Affle 3i's (NSE:AFFLE) investors will be pleased with their splendid 255% return over the last five years

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. One great example is Affle 3i Limited (NSE:AFFLE) which saw its share price drive 255% higher over five years. We note the stock price is up 1.7% in the last seven days.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

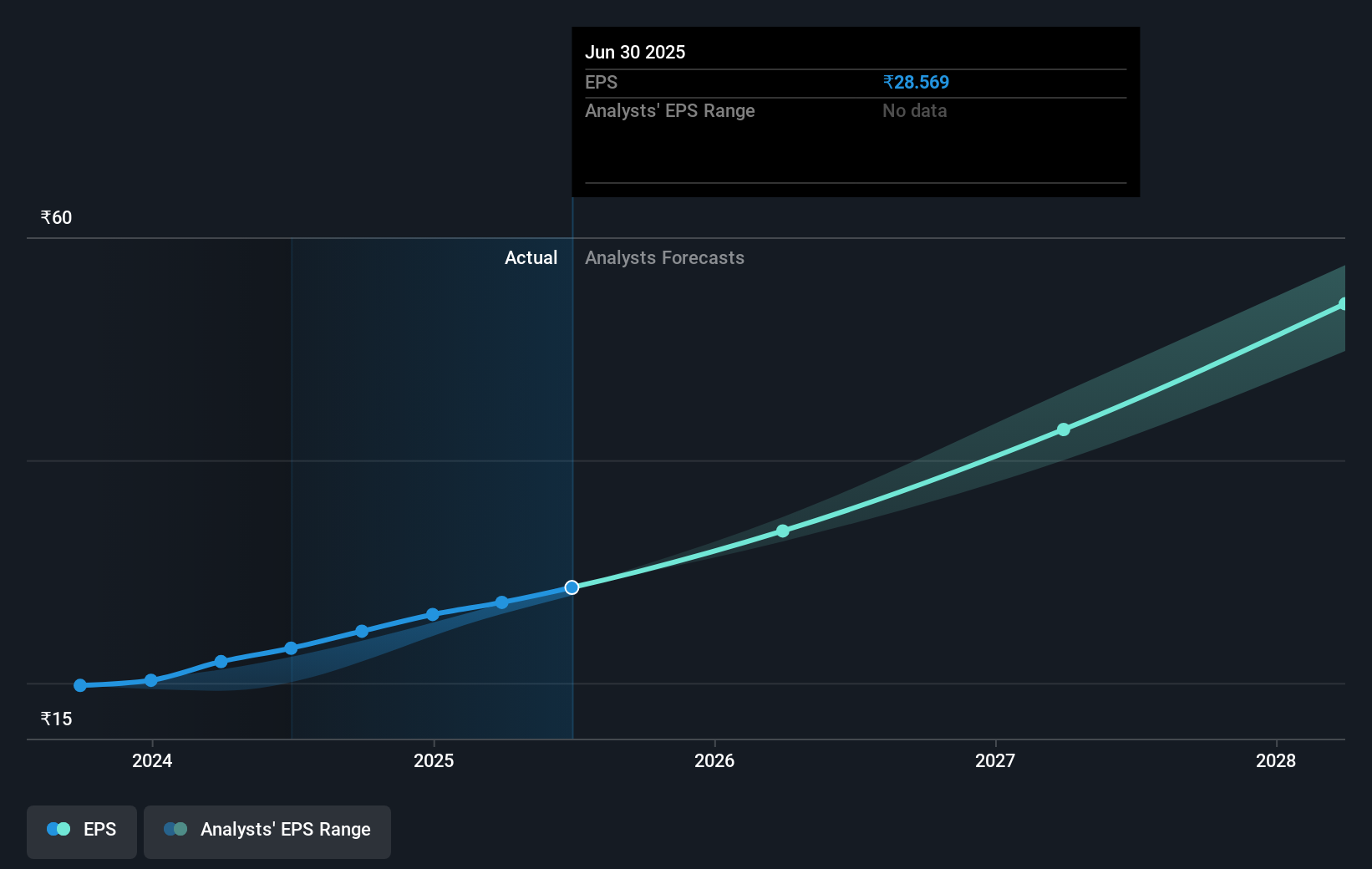

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Affle 3i managed to grow its earnings per share at 38% a year. The EPS growth is more impressive than the yearly share price gain of 29% over the same period. So it seems the market isn't so enthusiastic about the stock these days. Having said that, the market is still optimistic, given the P/E ratio of 67.28.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Affle 3i's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Affle 3i has rewarded shareholders with a total shareholder return of 20% in the last twelve months. Having said that, the five-year TSR of 29% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Before deciding if you like the current share price, check how Affle 3i scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AFFLE

Affle 3i

Provides mobile advertisement services through information technology and software development services for mobiles in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives