Vikas Ecotech's (NSE:VIKASECO) Solid Profits Have Weak Fundamentals

Unsurprisingly, Vikas Ecotech Limited's (NSE:VIKASECO) stock price was strong on the back of its healthy earnings report. However, we think that shareholders may be missing some concerning details in the numbers.

Our analysis indicates that VIKASECO is potentially undervalued!

Examining Cashflow Against Vikas Ecotech's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

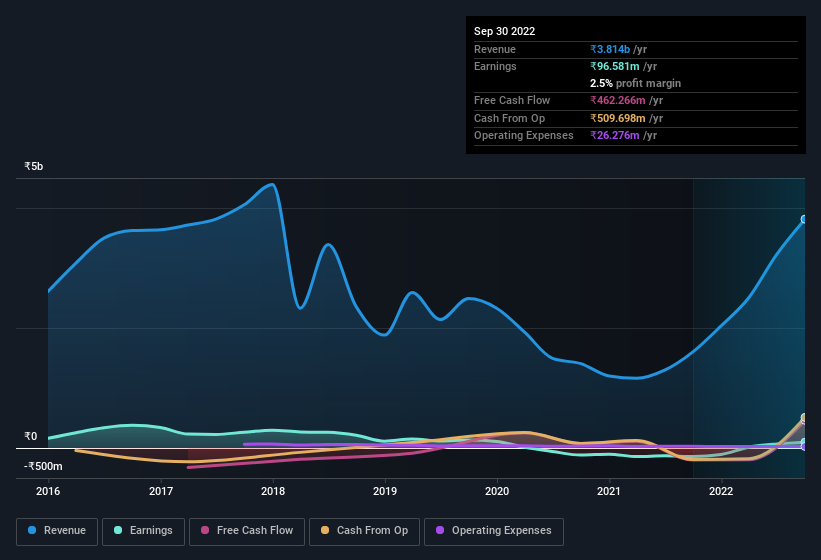

For the year to September 2022, Vikas Ecotech had an accrual ratio of -0.12. Therefore, its statutory earnings were quite a lot less than its free cashflow. To wit, it produced free cash flow of ₹462m during the period, dwarfing its reported profit of ₹96.6m. Notably, Vikas Ecotech had negative free cash flow last year, so the ₹462m it produced this year was a welcome improvement. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Vikas Ecotech.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Vikas Ecotech expanded the number of shares on issue by 47% over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Vikas Ecotech's historical EPS growth by clicking on this link.

A Look At The Impact Of Vikas Ecotech's Dilution On Its Earnings Per Share (EPS)

We don't have any data on the company's profits from three years ago. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

In the long term, if Vikas Ecotech's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Vikas Ecotech's Profit Performance

In conclusion, Vikas Ecotech has a strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share are dropping faster than its profit. Based on these factors, we think it's very unlikely that Vikas Ecotech's statutory profits make it seem much weaker than it is. If you'd like to know more about Vikas Ecotech as a business, it's important to be aware of any risks it's facing. For instance, we've identified 4 warning signs for Vikas Ecotech (1 doesn't sit too well with us) you should be familiar with.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VIKASECO

Vikas Ecotech

Engages in the manufacture and sale of specialty additives, and rubber-plastic and polymer compounds in India.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)