- India

- /

- Basic Materials

- /

- NSEI:SAGCEM

Sagar Cements Limited (NSE:SAGCEM) Stock Rockets 26% But Many Are Still Ignoring The Company

Sagar Cements Limited (NSE:SAGCEM) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

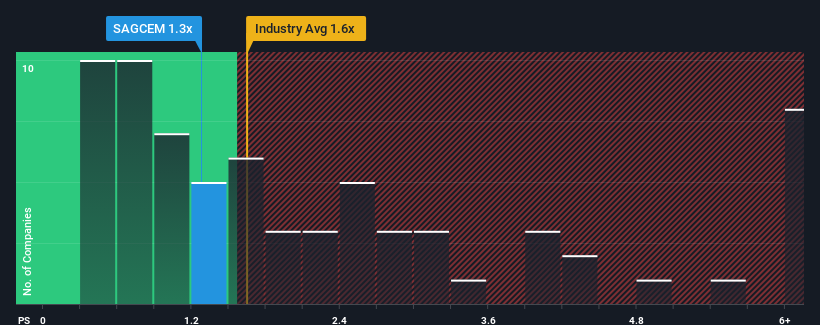

Although its price has surged higher, it's still not a stretch to say that Sagar Cements' price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Basic Materials industry in India, where the median P/S ratio is around 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 2 warning signs about Sagar Cements. View them for free.Check out our latest analysis for Sagar Cements

What Does Sagar Cements' P/S Mean For Shareholders?

Sagar Cements could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Sagar Cements will help you uncover what's on the horizon.How Is Sagar Cements' Revenue Growth Trending?

In order to justify its P/S ratio, Sagar Cements would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 4.5% decrease to the company's top line. Even so, admirably revenue has lifted 53% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 17% as estimated by the seven analysts watching the company. With the rest of the industry predicted to shrink by 1.0%, that would be a fantastic result.

With this in mind, we find it intriguing that Sagar Cements' P/S trades in-line with its industry peers. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What Does Sagar Cements' P/S Mean For Investors?

Its shares have lifted substantially and now Sagar Cements' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We note that even though Sagar Cements trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Sagar Cements that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SAGCEM

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives