- India

- /

- Basic Materials

- /

- NSEI:RAMCOCEM

Market Participants Recognise The Ramco Cements Limited's (NSE:RAMCOCEM) Earnings

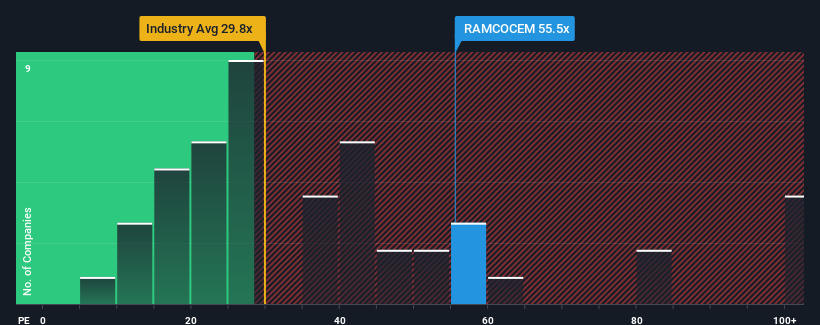

With a price-to-earnings (or "P/E") ratio of 55.5x The Ramco Cements Limited (NSE:RAMCOCEM) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 32x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Ramco Cements could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Ramco Cements

Is There Enough Growth For Ramco Cements?

In order to justify its P/E ratio, Ramco Cements would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 15% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 56% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 36% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 22% each year growth forecast for the broader market.

In light of this, it's understandable that Ramco Cements' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Ramco Cements' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ramco Cements maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Ramco Cements you should be aware of, and 1 of them can't be ignored.

Of course, you might also be able to find a better stock than Ramco Cements. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RAMCOCEM

Ramco Cements

Manufactures and sells cement, ready mix concrete, and dry mortar products in India.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives