growth of 44%, with earnings expected to grow by 16% annually. In this dynamic environment, identifying stocks like Jai Balaji Industries that have potential yet remain under the radar can offer intriguing opportunities for informed investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ingersoll-Rand (India) | NA | 14.12% | 26.31% | ★★★★★★ |

| Yuken India | 27.52% | 9.91% | -52.98% | ★★★★★★ |

| Force Motors | 23.24% | 17.79% | 29.78% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 20.60% | 62.92% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 38.22% | 31.27% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Master Trust | 37.05% | 26.63% | 41.10% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

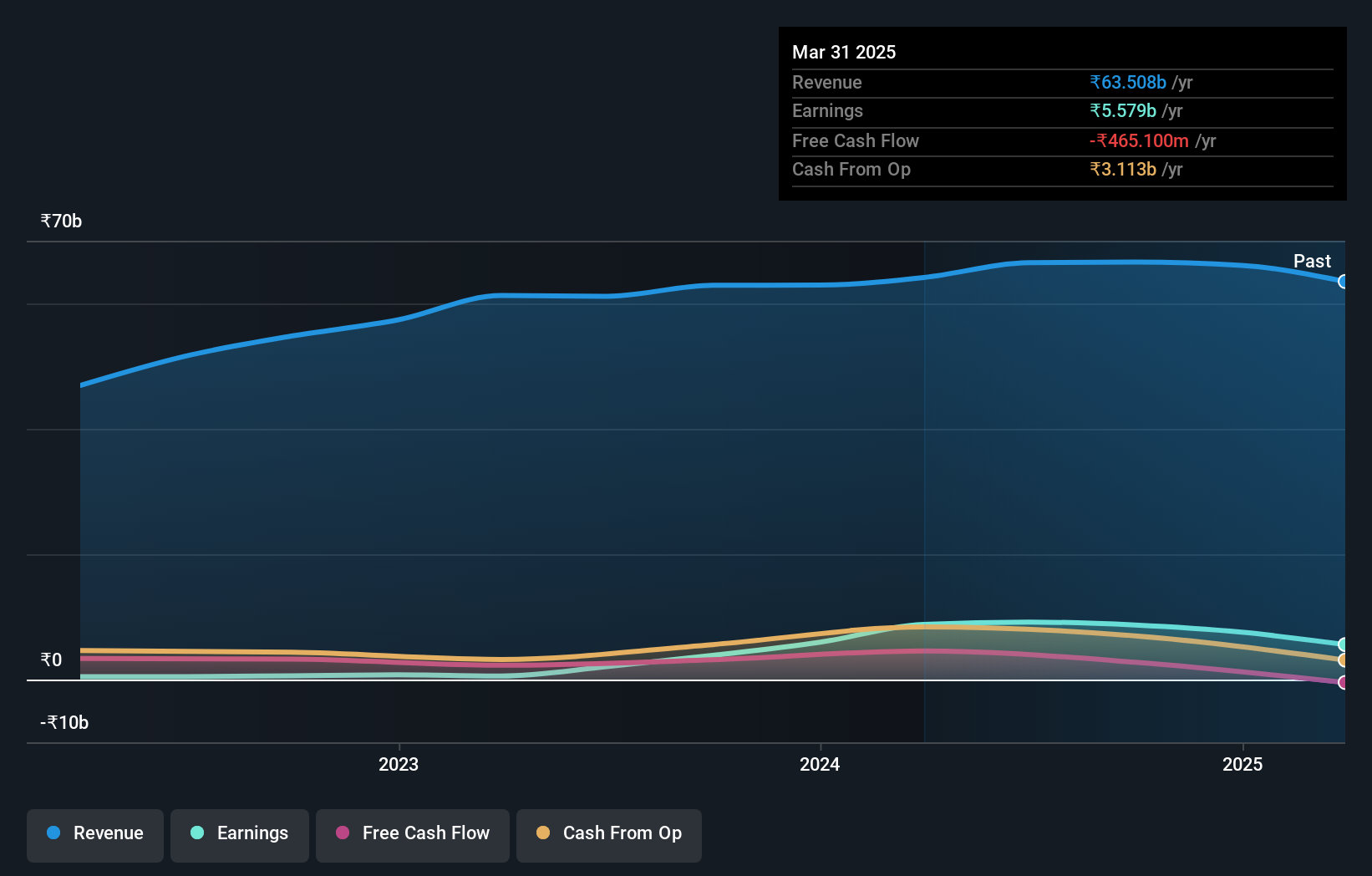

Jai Balaji Industries (NSEI:JAIBALAJI)

