Here's Why We Think Zuari Agro Chemicals (NSE:ZUARI) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Zuari Agro Chemicals (NSE:ZUARI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Zuari Agro Chemicals

Zuari Agro Chemicals' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Zuari Agro Chemicals grew its EPS from ₹35.51 to ₹250, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Zuari Agro Chemicals did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

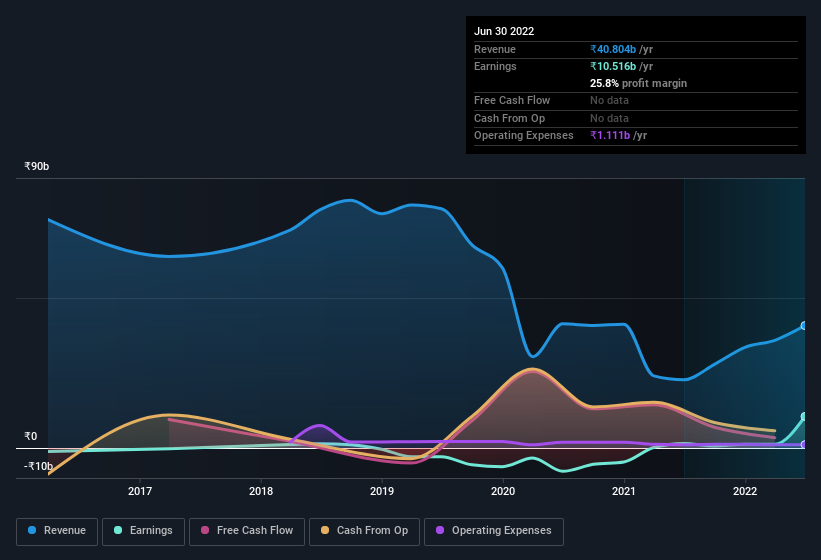

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Zuari Agro Chemicals isn't a huge company, given its market capitalisation of ₹7.0b. That makes it extra important to check on its balance sheet strength.

Are Zuari Agro Chemicals Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Zuari Agro Chemicals insiders have a significant amount of capital invested in the stock. Indeed, they hold ₹983m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 14% of the company; visible skin in the game.

Is Zuari Agro Chemicals Worth Keeping An Eye On?

Zuari Agro Chemicals' earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching Zuari Agro Chemicals very closely. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Zuari Agro Chemicals (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Zuari Agro Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZUARI

Zuari Agro Chemicals

Engages in manufacturing, trading, and marketing of chemical fertilizers and fertilizer products in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives