- India

- /

- Metals and Mining

- /

- NSEI:RKFORGE

Ramkrishna Forgings Limited (NSE:RKFORGE) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

Investors in Ramkrishna Forgings Limited (NSE:RKFORGE) had a good week, as its shares rose 7.3% to close at ₹985 following the release of its third-quarter results. It looks like the results were a bit of a negative overall. While revenues of ₹11b were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 4.3% to hit ₹5.51 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for Ramkrishna Forgings

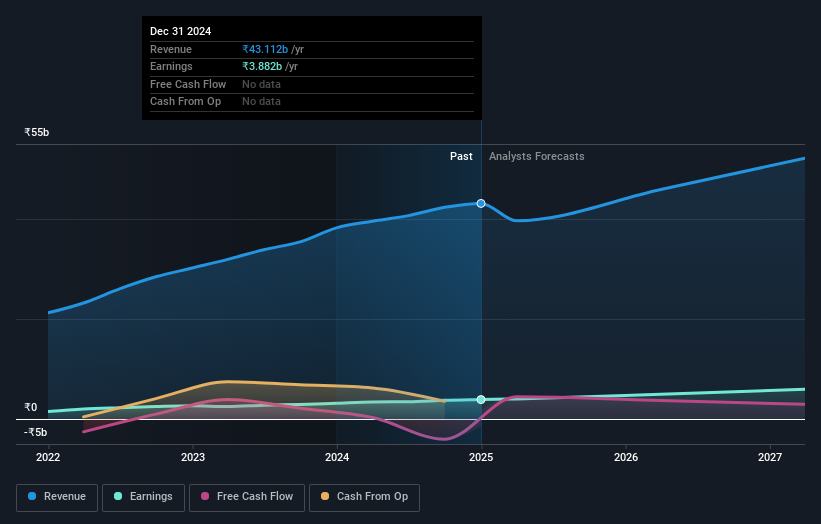

Taking into account the latest results, the consensus forecast from Ramkrishna Forgings' five analysts is for revenues of ₹45.9b in 2026. This reflects a reasonable 6.4% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to jump 32% to ₹28.40. Yet prior to the latest earnings, the analysts had been anticipated revenues of ₹53.6b and earnings per share (EPS) of ₹33.27 in 2026. It looks like sentiment has declined substantially in the aftermath of these results, with a real cut to revenue estimates and a real cut to earnings per share numbers as well.

The analysts made no major changes to their price target of ₹1,123, suggesting the downgrades are not expected to have a long-term impact on Ramkrishna Forgings' valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Ramkrishna Forgings analyst has a price target of ₹1,500 per share, while the most pessimistic values it at ₹870. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that Ramkrishna Forgings' revenue growth is expected to slow, with the forecast 5.1% annualised growth rate until the end of 2026 being well below the historical 29% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 13% per year. Factoring in the forecast slowdown in growth, it seems obvious that Ramkrishna Forgings is also expected to grow slower than other industry participants.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Ramkrishna Forgings. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target held steady at ₹1,123, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Ramkrishna Forgings going out to 2027, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 1 warning sign for Ramkrishna Forgings that you need to be mindful of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RKFORGE

Ramkrishna Forgings

Engages in the manufacture and sale of forged components for automobiles, railway wagons and coaches, and engineering parts in India and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion