- India

- /

- Metals and Mining

- /

- NSEI:SHYAMMETL

A Piece Of The Puzzle Missing From Shyam Metalics and Energy Limited's (NSE:SHYAMMETL) 31% Share Price Climb

Shyam Metalics and Energy Limited (NSE:SHYAMMETL) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. The annual gain comes to 102% following the latest surge, making investors sit up and take notice.

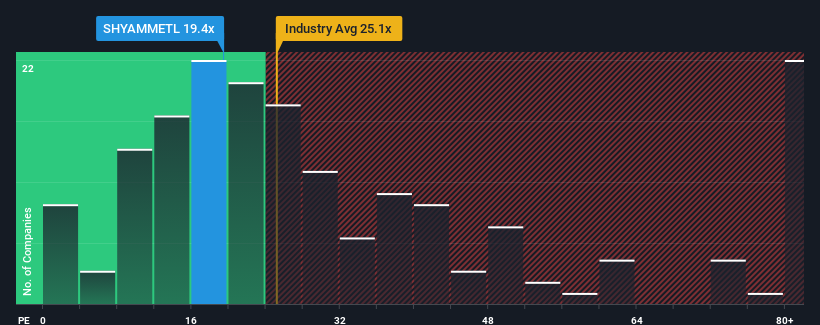

Even after such a large jump in price, Shyam Metalics and Energy's price-to-earnings (or "P/E") ratio of 19.4x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 34x and even P/E's above 66x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Shyam Metalics and Energy could be doing better as it's been growing earnings less than most other companies lately. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Shyam Metalics and Energy

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Shyam Metalics and Energy's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 18%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 35% over the next year. Meanwhile, the rest of the market is forecast to only expand by 25%, which is noticeably less attractive.

In light of this, it's peculiar that Shyam Metalics and Energy's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Shyam Metalics and Energy's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shyam Metalics and Energy currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Shyam Metalics and Energy.

If these risks are making you reconsider your opinion on Shyam Metalics and Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SHYAMMETL

Shyam Metalics and Energy

An integrated metal-producing company, manufactures and sells long steel products and ferro alloys in India, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives