- India

- /

- Basic Materials

- /

- NSEI:RAMCOCEM

The Ramco Cements Limited (NSE:RAMCOCEM) Not Flying Under The Radar

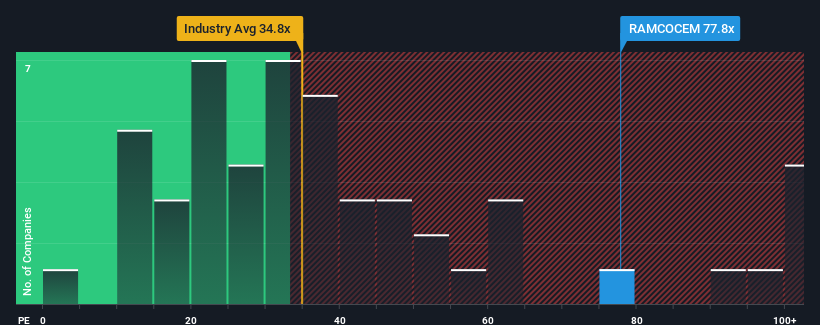

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 33x, you may consider The Ramco Cements Limited (NSE:RAMCOCEM) as a stock to avoid entirely with its 77.8x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Ramco Cements hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Ramco Cements

How Is Ramco Cements' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Ramco Cements' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 76% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 42% per year over the next three years. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that Ramco Cements' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ramco Cements maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Ramco Cements is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

Of course, you might also be able to find a better stock than Ramco Cements. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RAMCOCEM

Ramco Cements

Manufactures and sells cement and construction Chemicals in India.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives