The market is up 1.4% over the last week, with the Financials sector up 1.6%. In the last year, the market has climbed 46%, and earnings are expected to grow by 17% per annum over the next few years. In this favorable environment, identifying high growth tech stocks like Infosys and two others can be crucial for investors looking to capitalize on India's booming technology sector.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Industries | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.83% | 22.72% | ★★★★★★ |

| Happiest Minds Technologies | 21.99% | 21.80% | ★★★★★★ |

| Sonata Software | 13.29% | 29.79% | ★★★★★☆ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.12% | 41.74% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Sonata Software (NSEI:SONATSOFTW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sonata Software Limited, along with its subsidiaries, offers information technology services and solutions across the United States, Europe, the Middle East, Asia, India, and Australia with a market cap of ₹173.33 billion.

Operations: Sonata Software Limited, through its subsidiaries, generates revenue by providing a range of information technology services and solutions globally. The company's operations span multiple regions including the United States, Europe, the Middle East, Asia, India, and Australia.

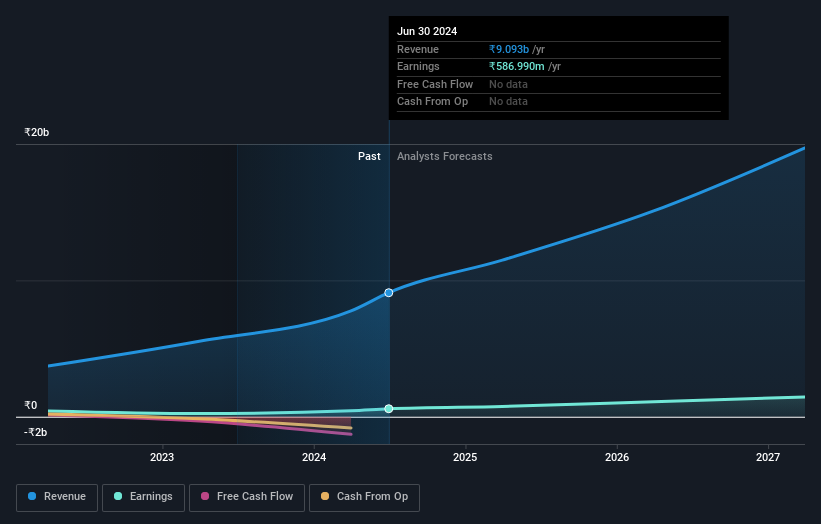

Sonata Software's recent partnership with Applied Systems underscores its strategic focus on platform engineering and enterprise modernization, leveraging robust cloud capabilities. Despite a 36.7% earnings drop over the past year, revenue is expected to grow at 13.3% annually, outpacing the Indian market's 10%. With an R&D expenditure of ₹1.5B impacting financial results and forecasted earnings growth of 29.8%, Sonata demonstrates a commitment to innovation that could drive future success in India's tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Sonata Software.

Gain insights into Sonata Software's past trends and performance with our Past report.

Tips Industries (NSEI:TIPSINDLTD)

Simply Wall St Growth Rating: ★★★★★★

Overview: Tips Industries Limited engages in the acquisition and exploitation of music rights in India and internationally, with a market cap of ₹94.31 billion.

Operations: Tips Industries Limited generates revenue primarily from its music segment, which includes audio and video content, amounting to ₹2.63 billion. The company focuses on acquiring and exploiting music rights both in India and internationally.

Tips Industries, now rebranded as Tips Music Limited, has shown impressive growth with earnings rising by 66.2% over the past year and revenue forecasted to grow at 24.7% annually, outpacing the Indian market's 10%. The company's earnings are expected to increase by 24.2% per year, reflecting a strong performance in the entertainment sector where it surpasses industry averages. Recent changes include a new independent director and an interim dividend of ₹2 per share declared for FY 2024-25.

- Dive into the specifics of Tips Industries here with our thorough health report.

Review our historical performance report to gain insights into Tips Industries''s past performance.

Zaggle Prepaid Ocean Services (NSEI:ZAGGLE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zaggle Prepaid Ocean Services Limited develops financial products and solutions to streamline business expenses for corporates, SMEs, and startups through automated workflows, with a market cap of ₹44.44 billion.

Operations: Zaggle Prepaid Ocean Services Limited generates revenue primarily through program fees (₹4.01 billion), gift card-related income (₹4.76 billion), and platform/service fees (₹326.27 million). The company focuses on creating financial solutions that automate expense management for businesses of various sizes.

Zaggle Prepaid Ocean Services has demonstrated remarkable earnings growth of 108.5% over the past year, significantly outpacing the software industry's 28.6%. The company's revenue is projected to grow at an impressive rate of 27.8% annually, with earnings expected to rise by 32.6% per year, underscoring its robust performance in the tech sector. Recent agreements with prominent clients like Baroda BNP Paribas and PNB MetLife enhance its market position, while substantial R&D investments bolster innovation and future prospects.

- Get an in-depth perspective on Zaggle Prepaid Ocean Services' performance by reading our health report here.

Learn about Zaggle Prepaid Ocean Services' historical performance.

Seize The Opportunity

- Delve into our full catalog of 38 Indian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SONATSOFTW

Sonata Software

Provides information technology services and solutions in the United States, Europe, the Middle East, the Asia Pacific, the United Kingdom, Australia, New Zealand, and Ireland.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)