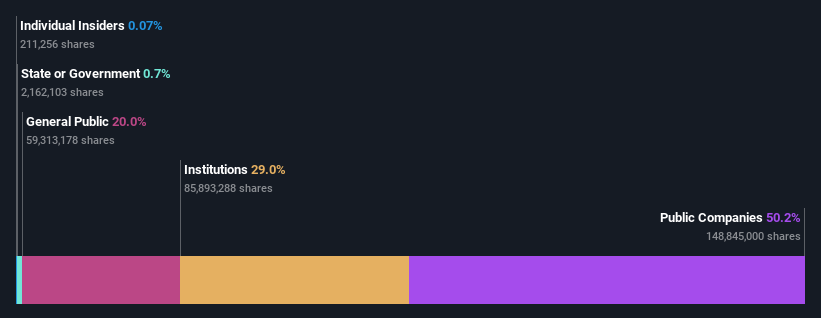

SRF Limited's (NSE:SRF) largest shareholders are public companies with 50% ownership, institutions own 29%

Key Insights

- The considerable ownership by public companies in SRF indicates that they collectively have a greater say in management and business strategy

- 50% of the company is held by a single shareholder (KAMA Holdings Limited)

- Institutions own 29% of SRF

To get a sense of who is truly in control of SRF Limited (NSE:SRF), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are public companies with 50% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Institutions, on the other hand, account for 29% of the company's stockholders. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones.

In the chart below, we zoom in on the different ownership groups of SRF.

Check out our latest analysis for SRF

What Does The Institutional Ownership Tell Us About SRF?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

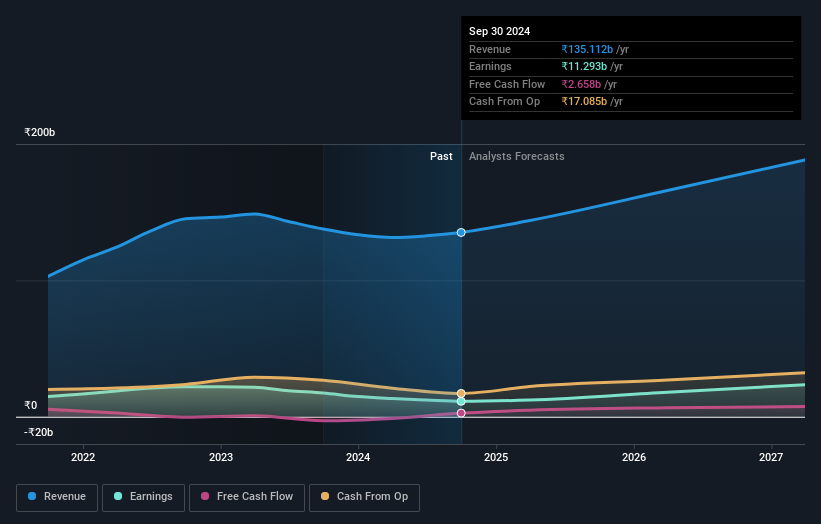

We can see that SRF does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see SRF's historic earnings and revenue below, but keep in mind there's always more to the story.

SRF is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is KAMA Holdings Limited with 50% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. Life Insurance Corporation of India, Asset Management Arm is the second largest shareholder owning 5.0% of common stock, and Kotak Mahindra Asset Management Company Limited holds about 4.1% of the company stock.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of SRF

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that SRF Limited insiders own under 1% of the company. Keep in mind that it's a big company, and the insiders own ₹483m worth of shares. The absolute value might be more important than the proportional share. It is good to see board members owning shares, but it might be worth checking if those insiders have been buying.

General Public Ownership

The general public-- including retail investors -- own 20% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

It appears to us that public companies own 50% of SRF. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand SRF better, we need to consider many other factors. For instance, we've identified 2 warning signs for SRF that you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SRF

SRF

Manufactures, purchases, and sells technical textiles, chemicals, packaging films, and other polymers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)