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Balaji Industries Limited is a company based in India, primarily engaged in the manufacturing and marketing of iron and steel products, with a market capitalization of approximately ₹14.83 billion.

Operations: The company operates in the iron and steel sector, generating a revenue of ₹64.14 billion as of the latest reporting period. It has demonstrated a notable increase in gross profit margin, reaching 35.40% recently, indicating improved operational efficiency or cost management strategies over time.

Jai Balaji Industries, a lesser-known contender in India's metals and mining sector, has shown remarkable performance with earnings growth of 1421% over the past year, far outpacing its industry average of 18%. With a Price-To-Earnings ratio at 17.7x—substantially below the market average of 34.2x—it presents an attractive valuation. The company's net debt to equity ratio stands at a manageable 25%, and interest payments are well-covered by EBIT at an impressive rate of 11.3 times. Additionally, recent strategic moves include a private placement that raised INR 225 million, enhancing its financial flexibility and signaling growth potential.

- Delve into the full analysis health report here for a deeper understanding of Jai Balaji Industries.

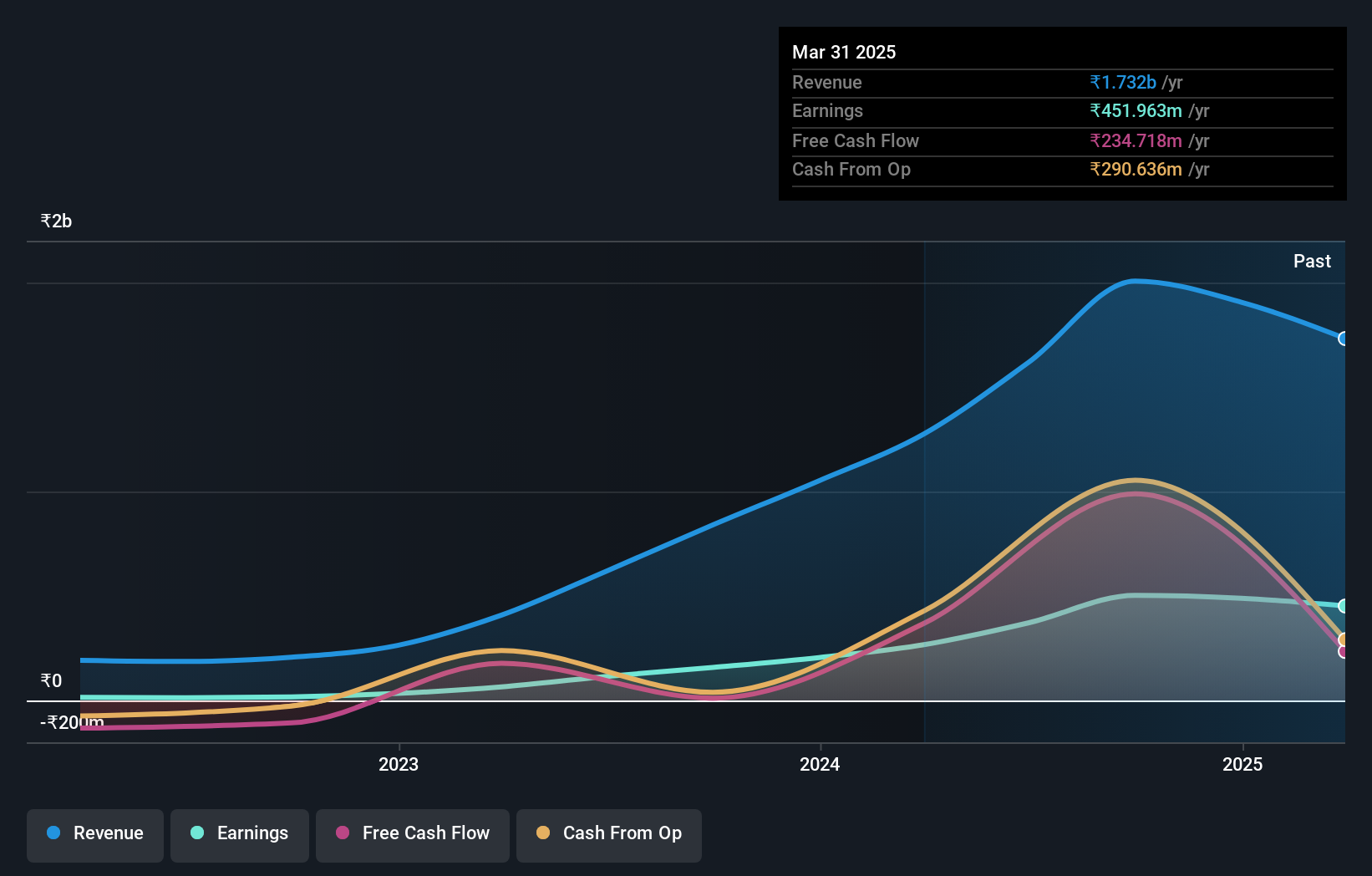

Network People Services Technologies (NSEI:NPST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Network People Services Technologies Limited specializes in creating digital payment solutions for banks, financial institutions, and merchants within the fintech sector in India, with a market capitalization of ₹45.88 billion.

Operations: NPST operates in the software and programming sector, generating revenue primarily through its offerings in this domain. The company has shown a notable increase in gross profit margin from 51.64% in March 2018 to 40.20% by July 2024, reflecting an evolving efficiency in managing production costs relative to sales.

Network People Services Technologies (NPST) stands out as a promising entity in India's financial sector, with earnings soaring by 222.5% over the past year, significantly outpacing the industry's growth of 21.3%. This remarkable performance is supported by a robust EBIT coverage of interest payments at 2231.2 times. Additionally, NPST has maintained more cash than total debt and recently secured significant contracts to enhance digital banking solutions in rural India, further solidifying its market position and future prospects.

- Get an in-depth perspective on Network People Services Technologies' performance by reading our health report here.

Learn about Network People Services Technologies' historical performance.

