- India

- /

- Basic Materials

- /

- NSEI:SHREECEM

Should You Buy Shree Cement Limited (NSE:SHREECEM) For Its Upcoming Dividend?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Shree Cement Limited (NSE:SHREECEM) is about to go ex-dividend in just 2 days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. Accordingly, Shree Cement investors that purchase the stock on or after the 3rd of November will not receive the dividend, which will be paid on the 27th of November.

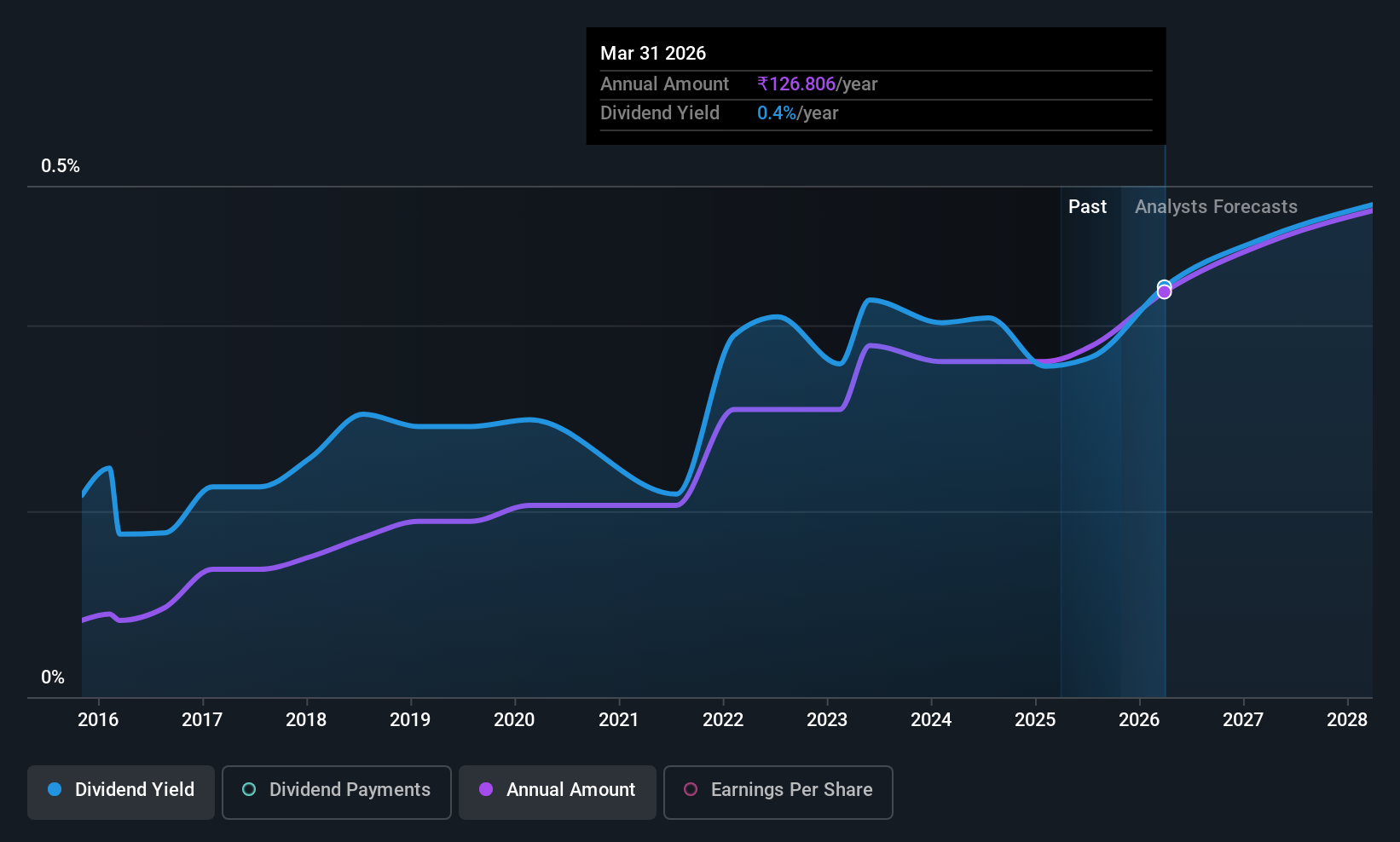

The company's upcoming dividend is ₹80.00 a share, following on from the last 12 months, when the company distributed a total of ₹110 per share to shareholders. Last year's total dividend payments show that Shree Cement has a trailing yield of 0.4% on the current share price of ₹28740.00. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Shree Cement has been able to grow its dividends, or if the dividend might be cut.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. That's why it's good to see Shree Cement paying out a modest 35% of its earnings. A useful secondary check can be to evaluate whether Shree Cement generated enough free cash flow to afford its dividend. It distributed 26% of its free cash flow as dividends, a comfortable payout level for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

View our latest analysis for Shree Cement

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That explains why we're not overly excited about Shree Cement's flat earnings over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run. Recent earnings growth has been limited. Yet there are several ways to grow the dividend, and one of them is simply that the company may choose to pay out more of its earnings as dividends.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last 10 years, Shree Cement has lifted its dividend by approximately 16% a year on average.

Final Takeaway

Is Shree Cement worth buying for its dividend? The company has barely grown earnings per share over this time, but at least it's paying out a decently low percentage of its earnings and cashflow as dividends. This could suggest management is reinvesting in future growth opportunities. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine strong earnings per share growth with a low payout ratio, and Shree Cement is halfway there. Overall we think this is an attractive combination and worthy of further research.

So while Shree Cement looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. Case in point: We've spotted 1 warning sign for Shree Cement you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHREECEM

Shree Cement

Engages in the manufacture and sale of cement and clinker in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)