- India

- /

- Entertainment

- /

- NSEI:TIPSMUSIC

Additional Considerations Required While Assessing Tips Music's (NSE:TIPSMUSIC) Strong Earnings

Despite announcing strong earnings, Tips Music Limited's (NSE:TIPSMUSIC) stock was sluggish. Our analysis uncovered some concerning factors that we believe the market might be paying attention to.

We've discovered 1 warning sign about Tips Music. View them for free.

A Closer Look At Tips Music's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

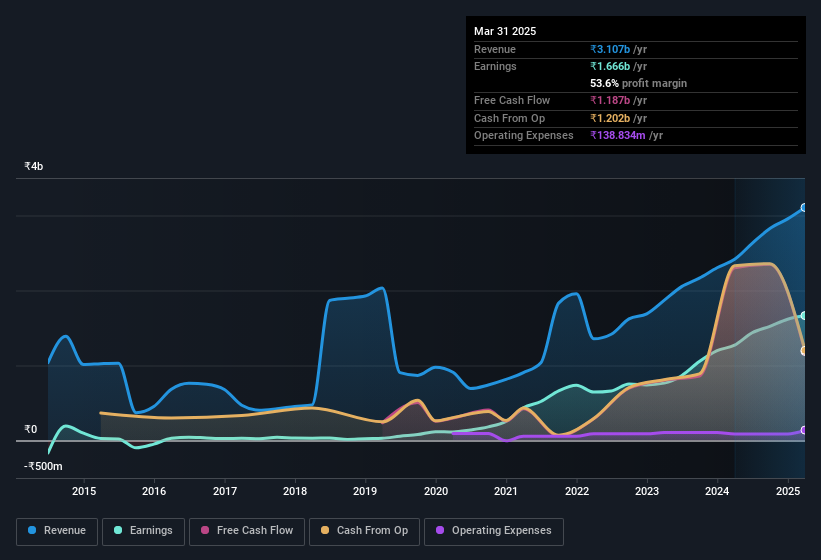

Over the twelve months to March 2025, Tips Music recorded an accrual ratio of 0.98. That means it didn't generate anywhere near enough free cash flow to match its profit. As a general rule, that bodes poorly for future profitability. In fact, it had free cash flow of ₹1.2b in the last year, which was a lot less than its statutory profit of ₹1.67b. Tips Music shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. One positive for Tips Music shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Tips Music's Profit Performance

As we have made quite clear, we're a bit worried that Tips Music didn't back up the last year's profit with free cashflow. As a result, we think it may well be the case that Tips Music's underlying earnings power is lower than its statutory profit. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. In terms of investment risks, we've identified 1 warning sign with Tips Music, and understanding it should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Tips Music's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tips Music might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIPSMUSIC

Tips Music

Engages in the acquisition and exploitation of music rights in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)