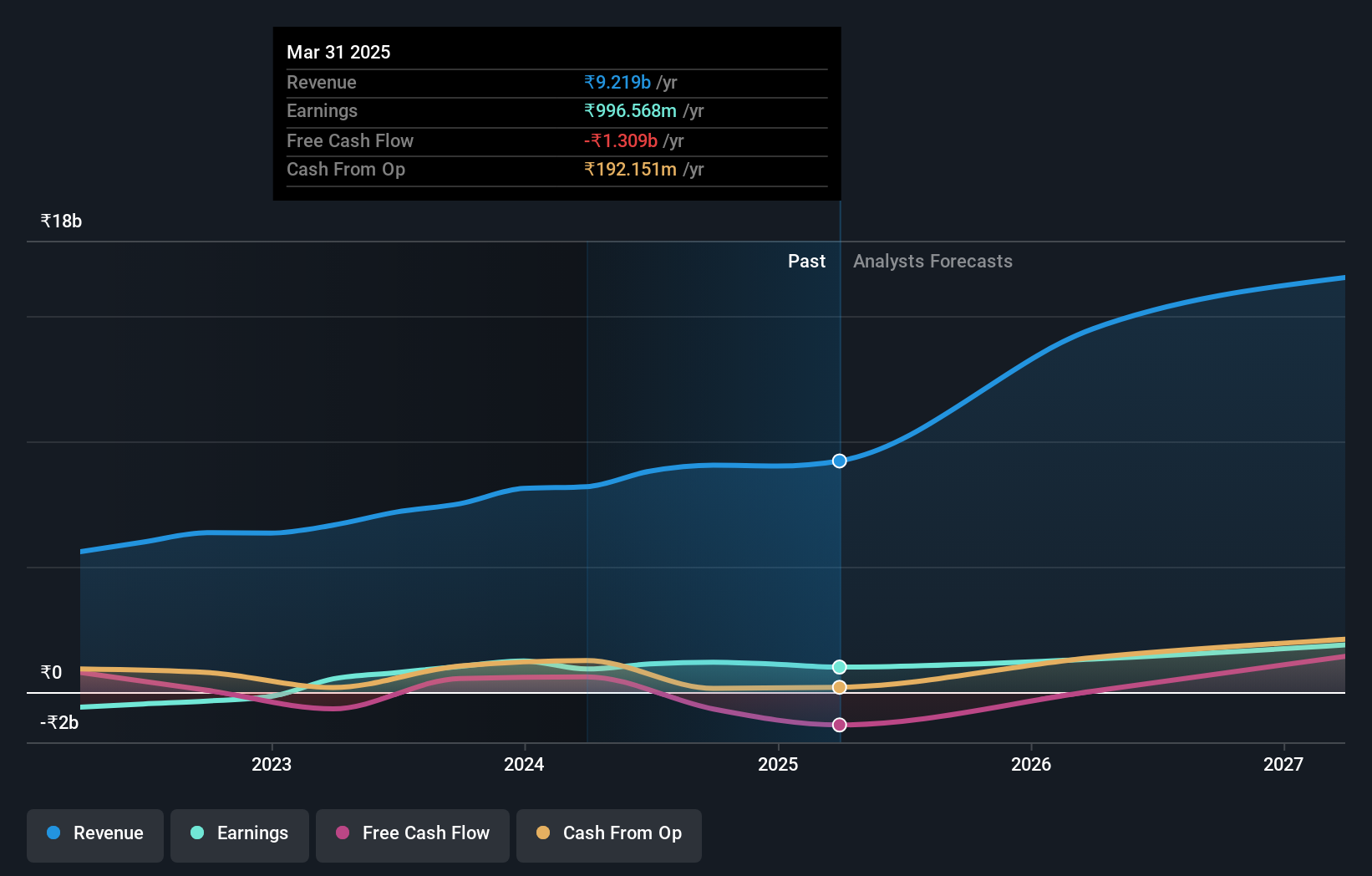

Orchid Pharma (NSEI:ORCHPHARMA)

Simply Wall St Value Rating: ★★★★★★

Overview: Orchid Pharma Limited is a pharmaceutical company based in India, specializing in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals, with a market capitalization of ₹69.48 billion.

Operations: Orchid Pharma generates its revenue primarily through the pharmaceuticals sector, with a recent report showing a total revenue of ₹8193.68 million. The company's business model involves significant costs related to goods sold and operating expenses, impacting profitability but maintaining a gross profit margin around 40% in recent periods.

Orchid Pharma, a lesser-known yet promising entity in India's pharmaceutical sector, has demonstrated robust growth and innovation. With a 73.6% earnings increase last year and an anticipated annual growth of 42.44%, the company outpaces industry averages significantly. Recent strategic partnerships, like that with Cipla for distributing the newly launched drug Cefepime-Enmetazobactam, underscore its commitment to addressing critical health challenges through advanced solutions. This collaboration leverages Orchid’s R&D strengths with Cipla’s extensive network, enhancing market presence and accessibility of vital medications across India.

- Dive into the specifics of Orchid Pharma here with our thorough health report.

Review our historical performance report to gain insights into Orchid Pharma's's past performance.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 450 Indian Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ORCHPHARMA

Orchid Pharma

A pharmaceutical company, engages in the development, manufacture, and marketing of active pharmaceutical ingredients, bulk actives, finished dosage formulations, and nutraceuticals in India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives