- India

- /

- Basic Materials

- /

- NSEI:UDAICEMENT

Udaipur Cement Works Limited's (NSE:UDAICEMENT) 30% Share Price Surge Not Quite Adding Up

Udaipur Cement Works Limited (NSE:UDAICEMENT) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 95% in the last year.

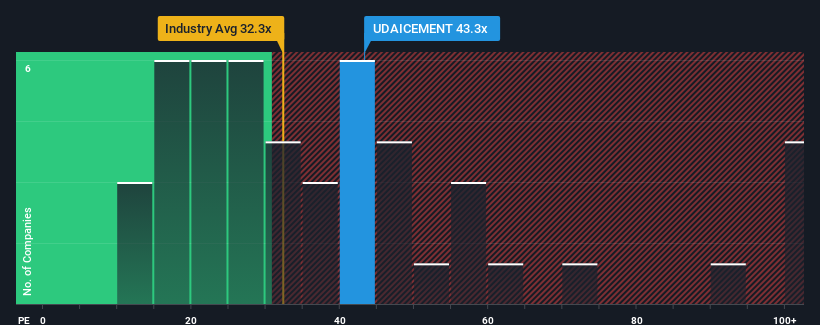

Following the firm bounce in price, Udaipur Cement Works may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 43.3x, since almost half of all companies in India have P/E ratios under 32x and even P/E's lower than 18x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Udaipur Cement Works recently, which is pleasing to see. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Udaipur Cement Works

Is There Enough Growth For Udaipur Cement Works?

The only time you'd be truly comfortable seeing a P/E as high as Udaipur Cement Works' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a decent 8.6% gain to the company's bottom line. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 38% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's an unpleasant look.

With this information, we find it concerning that Udaipur Cement Works is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in Udaipur Cement Works' shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Udaipur Cement Works currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 4 warning signs for Udaipur Cement Works (3 don't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Udaipur Cement Works, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Udaipur Cement Works, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:UDAICEMENT

Udaipur Cement Works

Manufactures and supplies cement and cementitious products in India.

Overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives