- India

- /

- Basic Materials

- /

- NSEI:ULTRACEMCO

With UltraTech Cement Limited (NSE:ULTRACEMCO) It Looks Like You'll Get What You Pay For

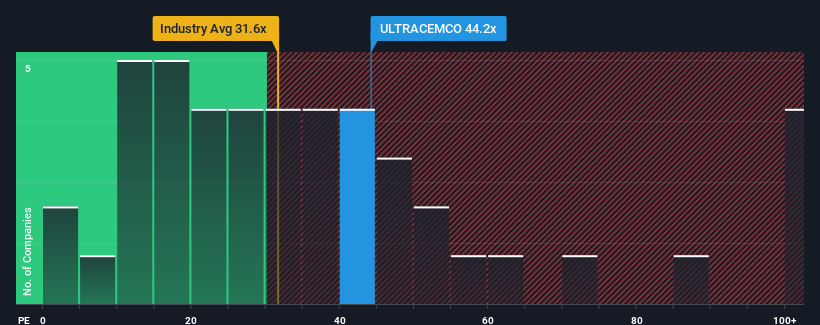

With a price-to-earnings (or "P/E") ratio of 44.2x UltraTech Cement Limited (NSE:ULTRACEMCO) may be sending bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 31x and even P/E's lower than 17x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's inferior to most other companies of late, UltraTech Cement has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for UltraTech Cement

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like UltraTech Cement's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.5% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 2.4% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 33% during the coming year according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 24%, which is noticeably less attractive.

In light of this, it's understandable that UltraTech Cement's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that UltraTech Cement maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for UltraTech Cement with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ULTRACEMCO

UltraTech Cement

Primarily engages in the manufacture and sale of clinker, cement, and related products in India.

Solid track record with excellent balance sheet and pays a dividend.