The CEO of Ramco Industries Limited (NSE:RAMCOIND) is Prem Shanker, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Ramco Industries.

Check out our latest analysis for Ramco Industries

Comparing Ramco Industries Limited's CEO Compensation With the industry

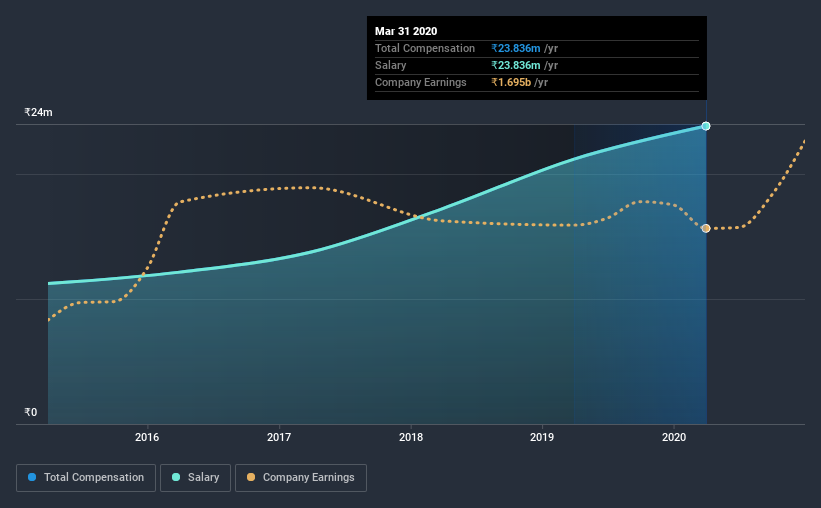

At the time of writing, our data shows that Ramco Industries Limited has a market capitalization of ₹22b, and reported total annual CEO compensation of ₹24m for the year to March 2020. We note that's an increase of 12% above last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹24m.

On examining similar-sized companies in the industry with market capitalizations between ₹15b and ₹58b, we discovered that the median CEO total compensation of that group was ₹34m. This suggests that Prem Shanker is paid below the industry median. Moreover, Prem Shanker also holds ₹2.8m worth of Ramco Industries stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹24m | ₹21m | 100% |

| Other | - | - | - |

| Total Compensation | ₹24m | ₹21m | 100% |

Talking in terms of the industry, salary represented approximately 89% of total compensation out of all the companies we analyzed, while other remuneration made up 11% of the pie. At the company level, Ramco Industries pays Prem Shanker solely through a salary, preferring to go down a conventional route. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Ramco Industries Limited's Growth Numbers

Ramco Industries Limited has seen its earnings per share (EPS) increase by 12% a year over the past three years. Its revenue is up 9.4% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Ramco Industries Limited Been A Good Investment?

With a total shareholder return of 4.0% over three years, Ramco Industries Limited has done okay by shareholders. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Ramco Industries rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we touched on above, Ramco Industries Limited is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Meanwhile, EPS growth has been rock solid for the past three years. However, shareholder returns have failed to show the same level of growth. Shareholder returns could be better but we're pleased with the positive EPS growth. So considering these factors, we think Prem is modestly compensated.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Ramco Industries (free visualization of insider trades).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Ramco Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:RAMCOIND

Ramco Industries

Engages in the building products, textiles, and power generation businesses in India.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)